-

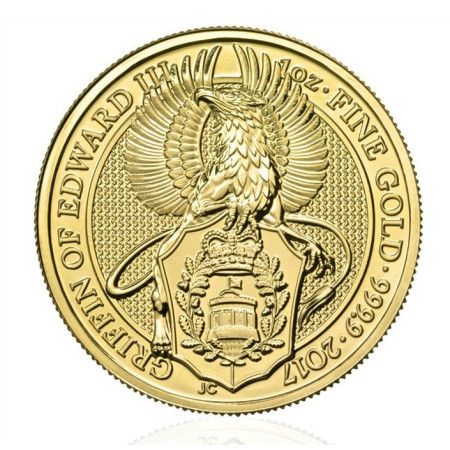

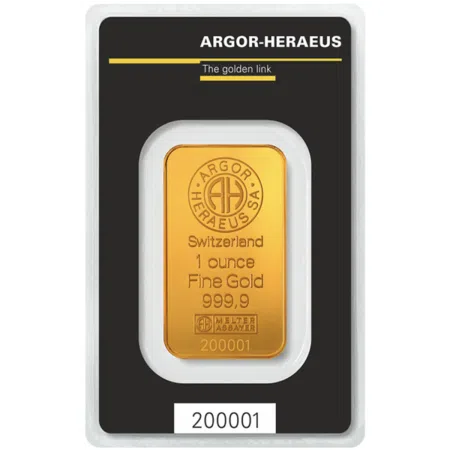

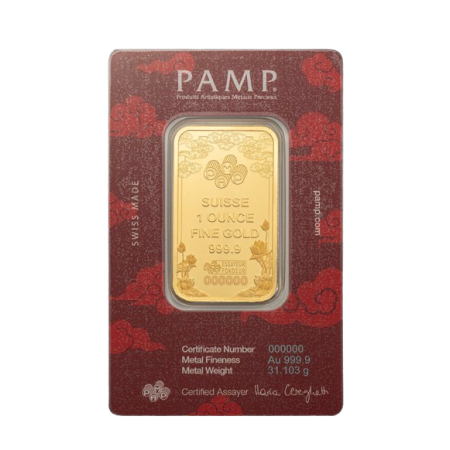

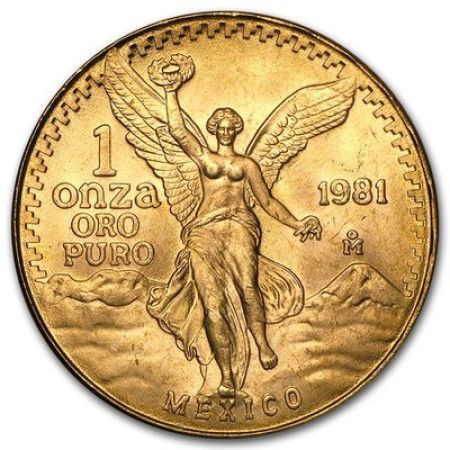

31.2 gramsNon-TaxableUS$ 6,635.05US$ 212.66US$ 6,635.0528.30%%US$ 5,171.62

31.2 gramsNon-TaxableUS$ 6,635.05US$ 212.66US$ 6,635.0528.30%%US$ 5,171.62 -

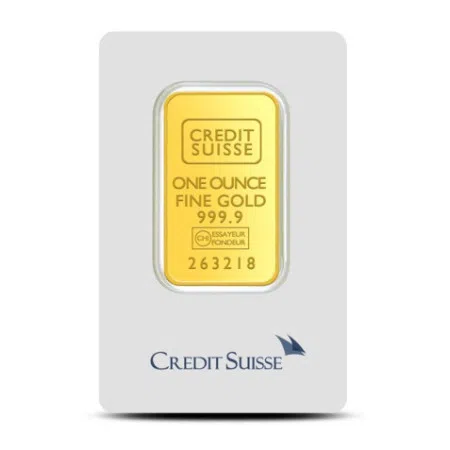

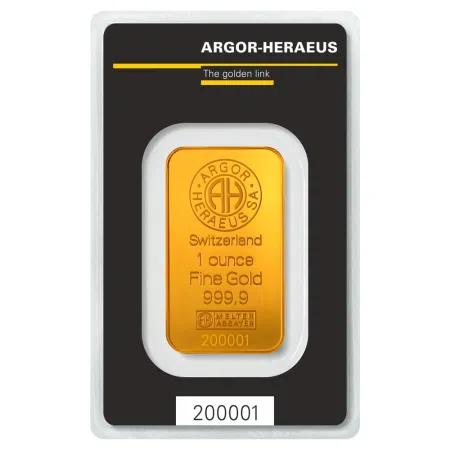

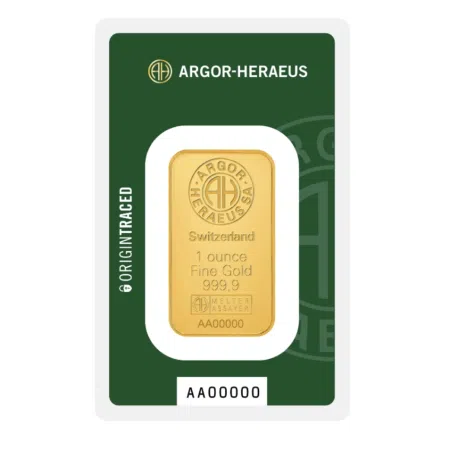

31.1 gramsNon-TaxableUS$ 5,616.47US$ 180.59US$ 5,616.479.94%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,616.47US$ 180.59US$ 5,616.479.94%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,616.47US$ 180.59US$ 5,616.479.94%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,616.47US$ 180.59US$ 5,616.479.94%%US$ 5,108.61 -

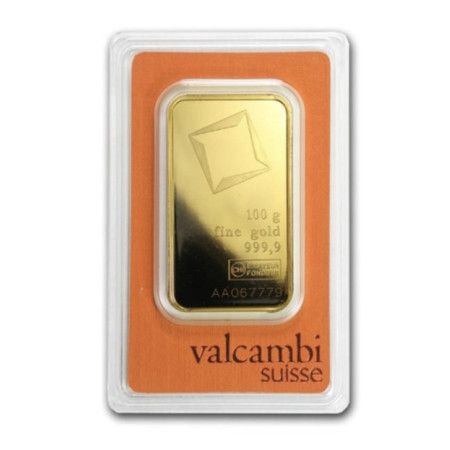

100 gramsNon-TaxableUS$ 17,155.96US$ 171.56US$ 5,327.944.76%%US$ 16,376.61

100 gramsNon-TaxableUS$ 17,155.96US$ 171.56US$ 5,327.944.76%%US$ 16,376.61 -

31.1 gramsNon-TaxableUS$ 6,024.32US$ 193.71US$ 6,024.3218.52%%US$ 5,082.81

31.1 gramsNon-TaxableUS$ 6,024.32US$ 193.71US$ 6,024.3218.52%%US$ 5,082.81 -

31.1 gramsNon-TaxableUS$ 5,829.27US$ 187.44US$ 5,829.2711.85%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,829.27US$ 187.44US$ 5,829.2711.85%%US$ 5,211.81 -

