-

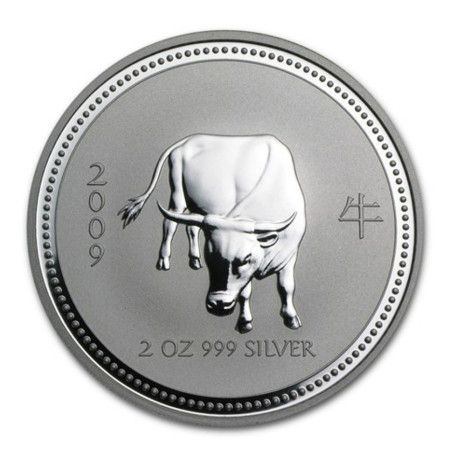

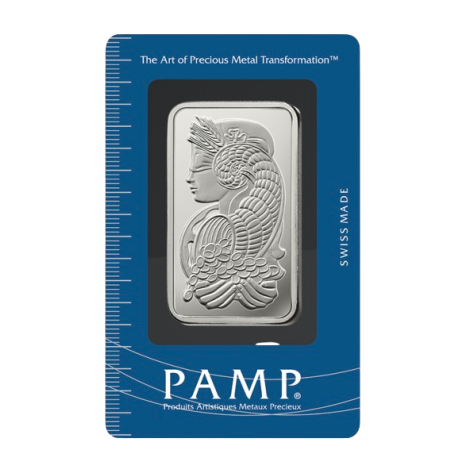

31.1 gramsNon-TaxableUS$ 97.26US$ 3.13US$ 97.2612.55%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.26US$ 3.13US$ 97.2612.55%%US$ 86.42 -

