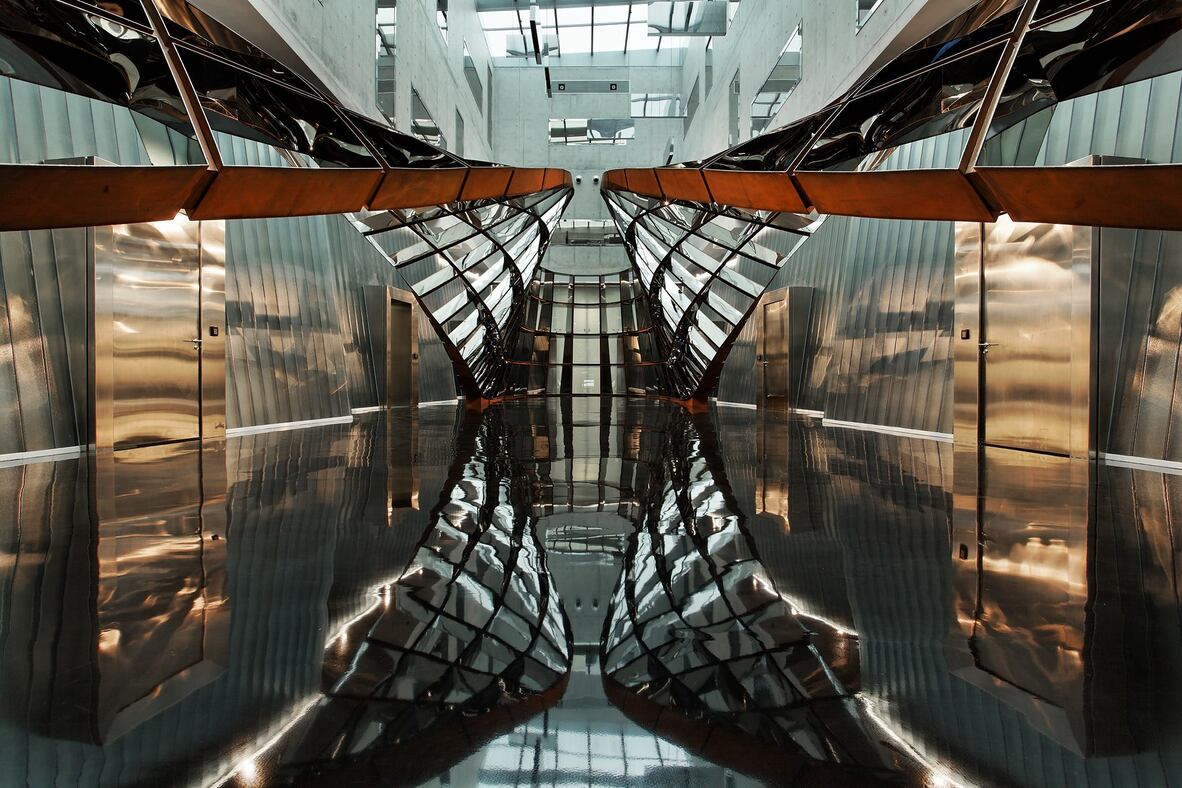

An Allocated Metal Account ensures the secure, segregated storage of individually numbered gold, silver, platinum, palladium, or rhodium bars and coins at Le Freeport, Singapore. These assets are held in the account holder’s name as their direct property.

Customers receive quarterly statements and vault storage invoices, guaranteeing full transparency and security.