31.2 gramsNon-TaxableUS$ 6,371.76US$ 204.22US$ 6,371.7624.33%%US$ 5,125.03

31.2 gramsNon-TaxableUS$ 6,371.76US$ 204.22US$ 6,371.7624.33%%US$ 5,125.03 -

1 KGNon-TaxableUS$ 167,935.42US$ 167.94US$ 5,223.502.24%%US$ 164,263.89

1 KGNon-TaxableUS$ 167,935.42US$ 167.94US$ 5,223.502.24%%US$ 164,263.89 -

31.1 gramsNon-TaxableUS$ 5,867.16US$ 188.65US$ 5,867.1612.24%%US$ 5,227.29

31.1 gramsNon-TaxableUS$ 5,867.16US$ 188.65US$ 5,867.1612.24%%US$ 5,227.29 -

31.1 gramsNon-TaxableUS$ 5,931.41US$ 190.72US$ 5,931.4115.52%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,931.41US$ 190.72US$ 5,931.4115.52%%US$ 5,134.41 -

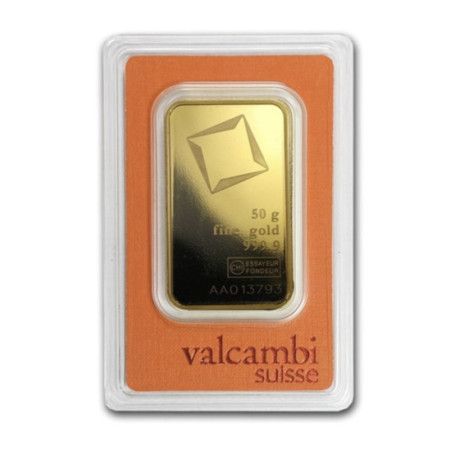

50 gramsNon-TaxableUS$ 8,739.24US$ 174.78US$ 5,428.106.40%%US$ 8,213.19

50 gramsNon-TaxableUS$ 8,739.24US$ 174.78US$ 5,428.106.40%%US$ 8,213.19 -

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.63%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.63%%US$ 5,129.25 -