62.2 gramsNon-TaxableUS$ 241.85US$ 3.89US$ 120.9339.93%%US$ 172.83

62.2 gramsNon-TaxableUS$ 241.85US$ 3.89US$ 120.9339.93%%US$ 172.83 -

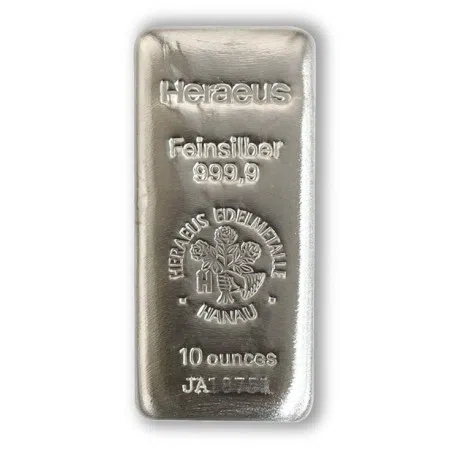

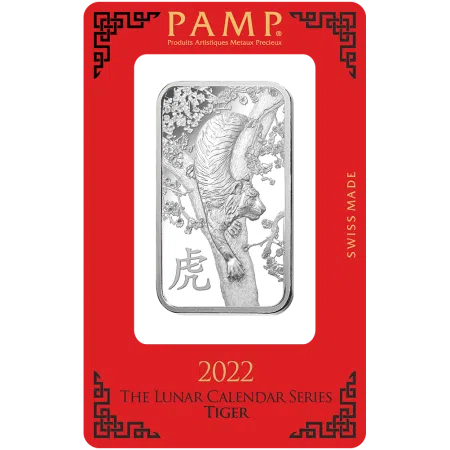

31.1 gramsNon-TaxableUS$ 105.86US$ 3.40US$ 105.8622.50%%US$ 86.42

31.1 gramsNon-TaxableUS$ 105.86US$ 3.40US$ 105.8622.50%%US$ 86.42 -

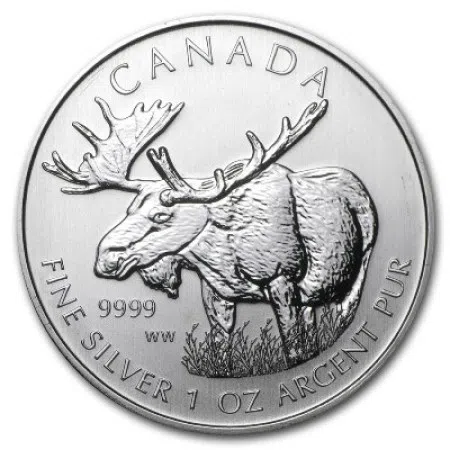

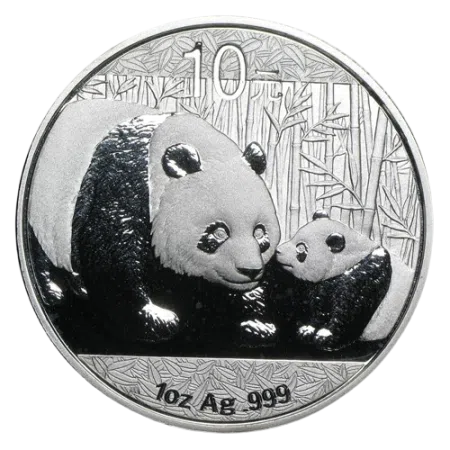

31.1 gramsTaxableUS$ 103.19US$ 3.32US$ 103.1919.41%%US$ 86.42

31.1 gramsTaxableUS$ 103.19US$ 3.32US$ 103.1919.41%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 104.97US$ 3.38US$ 104.9721.47%%US$ 86.42