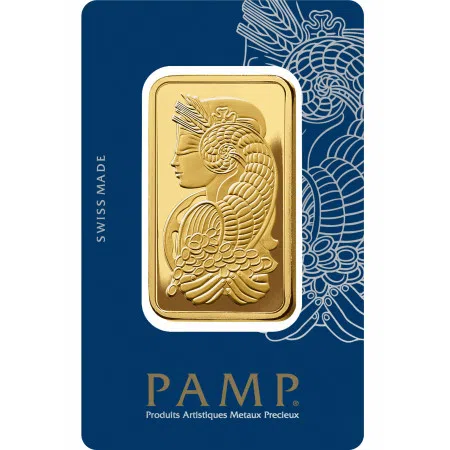

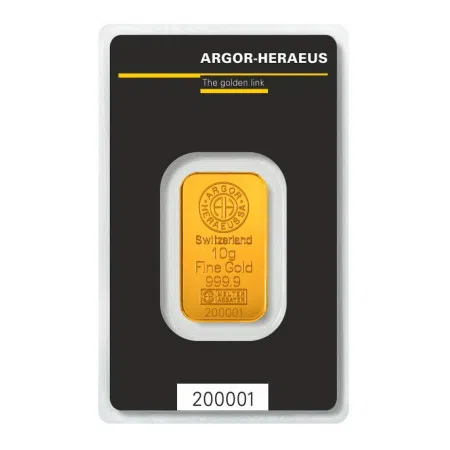

10 gramsNon-TaxableUS$ 1,871.19US$ 187.12US$ 5,847.4713.23%%US$ 1,652.59

10 gramsNon-TaxableUS$ 1,871.19US$ 187.12US$ 5,847.4713.23%%US$ 1,652.59 -

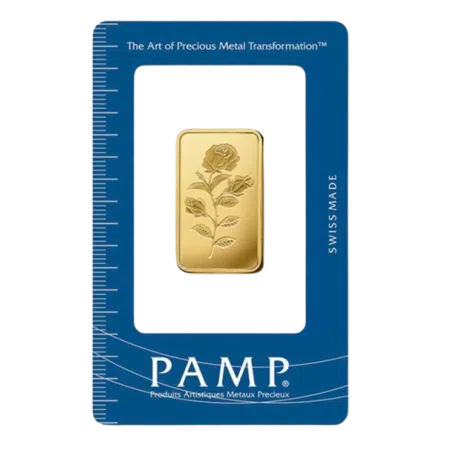

100 gramsNon-TaxableUS$ 17,276.03US$ 172.76US$ 5,365.235.17%%US$ 16,426.39

100 gramsNon-TaxableUS$ 17,276.03US$ 172.76US$ 5,365.235.17%%US$ 16,426.39 -

500 gramsNon-TaxableUS$ 85,486.72US$ 170.97US$ 5,316.344.61%%US$ 81,717.14

500 gramsNon-TaxableUS$ 85,486.72US$ 170.97US$ 5,316.344.61%%US$ 81,717.14 -

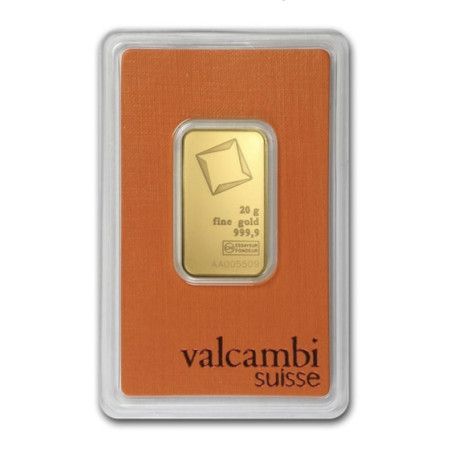

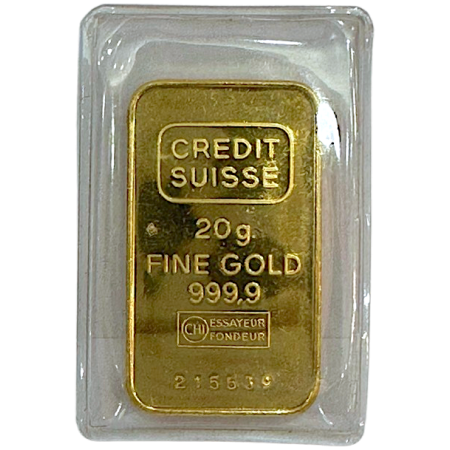

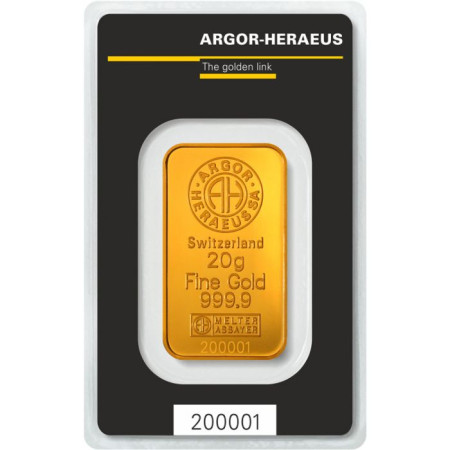

20 gramsNon-TaxableUS$ 3,581.63US$ 179.08US$ 5,596.309.57%%US$ 3,268.69

20 gramsNon-TaxableUS$ 3,581.63US$ 179.08US$ 5,596.309.57%%US$ 3,268.69 -

50 gramsNon-TaxableUS$ 8,789.85US$ 175.80US$ 5,459.537.56%%US$ 8,171.71

50 gramsNon-TaxableUS$ 8,789.85US$ 175.80US$ 5,459.537.56%%US$ 8,171.71 -

100 gramsNon-TaxableUS$ 17,461.61US$ 174.62US$ 5,422.866.63%%US$ 16,376.61

100 gramsNon-TaxableUS$ 17,461.61US$ 174.62US$ 5,422.866.63%%US$ 16,376.61 -

100 gramsNon-TaxableUS$ 17,265.72US$ 172.66US$ 5,362.025.54%%US$ 16,360.02

100 gramsNon-TaxableUS$ 17,265.72US$ 172.66US$ 5,362.025.54%%US$ 16,360.02 -

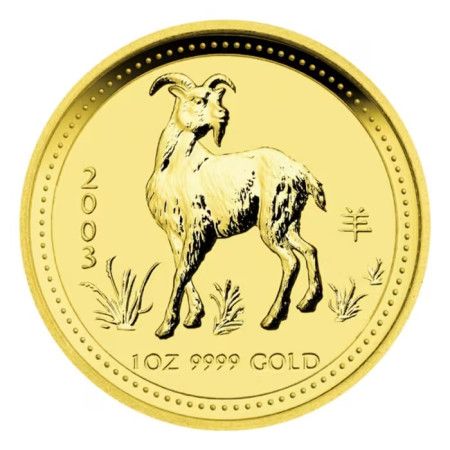

31.1 gramsNon-TaxableUS$ 7,086.20US$ 227.85US$ 7,086.2037.32%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 7,086.20US$ 227.85US$ 7,086.2037.32%%US$ 5,160.21 -

31.1 gramsNon-TaxableUS$ 5,462.26US$ 175.64US$ 5,462.266.92%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,462.26US$ 175.64US$ 5,462.266.92%%US$ 5,108.61 -

311 gramsNon-TaxableUS$ 53,572.14US$ 172.26US$ 5,357.215.29%%US$ 50,879.66

311 gramsNon-TaxableUS$ 53,572.14US$ 172.26US$ 5,357.215.29%%US$ 50,879.66 -

311 gramsNon-TaxableUS$ 52,844.68US$ 169.92US$ 5,284.473.86%%US$ 50,879.66

311 gramsNon-TaxableUS$ 52,844.68US$ 169.92US$ 5,284.473.86%%US$ 50,879.66 -

100 gramsNon-TaxableUS$ 17,225.42US$ 172.25US$ 5,349.514.86%%US$ 16,426.39

100 gramsNon-TaxableUS$ 17,225.42US$ 172.25US$ 5,349.514.86%%US$ 16,426.39 -

10 gramsNon-TaxableUS$ 1,848.39US$ 184.84US$ 5,776.2211.96%%US$ 1,650.94

10 gramsNon-TaxableUS$ 1,848.39US$ 184.84US$ 5,776.2211.96%%US$ 1,650.94 -

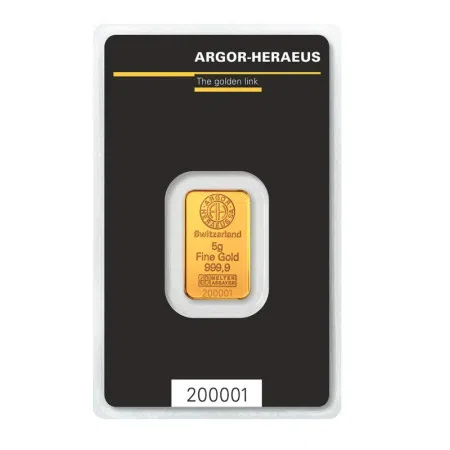

5 gramsNon-TaxableUS$ 949.40US$ 189.88US$ 5,933.7514.67%%US$ 827.96

5 gramsNon-TaxableUS$ 949.40US$ 189.88US$ 5,933.7514.67%%US$ 827.96 -

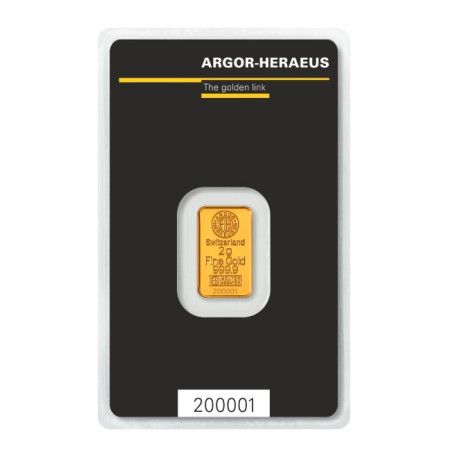

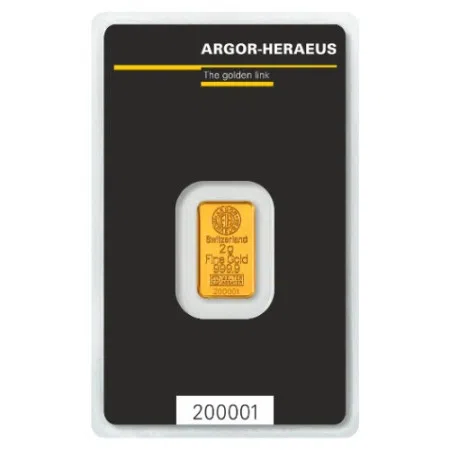

2 gramsNon-TaxableUS$ 434.84US$ 217.42US$ 7,247.3329.10%%US$ 336.82

2 gramsNon-TaxableUS$ 434.84US$ 217.42US$ 7,247.3329.10%%US$ 336.82 -

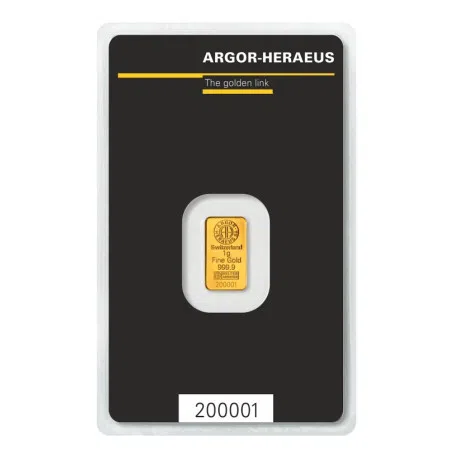

1 gramsNon-TaxableUS$ 243.90US$ 243.90US$ 8,130.0043.69%%US$ 169.74

1 gramsNon-TaxableUS$ 243.90US$ 243.90US$ 8,130.0043.69%%US$ 169.74 -

10 gramsNon-TaxableUS$ 1,814.78US$ 181.48US$ 5,671.1910.48%%US$ 1,642.64

10 gramsNon-TaxableUS$ 1,814.78US$ 181.48US$ 5,671.1910.48%%US$ 1,642.64 -

1 gramsNon-TaxableUS$ 252.31US$ 252.31US$ 8,410.3352.06%%US$ 165.92

1 gramsNon-TaxableUS$ 252.31US$ 252.31US$ 8,410.3352.06%%US$ 165.92 -

100 gramsNon-TaxableUS$ 17,427.86US$ 174.28US$ 5,412.386.10%%US$ 16,426.39

100 gramsNon-TaxableUS$ 17,427.86US$ 174.28US$ 5,412.386.10%%US$ 16,426.39 -

31.1 gramsNon-TaxableUS$ 5,500.99US$ 176.88US$ 5,500.997.25%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,500.99US$ 176.88US$ 5,500.997.25%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,364.26US$ 172.48US$ 5,364.264.58%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,364.26US$ 172.48US$ 5,364.264.58%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,640.43US$ 181.36US$ 5,640.438.22%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,640.43US$ 181.36US$ 5,640.438.22%%US$ 5,211.81 -

50 gramsNon-TaxableUS$ 8,785.64US$ 175.71US$ 5,456.926.65%%US$ 8,238.08

50 gramsNon-TaxableUS$ 8,785.64US$ 175.71US$ 5,456.926.65%%US$ 8,238.08 -

50 gramsNon-TaxableUS$ 8,772.98US$ 175.46US$ 5,449.066.82%%US$ 8,213.19

50 gramsNon-TaxableUS$ 8,772.98US$ 175.46US$ 5,449.066.82%%US$ 8,213.19 -

2 gramsNon-TaxableUS$ 453.70US$ 226.85US$ 7,561.6734.97%%US$ 336.16

2 gramsNon-TaxableUS$ 453.70US$ 226.85US$ 7,561.6734.97%%US$ 336.16 -

31.1 gramsNon-TaxableUS$ 5,561.73US$ 178.83US$ 5,561.738.11%%US$ 5,144.73

31.1 gramsNon-TaxableUS$ 5,561.73US$ 178.83US$ 5,561.738.11%%US$ 5,144.73 -

50 gramsNon-TaxableUS$ 8,809.51US$ 176.19US$ 5,471.757.26%%US$ 8,213.19

50 gramsNon-TaxableUS$ 8,809.51US$ 176.19US$ 5,471.757.26%%US$ 8,213.19 -

31.1 gramsNon-TaxableUS$ 5,451.34US$ 175.28US$ 5,451.346.17%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,451.34US$ 175.28US$ 5,451.346.17%%US$ 5,134.41 -

100 gramsNon-TaxableUS$ 17,105.40US$ 171.05US$ 5,312.244.13%%US$ 16,426.39

100 gramsNon-TaxableUS$ 17,105.40US$ 171.05US$ 5,312.244.13%%US$ 16,426.39 -

2 gramsNon-TaxableUS$ 424.73US$ 212.37US$ 7,078.8326.72%%US$ 335.16

2 gramsNon-TaxableUS$ 424.73US$ 212.37US$ 7,078.8326.72%%US$ 335.16 -

2.5 gramsNon-TaxableUS$ 561.53US$ 224.61US$ 7,019.1330.29%%US$ 430.99

2.5 gramsNon-TaxableUS$ 561.53US$ 224.61US$ 7,019.1330.29%%US$ 430.99 -

20 gramsNon-TaxableUS$ 3,576.03US$ 178.80US$ 5,587.558.30%%US$ 3,301.87

20 gramsNon-TaxableUS$ 3,576.03US$ 178.80US$ 5,587.558.30%%US$ 3,301.87 -

31.1 gramsNon-TaxableUS$ 5,437.60US$ 174.84US$ 5,437.605.91%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,437.60US$ 174.84US$ 5,437.605.91%%US$ 5,134.41 -

31.1 gramsNon-TaxableUS$ 5,471.79US$ 175.94US$ 5,471.796.57%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,471.79US$ 175.94US$ 5,471.796.57%%US$ 5,134.41 -

59.1 gramsNon-TaxableUS$ 11,770.33US$ 199.16US$ 6,194.9116.54%%US$ 10,100.24

59.1 gramsNon-TaxableUS$ 11,770.33US$ 199.16US$ 6,194.9116.54%%US$ 10,100.24 -

31.1 gramsNon-TaxableUS$ 5,364.26US$ 172.48US$ 5,364.264.58%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,364.26US$ 172.48US$ 5,364.264.58%%US$ 5,129.25 -

5 gramsNon-TaxableUS$ 966.20US$ 193.24US$ 6,038.7516.46%%US$ 829.62

5 gramsNon-TaxableUS$ 966.20US$ 193.24US$ 6,038.7516.46%%US$ 829.62 -

50 gramsNon-TaxableUS$ 8,747.99US$ 174.96US$ 5,433.535.98%%US$ 8,254.68

50 gramsNon-TaxableUS$ 8,747.99US$ 174.96US$ 5,433.535.98%%US$ 8,254.68 -

100 gramsNon-TaxableUS$ 17,487.53US$ 174.88US$ 5,430.915.93%%US$ 16,509.35

100 gramsNon-TaxableUS$ 17,487.53US$ 174.88US$ 5,430.915.93%%US$ 16,509.35 -

129.3 gramsTaxableUS$ 24,216.68US$ 187.29US$ 5,821.3211.76%%US$ 21,668.40

129.3 gramsTaxableUS$ 24,216.68US$ 187.29US$ 5,821.3211.76%%US$ 21,668.40 -

129.9 gramsTaxableUS$ 24,329.05US$ 187.29US$ 5,820.3511.76%%US$ 21,768.95

129.9 gramsTaxableUS$ 24,329.05US$ 187.29US$ 5,820.3511.76%%US$ 21,768.95 -

101.5 gramsTaxableUS$ 19,010.00US$ 187.29US$ 5,831.2911.76%%US$ 17,009.61

101.5 gramsTaxableUS$ 19,010.00US$ 187.29US$ 5,831.2911.76%%US$ 17,009.61 -

101.4 gramsTaxableUS$ 19,025.40US$ 187.63US$ 5,836.0111.96%%US$ 16,992.85

101.4 gramsTaxableUS$ 19,025.40US$ 187.63US$ 5,836.0111.96%%US$ 16,992.85 -

31.1 gramsNon-TaxableUS$ 5,431.71US$ 174.65US$ 5,431.715.26%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,431.71US$ 174.65US$ 5,431.715.26%%US$ 5,160.21 -