31.1 gramsNon-TaxableUS$ 104.97US$ 3.38US$ 104.9721.47%%US$ 86.42 -

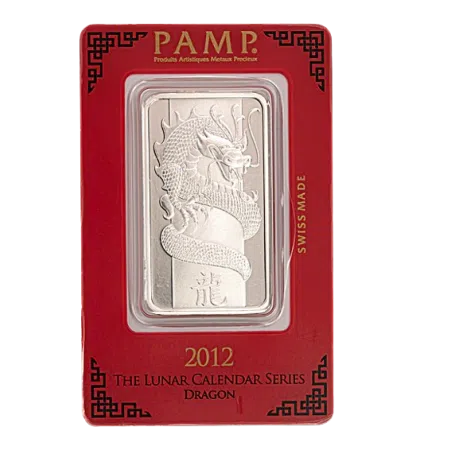

31.1 gramsNon-TaxableUS$ 144.11US$ 4.63US$ 144.1166.76%%US$ 86.42

31.1 gramsNon-TaxableUS$ 144.11US$ 4.63US$ 144.1166.76%%US$ 86.42 -

62.2 gramsNon-TaxableUS$ 220.62US$ 3.55US$ 110.3127.65%%US$ 172.83

62.2 gramsNon-TaxableUS$ 220.62US$ 3.55US$ 110.3127.65%%US$ 172.83 -

62.2 gramsNon-TaxableUS$ 211.72US$ 3.40US$ 105.8622.50%%US$ 172.83

62.2 gramsNon-TaxableUS$ 211.72US$ 3.40US$ 105.8622.50%%US$ 172.83 -

62.2 gramsNon-TaxableUS$ 338.04US$ 5.43US$ 169.0295.59%%US$ 172.83

62.2 gramsNon-TaxableUS$ 338.04US$ 5.43US$ 169.0295.59%%US$ 172.83 -

31.1 gramsNon-TaxableUS$ 105.86US$ 3.40US$ 105.8622.50%%US$ 86.42

31.1 gramsNon-TaxableUS$ 105.86US$ 3.40US$ 105.8622.50%%US$ 86.42 -

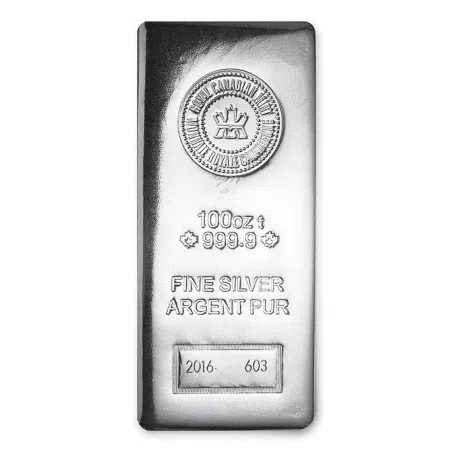

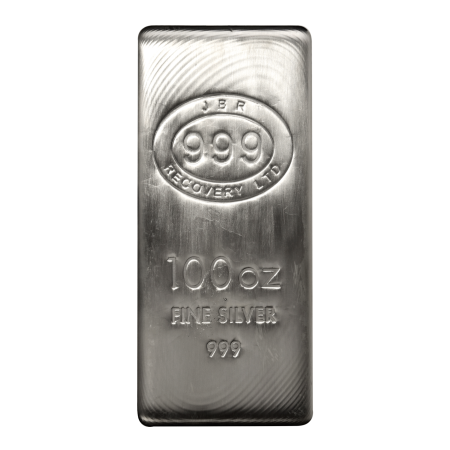

311 gramsNon-TaxableUS$ 1,084.83US$ 3.49US$ 108.4828.05%%US$ 847.21

311 gramsNon-TaxableUS$ 1,084.83US$ 3.49US$ 108.4828.05%%US$ 847.21 -

62.2 gramsNon-TaxableUS$ 314.79US$ 5.06US$ 157.4082.14%%US$ 172.83

62.2 gramsNon-TaxableUS$ 314.79US$ 5.06US$ 157.4082.14%%US$ 172.83 -

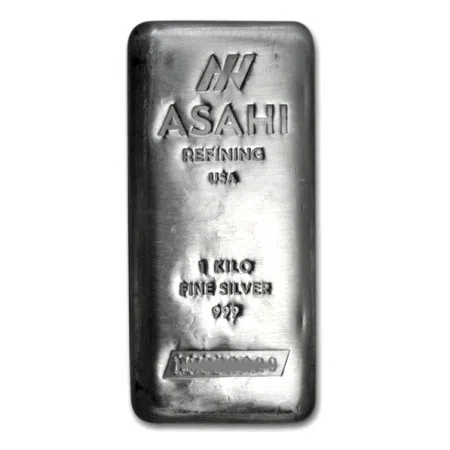

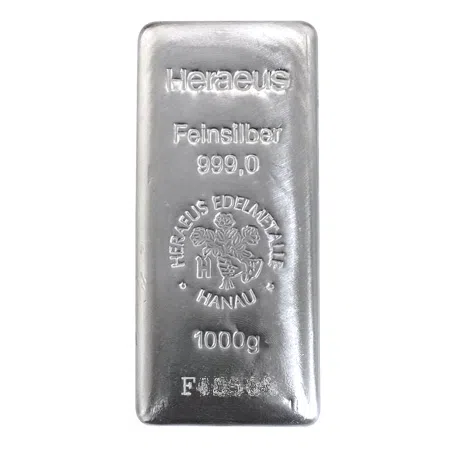

1 KGNon-TaxableUS$ 3,305.68US$ 3.31US$ 102.8222.57%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,305.68US$ 3.31US$ 102.8222.57%%US$ 2,696.90 -

1 KGNon-TaxableUS$ 3,126.45US$ 3.13US$ 97.2515.93%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,126.45US$ 3.13US$ 97.2515.93%%US$ 2,696.90 -