30 gramsNon-TaxableUS$ 5,356.45US$ 178.55US$ 5,579.648.70%%US$ 4,927.92

30 gramsNon-TaxableUS$ 5,356.45US$ 178.55US$ 5,579.648.70%%US$ 4,927.92 -

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.21%%US$ 5,149.89

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.21%%US$ 5,149.89 -

5 gramsNon-TaxableUS$ 979.50US$ 195.90US$ 6,121.8819.26%%US$ 821.32

5 gramsNon-TaxableUS$ 979.50US$ 195.90US$ 6,121.8819.26%%US$ 821.32 -

31.1 gramsNon-TaxableUS$ 5,466.57US$ 175.77US$ 5,466.577.01%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,466.57US$ 175.77US$ 5,466.577.01%%US$ 5,108.61 -

119.8 gramsTaxableUS$ 22,437.42US$ 187.29US$ 5,827.9011.76%%US$ 20,076.37

119.8 gramsTaxableUS$ 22,437.42US$ 187.29US$ 5,827.9011.76%%US$ 20,076.37 -

49.3 gramsTaxableUS$ 9,050.92US$ 183.59US$ 5,692.409.55%%US$ 8,261.81

49.3 gramsTaxableUS$ 9,050.92US$ 183.59US$ 5,692.409.55%%US$ 8,261.81 -

31.1 gramsNon-TaxableUS$ 5,458.56US$ 175.52US$ 5,458.566.31%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,458.56US$ 175.52US$ 5,458.566.31%%US$ 5,134.41 -

31.1 gramsNon-TaxableUS$ 5,385.22US$ 173.16US$ 5,385.224.99%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,385.22US$ 173.16US$ 5,385.224.99%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,488.52US$ 176.48US$ 5,488.527.11%%US$ 5,124.09

31.1 gramsNon-TaxableUS$ 5,488.52US$ 176.48US$ 5,488.527.11%%US$ 5,124.09 -

31.1 gramsNon-TaxableUS$ 5,406.51US$ 173.84US$ 5,406.516.37%%US$ 5,082.81

31.1 gramsNon-TaxableUS$ 5,406.51US$ 173.84US$ 5,406.516.37%%US$ 5,082.81 -

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.53%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.53%%US$ 5,134.41 -

31.1 gramsNon-TaxableUS$ 5,348.43US$ 171.98US$ 5,348.434.27%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,348.43US$ 171.98US$ 5,348.434.27%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,368.66US$ 172.63US$ 5,368.664.67%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,368.66US$ 172.63US$ 5,368.664.67%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,646.28US$ 181.55US$ 5,646.2810.52%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,646.28US$ 181.55US$ 5,646.2810.52%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,600.72US$ 180.09US$ 5,600.7210.98%%US$ 5,046.68

31.1 gramsNon-TaxableUS$ 5,600.72US$ 180.09US$ 5,600.7210.98%%US$ 5,046.68 -

101.5 gramsTaxableUS$ 19,044.16US$ 187.63US$ 5,841.7711.96%%US$ 17,009.61

101.5 gramsTaxableUS$ 19,044.16US$ 187.63US$ 5,841.7711.96%%US$ 17,009.61 -

30.8 gramsTaxableUS$ 5,654.53US$ 183.59US$ 5,711.659.55%%US$ 5,161.54

30.8 gramsTaxableUS$ 5,654.53US$ 183.59US$ 5,711.659.55%%US$ 5,161.54 -

132.3 gramsTaxableUS$ 24,778.55US$ 187.29US$ 5,830.2511.76%%US$ 22,171.14

132.3 gramsTaxableUS$ 24,778.55US$ 187.29US$ 5,830.2511.76%%US$ 22,171.14 -

311 gramsNon-TaxableUS$ 52,899.86US$ 170.10US$ 5,289.993.03%%US$ 51,344.08

311 gramsNon-TaxableUS$ 52,899.86US$ 170.10US$ 5,289.993.03%%US$ 51,344.08 -

31.1 gramsNon-TaxableUS$ 5,438.00US$ 174.86US$ 5,438.005.91%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,438.00US$ 174.86US$ 5,438.005.91%%US$ 5,134.41 -

100 gramsNon-TaxableUS$ 17,056.89US$ 170.57US$ 5,297.173.32%%US$ 16,509.35

100 gramsNon-TaxableUS$ 17,056.89US$ 170.57US$ 5,297.173.32%%US$ 16,509.35 -

100 gramsNon-TaxableUS$ 17,307.07US$ 173.07US$ 5,374.874.94%%US$ 16,492.76

100 gramsNon-TaxableUS$ 17,307.07US$ 173.07US$ 5,374.874.94%%US$ 16,492.76 -

31.1 gramsNon-TaxableUS$ 5,511.49US$ 177.22US$ 5,511.497.45%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,511.49US$ 177.22US$ 5,511.497.45%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,368.66US$ 172.63US$ 5,368.664.67%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,368.66US$ 172.63US$ 5,368.664.67%%US$ 5,129.25 -

1 gramsNon-TaxableUS$ 235.48US$ 235.48US$ 7,849.3339.14%%US$ 169.24

1 gramsNon-TaxableUS$ 235.48US$ 235.48US$ 7,849.3339.14%%US$ 169.24 -

7.8 gramsNon-TaxableUS$ 1,553.44US$ 199.16US$ 6,213.7618.14%%US$ 1,314.91

7.8 gramsNon-TaxableUS$ 1,553.44US$ 199.16US$ 6,213.7618.14%%US$ 1,314.91 -

31.1 gramsNon-TaxableUS$ 5,458.56US$ 175.52US$ 5,458.566.31%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,458.56US$ 175.52US$ 5,458.566.31%%US$ 5,134.41 -

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.53%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.506.53%%US$ 5,134.41 -

7.8 gramsNon-TaxableUS$ 1,434.96US$ 183.97US$ 5,739.849.78%%US$ 1,307.14

7.8 gramsNon-TaxableUS$ 1,434.96US$ 183.97US$ 5,739.849.78%%US$ 1,307.14 -

7.8 gramsNon-TaxableUS$ 1,488.22US$ 190.80US$ 5,952.8813.85%%US$ 1,307.14

7.8 gramsNon-TaxableUS$ 1,488.22US$ 190.80US$ 5,952.8813.85%%US$ 1,307.14 -

31.1 gramsNon-TaxableUS$ 5,663.71US$ 182.11US$ 5,663.7110.87%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,663.71US$ 182.11US$ 5,663.7110.87%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,641.06US$ 181.38US$ 5,641.0611.78%%US$ 5,046.68

31.1 gramsNon-TaxableUS$ 5,641.06US$ 181.38US$ 5,641.0611.78%%US$ 5,046.68 -

15.6 gramsNon-TaxableUS$ 3,185.88US$ 204.22US$ 6,371.7625.59%%US$ 2,536.63

15.6 gramsNon-TaxableUS$ 3,185.88US$ 204.22US$ 6,371.7625.59%%US$ 2,536.63 -

15.6 gramsNon-TaxableUS$ 3,159.55US$ 202.54US$ 6,319.1024.56%%US$ 2,536.63

15.6 gramsNon-TaxableUS$ 3,159.55US$ 202.54US$ 6,319.1024.56%%US$ 2,536.63 -

7.8 gramsNon-TaxableUS$ 1,639.02US$ 210.13US$ 6,556.0824.65%%US$ 1,314.91

7.8 gramsNon-TaxableUS$ 1,639.02US$ 210.13US$ 6,556.0824.65%%US$ 1,314.91 -

62.2 gramsNon-TaxableUS$ 10,676.54US$ 171.65US$ 5,338.274.81%%US$ 10,186.25

62.2 gramsNon-TaxableUS$ 10,676.54US$ 171.65US$ 5,338.274.81%%US$ 10,186.25 -

31.1 gramsNon-TaxableUS$ 5,309.26US$ 170.72US$ 5,309.263.41%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,309.26US$ 170.72US$ 5,309.263.41%%US$ 5,134.41 -

7.8 gramsNon-TaxableUS$ 1,540.28US$ 197.47US$ 6,161.1219.49%%US$ 1,289.02

7.8 gramsNon-TaxableUS$ 1,540.28US$ 197.47US$ 6,161.1219.49%%US$ 1,289.02 -

3.1 gramsNon-TaxableUS$ 826.68US$ 266.67US$ 8,266.8053.21%%US$ 539.57

3.1 gramsNon-TaxableUS$ 826.68US$ 266.67US$ 8,266.8053.21%%US$ 539.57 -

1.5 gramsNon-TaxableUS$ 468.36US$ 312.24US$ 9,367.2079.22%%US$ 261.33

1.5 gramsNon-TaxableUS$ 468.36US$ 312.24US$ 9,367.2079.22%%US$ 261.33 -

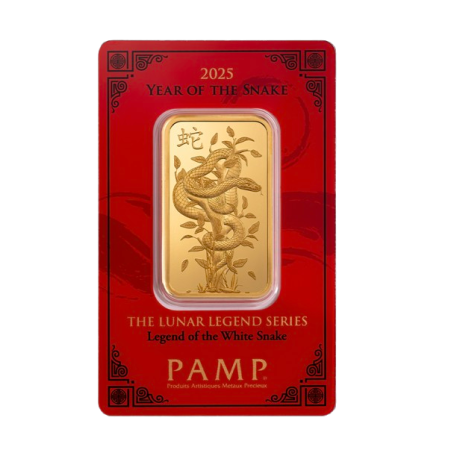

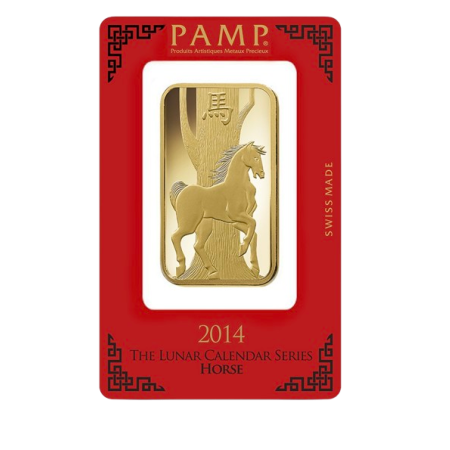

59.1 gramsNon-TaxableUS$ 13,366.31US$ 226.16US$ 7,034.9032.34%%US$ 10,100.24

59.1 gramsNon-TaxableUS$ 13,366.31US$ 226.16US$ 7,034.9032.34%%US$ 10,100.24 -

31.1 gramsNon-TaxableUS$ 5,477.54US$ 176.13US$ 5,477.547.22%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,477.54US$ 176.13US$ 5,477.547.22%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,372.70US$ 172.76US$ 5,372.704.12%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,372.70US$ 172.76US$ 5,372.704.12%%US$ 5,160.21 -

31.1 gramsNon-TaxableUS$ 6,036.39US$ 194.10US$ 6,036.3918.16%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 6,036.39US$ 194.10US$ 6,036.3918.16%%US$ 5,108.61 -

20 gramsNon-TaxableUS$ 3,587.01US$ 179.35US$ 5,604.709.18%%US$ 3,285.28

20 gramsNon-TaxableUS$ 3,587.01US$ 179.35US$ 5,604.709.18%%US$ 3,285.28 -

3.1 gramsNon-TaxableUS$ 637.04US$ 205.50US$ 6,370.4022.62%%US$ 519.51

3.1 gramsNon-TaxableUS$ 637.04US$ 205.50US$ 6,370.4022.62%%US$ 519.51 -

20 gramsNon-TaxableUS$ 3,597.15US$ 179.86US$ 5,620.558.40%%US$ 3,318.46

20 gramsNon-TaxableUS$ 3,597.15US$ 179.86US$ 5,620.558.40%%US$ 3,318.46 -

31.1 gramsNon-TaxableUS$ 5,359.02US$ 172.32US$ 5,359.024.48%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,359.02US$ 172.32US$ 5,359.024.48%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,624.70US$ 180.86US$ 5,624.707.92%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,624.70US$ 180.86US$ 5,624.707.92%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,710.01US$ 183.60US$ 5,710.019.56%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,710.01US$ 183.60US$ 5,710.019.56%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,356.41US$ 172.23US$ 5,356.414.43%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,356.41US$ 172.23US$ 5,356.414.43%%US$ 5,129.25 -

23.3 gramsTaxableUS$ 7,253.52US$ 311.31US$ 9,671.3621.05%%US$ 5,992.31

23.3 gramsTaxableUS$ 7,253.52US$ 311.31US$ 9,671.3621.05%%US$ 5,992.31 -

31.1 gramsNon-TaxableUS$ 5,311.33US$ 170.78US$ 5,311.333.45%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,311.33US$ 170.78US$ 5,311.333.45%%US$ 5,134.41 -

23.2 gramsTaxableUS$ 4,278.77US$ 184.43US$ 5,705.0310.05%%US$ 3,887.91

23.2 gramsTaxableUS$ 4,278.77US$ 184.43US$ 5,705.0310.05%%US$ 3,887.91 -

100 gramsNon-TaxableUS$ 17,088.55US$ 170.89US$ 5,307.003.72%%US$ 16,476.17

100 gramsNon-TaxableUS$ 17,088.55US$ 170.89US$ 5,307.003.72%%US$ 16,476.17 -

31.1 gramsNon-TaxableUS$ 5,443.25US$ 175.02US$ 5,443.257.09%%US$ 5,082.81

31.1 gramsNon-TaxableUS$ 5,443.25US$ 175.02US$ 5,443.257.09%%US$ 5,082.81 -

31.1 gramsNon-TaxableUS$ 5,472.12US$ 175.95US$ 5,472.126.68%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,472.12US$ 175.95US$ 5,472.126.68%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,579.73US$ 179.41US$ 5,579.738.13%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,579.73US$ 179.41US$ 5,579.738.13%%US$ 5,160.21 -