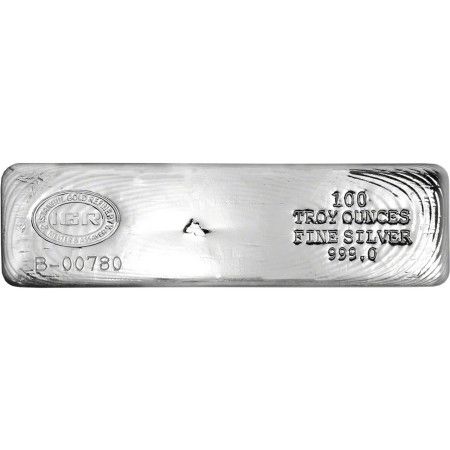

31.1 KGNon-TaxableUS$ 88,379.91US$ 2.84US$ 88.385.36%%US$ 83,882.96

31.1 KGNon-TaxableUS$ 88,379.91US$ 2.84US$ 88.385.36%%US$ 83,882.96 -

62.2 gramsNon-TaxableUS$ 316.69US$ 5.09US$ 158.3583.24%%US$ 172.83

62.2 gramsNon-TaxableUS$ 316.69US$ 5.09US$ 158.3583.24%%US$ 172.83 -

31.1 gramsNon-TaxableUS$ 113.87US$ 3.66US$ 113.8731.77%%US$ 86.42

31.1 gramsNon-TaxableUS$ 113.87US$ 3.66US$ 113.8731.77%%US$ 86.42 -

1 KGNon-TaxableUS$ 3,237.13US$ 3.24US$ 100.6920.03%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,237.13US$ 3.24US$ 100.6920.03%%US$ 2,696.90 -

62.4 gramsNon-TaxableUS$ 267.73US$ 4.29US$ 133.2054.41%%US$ 173.39

62.4 gramsNon-TaxableUS$ 267.73US$ 4.29US$ 133.2054.41%%US$ 173.39 -

62.2 gramsNon-TaxableUS$ 284.67US$ 4.58US$ 142.3464.71%%US$ 172.83

62.2 gramsNon-TaxableUS$ 284.67US$ 4.58US$ 142.3464.71%%US$ 172.83 -

62.2 gramsNon-TaxableUS$ 284.67US$ 4.58US$ 142.3464.71%%US$ 172.83

62.2 gramsNon-TaxableUS$ 284.67US$ 4.58US$ 142.3464.71%%US$ 172.83 -

3.11 KGNon-TaxableUS$ 9,552.11US$ 3.07US$ 95.5213.19%%US$ 8,439.00

3.11 KGNon-TaxableUS$ 9,552.11US$ 3.07US$ 95.5213.19%%US$ 8,439.00 -

1 KGNon-TaxableUS$ 3,278.63US$ 3.28US$ 101.9821.57%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,278.63US$ 3.28US$ 101.9821.57%%US$ 2,696.90 -

3.11 KGNon-TaxableUS$ 9,516.05US$ 3.06US$ 95.1615.19%%US$ 8,261.33

3.11 KGNon-TaxableUS$ 9,516.05US$ 3.06US$ 95.1615.19%%US$ 8,261.33 -

31.1 gramsNon-TaxableUS$ 97.26US$ 3.13US$ 97.2612.55%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.26US$ 3.13US$ 97.2612.55%%US$ 86.42 -

3.11 KGNon-TaxableUS$ 9,447.05US$ 3.04US$ 94.4714.36%%US$ 8,261.07

3.11 KGNon-TaxableUS$ 9,447.05US$ 3.04US$ 94.4714.36%%US$ 8,261.07 -

31.1 gramsNon-TaxableUS$ 102.83US$ 3.31US$ 102.8321.38%%US$ 84.72

31.1 gramsNon-TaxableUS$ 102.83US$ 3.31US$ 102.8321.38%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 114.96US$ 3.70US$ 114.9635.69%%US$ 84.72

31.1 gramsNon-TaxableUS$ 114.96US$ 3.70US$ 114.9635.69%%US$ 84.72 -

1 KGNon-TaxableUS$ 3,319.57US$ 3.32US$ 103.2523.09%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,319.57US$ 3.32US$ 103.2523.09%%US$ 2,696.90 -