30 gramsNon-TaxableUS$ 5,382.37US$ 179.41US$ 5,606.649.22%%US$ 4,927.92

30 gramsNon-TaxableUS$ 5,382.37US$ 179.41US$ 5,606.649.22%%US$ 4,927.92 -

31.1 gramsNon-TaxableUS$ 5,264.42US$ 169.27US$ 5,264.422.74%%US$ 5,124.09

31.1 gramsNon-TaxableUS$ 5,264.42US$ 169.27US$ 5,264.422.74%%US$ 5,124.09 -

31.1 gramsNon-TaxableUS$ 5,646.28US$ 181.55US$ 5,646.2810.52%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,646.28US$ 181.55US$ 5,646.2810.52%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,646.28US$ 181.55US$ 5,646.2810.52%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 5,646.28US$ 181.55US$ 5,646.2810.52%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,385.51US$ 173.17US$ 5,385.515.00%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,385.51US$ 173.17US$ 5,385.515.00%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,501.21US$ 176.89US$ 5,501.216.61%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,501.21US$ 176.89US$ 5,501.216.61%%US$ 5,160.21 -

31.1 gramsNon-TaxableUS$ 5,380.26US$ 173.00US$ 5,380.265.00%%US$ 5,124.09

31.1 gramsNon-TaxableUS$ 5,380.26US$ 173.00US$ 5,380.265.00%%US$ 5,124.09 -

20 gramsNon-TaxableUS$ 3,528.75US$ 176.44US$ 5,513.677.41%%US$ 3,285.28

20 gramsNon-TaxableUS$ 3,528.75US$ 176.44US$ 5,513.677.41%%US$ 3,285.28 -

100 gramsNon-TaxableUS$ 17,647.97US$ 176.48US$ 5,480.747.22%%US$ 16,459.57

100 gramsNon-TaxableUS$ 17,647.97US$ 176.48US$ 5,480.747.22%%US$ 16,459.57 -

100 gramsNon-TaxableUS$ 17,249.25US$ 172.49US$ 5,356.914.69%%US$ 16,476.17

100 gramsNon-TaxableUS$ 17,249.25US$ 172.49US$ 5,356.914.69%%US$ 16,476.17 -

3.1 gramsNon-TaxableUS$ 810.98US$ 261.61US$ 8,109.8059.26%%US$ 509.22

3.1 gramsNon-TaxableUS$ 810.98US$ 261.61US$ 8,109.8059.26%%US$ 509.22 -

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.505.99%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,469.50US$ 175.87US$ 5,469.505.99%%US$ 5,160.21 -

31.1 gramsNon-TaxableUS$ 5,878.92US$ 189.03US$ 5,878.9214.62%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,878.92US$ 189.03US$ 5,878.9214.62%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,312.03US$ 170.80US$ 5,312.034.30%%US$ 5,093.13

31.1 gramsNon-TaxableUS$ 5,312.03US$ 170.80US$ 5,312.034.30%%US$ 5,093.13 -

31.1 gramsNon-TaxableUS$ 5,724.87US$ 184.08US$ 5,724.879.84%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,724.87US$ 184.08US$ 5,724.879.84%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,495.74US$ 176.71US$ 5,495.747.15%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,495.74US$ 176.71US$ 5,495.747.15%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,397.06US$ 173.54US$ 5,397.065.22%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,397.06US$ 173.54US$ 5,397.065.22%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,983.90US$ 192.41US$ 5,983.9016.66%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,983.90US$ 192.41US$ 5,983.9016.66%%US$ 5,129.25 -

7.8 gramsNon-TaxableUS$ 1,500.79US$ 192.41US$ 6,003.1614.81%%US$ 1,307.14

7.8 gramsNon-TaxableUS$ 1,500.79US$ 192.41US$ 6,003.1614.81%%US$ 1,307.14 -

10 gramsNon-TaxableUS$ 1,867.81US$ 186.78US$ 5,836.9113.02%%US$ 1,652.59

10 gramsNon-TaxableUS$ 1,867.81US$ 186.78US$ 5,836.9113.02%%US$ 1,652.59 -

31.1 gramsNon-TaxableUS$ 5,773.94US$ 185.66US$ 5,773.9412.46%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,773.94US$ 185.66US$ 5,773.9412.46%%US$ 5,134.41 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81

31.1 gramsNon-TaxableUS$ 5,600.20US$ 180.07US$ 5,600.207.45%%US$ 5,211.81 -

19.8 gramsTaxableUS$ 4,781.21US$ 241.48US$ 7,470.6445.53%%US$ 3,285.28

19.8 gramsTaxableUS$ 4,781.21US$ 241.48US$ 7,470.6445.53%%US$ 3,285.28 -

31.1 gramsNon-TaxableUS$ 5,353.79US$ 172.15US$ 5,353.793.75%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,353.79US$ 172.15US$ 5,353.793.75%%US$ 5,160.21 -

31.1 gramsNon-TaxableUS$ 5,353.79US$ 172.15US$ 5,353.794.38%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,353.79US$ 172.15US$ 5,353.794.38%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 6,036.39US$ 194.10US$ 6,036.3918.16%%US$ 5,108.61

31.1 gramsNon-TaxableUS$ 6,036.39US$ 194.10US$ 6,036.3918.16%%US$ 5,108.61 -

31.1 gramsNon-TaxableUS$ 5,572.55US$ 179.18US$ 5,572.558.21%%US$ 5,149.89

31.1 gramsNon-TaxableUS$ 5,572.55US$ 179.18US$ 5,572.558.21%%US$ 5,149.89 -

10 gramsNon-TaxableUS$ 1,873.59US$ 187.36US$ 5,854.9713.15%%US$ 1,655.91

10 gramsNon-TaxableUS$ 1,873.59US$ 187.36US$ 5,854.9713.15%%US$ 1,655.91 -

31.1 gramsNon-TaxableUS$ 5,343.31US$ 171.81US$ 5,343.314.17%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,343.31US$ 171.81US$ 5,343.314.17%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,274.85US$ 169.61US$ 5,274.852.84%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,274.85US$ 169.61US$ 5,274.852.84%%US$ 5,129.25 -

20 gramsNon-TaxableUS$ 3,607.28US$ 180.36US$ 5,636.3810.36%%US$ 3,268.69

20 gramsNon-TaxableUS$ 3,607.28US$ 180.36US$ 5,636.3810.36%%US$ 3,268.69 -

31.1 gramsNon-TaxableUS$ 5,320.45US$ 171.08US$ 5,320.453.62%%US$ 5,134.41

31.1 gramsNon-TaxableUS$ 5,320.45US$ 171.08US$ 5,320.453.62%%US$ 5,134.41 -

31.1 gramsNon-TaxableUS$ 5,375.01US$ 172.83US$ 5,375.014.90%%US$ 5,124.09

31.1 gramsNon-TaxableUS$ 5,375.01US$ 172.83US$ 5,375.014.90%%US$ 5,124.09 -

31.1 gramsNon-TaxableUS$ 5,280.05US$ 169.78US$ 5,280.052.94%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,280.05US$ 169.78US$ 5,280.052.94%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,384.88US$ 173.15US$ 5,384.884.98%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,384.88US$ 173.15US$ 5,384.884.98%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,368.66US$ 172.63US$ 5,368.664.67%%US$ 5,129.25

31.1 gramsNon-TaxableUS$ 5,368.66US$ 172.63US$ 5,368.664.67%%US$ 5,129.25 -

31.1 gramsNon-TaxableUS$ 5,462.26US$ 175.64US$ 5,462.265.85%%US$ 5,160.21

31.1 gramsNon-TaxableUS$ 5,462.26US$ 175.64US$ 5,462.265.85%%US$ 5,160.21

Gold Price Singapore: Live Gold Price Chart & Insight

As someone with over 4 decades navigating global financial markets, I can say with confidence: monitoring the latest gold price in Singapore is not simply for the keen investor, but for anyone who seeks financial stability amid global uncertainty built on the largest global debt crisis in economic history. Here, you’ll find up-to-date answers, the live gold prices across 10 major global currencies, historical context, and practical guidance on buying and selling gold—all from the perspective of those who view precious metals as a cornerstone of wealth preservation.