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72 -

311 gramsNon-TaxableUS$ 1,042.32US$ 3.35US$ 104.2323.03%%US$ 847.21

311 gramsNon-TaxableUS$ 1,042.32US$ 3.35US$ 104.2323.03%%US$ 847.21 -

124.4 gramsTaxableUS$ 569.33US$ 4.58US$ 142.3369.70%%US$ 335.49

124.4 gramsTaxableUS$ 569.33US$ 4.58US$ 142.3369.70%%US$ 335.49 -

62.2 gramsNon-TaxableUS$ 831.19US$ 13.36US$ 415.60380.93%%US$ 172.83

62.2 gramsNon-TaxableUS$ 831.19US$ 13.36US$ 415.60380.93%%US$ 172.83 -

31.1 gramsTaxableUS$ 149.14US$ 4.80US$ 149.1472.59%%US$ 86.42

31.1 gramsTaxableUS$ 149.14US$ 4.80US$ 149.1472.59%%US$ 86.42 -

1 KGNon-TaxableUS$ 3,209.46US$ 3.21US$ 99.8319.01%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,209.46US$ 3.21US$ 99.8319.01%%US$ 2,696.90 -

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2375.00%%US$ 86.42

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2375.00%%US$ 86.42 -

3.11 KGNon-TaxableUS$ 9,644.57US$ 3.10US$ 96.4516.75%%US$ 8,261.07

3.11 KGNon-TaxableUS$ 9,644.57US$ 3.10US$ 96.4516.75%%US$ 8,261.07 -

3.11 KGNon-TaxableUS$ 9,515.75US$ 3.06US$ 95.1615.19%%US$ 8,261.07

3.11 KGNon-TaxableUS$ 9,515.75US$ 3.06US$ 95.1615.19%%US$ 8,261.07 -

1 KGNon-TaxableUS$ 3,234.36US$ 3.23US$ 100.6019.93%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,234.36US$ 3.23US$ 100.6019.93%%US$ 2,696.90 -

3.11 KGNon-TaxableUS$ 9,618.81US$ 3.09US$ 96.1916.44%%US$ 8,261.07

3.11 KGNon-TaxableUS$ 9,618.81US$ 3.09US$ 96.1916.44%%US$ 8,261.07 -

31.1 gramsNon-TaxableUS$ 98.15US$ 3.16US$ 98.1513.58%%US$ 86.42

31.1 gramsNon-TaxableUS$ 98.15US$ 3.16US$ 98.1513.58%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 96.46US$ 3.10US$ 96.4611.62%%US$ 86.42

31.1 gramsNon-TaxableUS$ 96.46US$ 3.10US$ 96.4611.62%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 158.35US$ 5.09US$ 158.3585.06%%US$ 85.57

31.1 gramsNon-TaxableUS$ 158.35US$ 5.09US$ 158.3585.06%%US$ 85.57 -

1 KGNon-TaxableUS$ 3,319.57US$ 3.32US$ 103.2523.09%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,319.57US$ 3.32US$ 103.2523.09%%US$ 2,696.90 -

31.1 gramsNon-TaxableUS$ 102.30US$ 3.29US$ 102.3018.38%%US$ 86.42

31.1 gramsNon-TaxableUS$ 102.30US$ 3.29US$ 102.3018.38%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 160.13US$ 5.15US$ 160.1385.30%%US$ 86.42

31.1 gramsNon-TaxableUS$ 160.13US$ 5.15US$ 160.1385.30%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 195.71US$ 6.29US$ 195.71128.72%%US$ 85.57

31.1 gramsNon-TaxableUS$ 195.71US$ 6.29US$ 195.71128.72%%US$ 85.57 -

31.1 gramsNon-TaxableUS$ 167.40US$ 5.38US$ 167.4097.99%%US$ 84.55

31.1 gramsNon-TaxableUS$ 167.40US$ 5.38US$ 167.4097.99%%US$ 84.55 -

31.1 gramsNon-TaxableUS$ 102.94US$ 3.31US$ 102.9421.51%%US$ 84.72

31.1 gramsNon-TaxableUS$ 102.94US$ 3.31US$ 102.9421.51%%US$ 84.72 -

31.1 gramsTaxableUS$ 105.86US$ 3.40US$ 105.8622.50%%US$ 86.42

31.1 gramsTaxableUS$ 105.86US$ 3.40US$ 105.8622.50%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 93.85US$ 3.02US$ 93.8510.78%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.85US$ 3.02US$ 93.8510.78%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 107.66US$ 3.46US$ 107.6624.58%%US$ 86.42

31.1 gramsNon-TaxableUS$ 107.66US$ 3.46US$ 107.6624.58%%US$ 86.42 -

62.2 gramsNon-TaxableUS$ 275.77US$ 4.43US$ 137.8959.56%%US$ 172.83

62.2 gramsNon-TaxableUS$ 275.77US$ 4.43US$ 137.8959.56%%US$ 172.83 -

62.2 gramsNon-TaxableUS$ 195.71US$ 3.15US$ 97.8613.24%%US$ 172.83

62.2 gramsNon-TaxableUS$ 195.71US$ 3.15US$ 97.8613.24%%US$ 172.83 -

31.1 gramsNon-TaxableUS$ 97.56US$ 3.14US$ 97.5612.90%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.56US$ 3.14US$ 97.5612.90%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.07US$ 3.12US$ 97.0712.33%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.07US$ 3.12US$ 97.0712.33%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.09US$ 3.12US$ 97.0912.35%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.09US$ 3.12US$ 97.0912.35%%US$ 86.42 -

15 KGNon-TaxableUS$ 42,084.98US$ 2.81US$ 87.274.88%%US$ 40,126.57

15 KGNon-TaxableUS$ 42,084.98US$ 2.81US$ 87.274.88%%US$ 40,126.57 -

31.1 gramsNon-TaxableUS$ 115.37US$ 3.71US$ 115.3734.83%%US$ 85.57

31.1 gramsNon-TaxableUS$ 115.37US$ 3.71US$ 115.3734.83%%US$ 85.57 -

62.2 gramsNon-TaxableUS$ 320.25US$ 5.15US$ 160.1385.30%%US$ 172.83

62.2 gramsNon-TaxableUS$ 320.25US$ 5.15US$ 160.1385.30%%US$ 172.83 -

31.1 gramsNon-TaxableUS$ 99.63US$ 3.20US$ 99.6315.29%%US$ 86.42

31.1 gramsNon-TaxableUS$ 99.63US$ 3.20US$ 99.6315.29%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2376.74%%US$ 85.57

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2376.74%%US$ 85.57 -

31.1 gramsNon-TaxableUS$ 108.53US$ 3.49US$ 108.5325.59%%US$ 86.42

31.1 gramsNon-TaxableUS$ 108.53US$ 3.49US$ 108.5325.59%%US$ 86.42 -

311 gramsNon-TaxableUS$ 1,058.60US$ 3.40US$ 105.8622.50%%US$ 864.15

311 gramsNon-TaxableUS$ 1,058.60US$ 3.40US$ 105.8622.50%%US$ 864.15 -

62.2 gramsNon-TaxableUS$ 195.71US$ 3.15US$ 97.8613.24%%US$ 172.83

62.2 gramsNon-TaxableUS$ 195.71US$ 3.15US$ 97.8613.24%%US$ 172.83 -

311 gramsNon-TaxableUS$ 1,058.60US$ 3.40US$ 105.8622.50%%US$ 864.15

311 gramsNon-TaxableUS$ 1,058.60US$ 3.40US$ 105.8622.50%%US$ 864.15 -

1 KGNon-TaxableUS$ 3,131.99US$ 3.13US$ 97.4216.13%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,131.99US$ 3.13US$ 97.4216.13%%US$ 2,696.90 -