Why Is the Gold Price Important?

How much is 1g of gold in Singapore today?

As of this morning, the gold price per gram in Singapore is live and visible atop this page. Gold prices here reflect global movements, currency cycles, and local demand. Constant vigilance is key—these figures are updated in real time, empowering you to act with certainty whether purchasing as an investor, jeweller, or for personal security.

What is the price of gold today? Is the gold price going down?

Today’s gold price in Singapore is a window into prevailing economic confidence—our interactive gold price chart helps you spot whether gold is rising or entering a trough. Regularly updated data ensures you always have a finger on the market’s pulse.

What Drives the Gold Price in Singapore?

Several key factors shape the gold price per gram you see each day:

- Global Economic Uncertainty: Whenever markets wobble, investors flock to gold—as we saw in the wake of the 2008 crisis, and during the Covid-19 pandemic. These moments are plain on the gold price chart 10 years for Singapore. The unavoidable secular bull market in golds revaluation is here.

- Geopolitical Turbulence: Political tensions can send safe-haven demand surging. Consequently, even a remote conflict can nudge the price you’ll pay at local dealers.

- Currency Moves: The strength of the Singapore dollar versus the US dollar or euro will either cushion or amplify price moves. A solid SGD generally means more value per gram for buyers here.

- Inflation and Interest Rates: Persistent global inflation erodes cash, making gold—resilient, tangible, and borderless—exceptionally appealing.

Gold Price History and Trends

Track performance using the interactive gold price chart, spanning daily action to over a decade of history. Ask yourself: What is the highest price gold has ever been? In 2025, gold hit a new record high—easily spotted on the chart, arming you with historical context each time you trade or invest.

Gold price trend analysis isn’t just for analysts—patterns emerge that inform anyone seeking to buy gold Singapore or time a sale for maximum result.

Answers To Popular Gold Price Questions

- How much is gold worth right now?

The worth of gold hinges on the international spot price, but local supply, demand, and currency conversion set the price you pay in Singapore. - Is gold in Singapore cheap? Which country has the cheapest gold?

Singapore’s efficiency, tax environment, and market transparency routinely make it one of the most cost-effective places to buy gold globally, alongside Dubai and Hong Kong. - What is the price of gold today?

The answer is always current, right here—refresh this page for the latest live gold price chart and table.

Buying & Selling Gold in Singapore

Choosing where and how to transact matters. Well-established dealers—such as ourselves at Indigo Precious Metals—offer competitive rates, trustworthy guidance, and secure storage or delivery. In Singapore, consumers benefit from clear pricing and regulatory confidence.

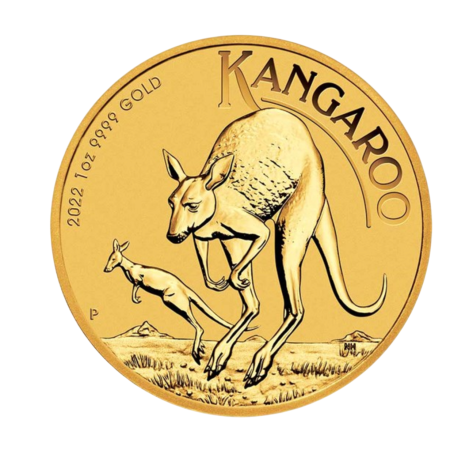

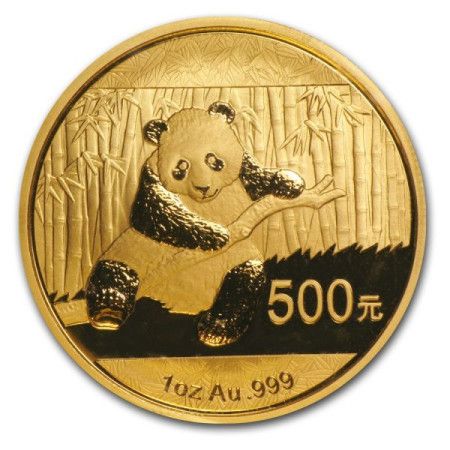

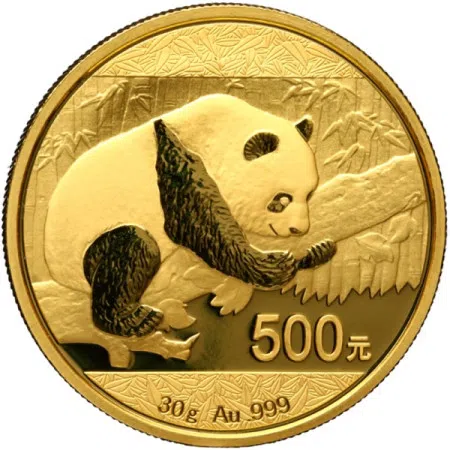

Whether you’re interested in physical gold (bars, coins, bullion), investing in gold-tracking stocks, or accumulating through gold savings accounts, each option carries unique attributes. Physical gold remains the most robust asset, but ETFs and gram savings plans bring flexibility. Our role is to help you decide which path aligns with your risk tolerance and objectives.

Timing The Market

When is the best time to sell gold in Singapore?

No one can predict the next peak, but regular review of the gold price trend—and professional guidance from our team at Indigo Precious Metals—can maximise your returns and offer peace of mind.

Precious Metals Beyond Gold

Savvy investors often track more than the gold price alone. That’s why our live tools also show the silver price today, plus up-to-date prices for platinum. Silver is more volatile but offers opportunity in bull markets. Platinum, meanwhile, is prized for its industrial uses, especially in automotive technology.

Why Trust Indigo Precious Metals?

For over a decade, Indigo Precious Metals has empowered Singapore clients with honest advice, transparent pricing, and a global perspective rooted in real experience. We believe the gold market should be accessible and understandable—helping you navigate choices, from monitoring the live gold price Singapore to building a securely stored portfolio.

Whether you’re tracking the gold price for investment, jewellery, or inheritance planning, let this page be your guide. For personal support, expert insight, or bespoke portfolio construction, our team is always here to help you safeguard and grow your wealth with confidence.

Author : David J Mitchell, Managing Director