31.1 gramsNon-TaxableUS$ 94.79US$ 3.05US$ 94.799.69%%US$ 86.42

31.1 gramsNon-TaxableUS$ 94.79US$ 3.05US$ 94.799.69%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.00US$ 3.12US$ 97.0012.25%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.00US$ 3.12US$ 97.0012.25%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 93.73US$ 3.01US$ 93.7310.63%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.73US$ 3.01US$ 93.7310.63%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 93.83US$ 3.02US$ 93.8310.75%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.83US$ 3.02US$ 93.8310.75%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 106.32US$ 3.42US$ 106.3224.25%%US$ 85.57

31.1 gramsNon-TaxableUS$ 106.32US$ 3.42US$ 106.3224.25%%US$ 85.57 -

31.1 gramsNon-TaxableUS$ 97.46US$ 3.13US$ 97.4612.78%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.46US$ 3.13US$ 97.4612.78%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 103.27US$ 3.32US$ 103.2719.50%%US$ 86.42

31.1 gramsNon-TaxableUS$ 103.27US$ 3.32US$ 103.2719.50%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 101.00US$ 3.25US$ 101.0016.88%%US$ 86.42

31.1 gramsNon-TaxableUS$ 101.00US$ 3.25US$ 101.0016.88%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 101.00US$ 3.25US$ 101.0016.88%%US$ 86.42

31.1 gramsNon-TaxableUS$ 101.00US$ 3.25US$ 101.0016.88%%US$ 86.42 -

3.11 KGNon-TaxableUS$ 9,280.58US$ 2.98US$ 92.8212.93%%US$ 8,217.91

3.11 KGNon-TaxableUS$ 9,280.58US$ 2.98US$ 92.8212.93%%US$ 8,217.91 -

311 gramsNon-TaxableUS$ 1,021.90US$ 3.29US$ 102.1920.62%%US$ 847.21

311 gramsNon-TaxableUS$ 1,021.90US$ 3.29US$ 102.1920.62%%US$ 847.21 -

15.6 gramsNon-TaxableUS$ 82.55US$ 5.29US$ 165.1090.44%%US$ 43.35

15.6 gramsNon-TaxableUS$ 82.55US$ 5.29US$ 165.1090.44%%US$ 43.35 -

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 93.73US$ 3.01US$ 93.7310.63%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.73US$ 3.01US$ 93.7310.63%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 104.53US$ 3.36US$ 104.5323.38%%US$ 84.72

31.1 gramsNon-TaxableUS$ 104.53US$ 3.36US$ 104.5323.38%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 114.49US$ 3.68US$ 114.4932.49%%US$ 86.42

31.1 gramsNon-TaxableUS$ 114.49US$ 3.68US$ 114.4932.49%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 131.75US$ 4.24US$ 131.7557.08%%US$ 83.87

31.1 gramsNon-TaxableUS$ 131.75US$ 4.24US$ 131.7557.08%%US$ 83.87 -

31.1 gramsTaxableUS$ 158.85US$ 5.11US$ 158.8583.82%%US$ 86.42

31.1 gramsTaxableUS$ 158.85US$ 5.11US$ 158.8583.82%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 211.45US$ 6.80US$ 211.45150.08%%US$ 84.55

31.1 gramsNon-TaxableUS$ 211.45US$ 6.80US$ 211.45150.08%%US$ 84.55 -

31.1 gramsNon-TaxableUS$ 137.89US$ 4.43US$ 137.8959.57%%US$ 86.42

31.1 gramsNon-TaxableUS$ 137.89US$ 4.43US$ 137.8959.57%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.04US$ 3.12US$ 97.0412.30%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.04US$ 3.12US$ 97.0412.30%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 99.92US$ 3.21US$ 99.9215.63%%US$ 86.42

31.1 gramsNon-TaxableUS$ 99.92US$ 3.21US$ 99.9215.63%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 100.52US$ 3.23US$ 100.5216.32%%US$ 86.42

31.1 gramsNon-TaxableUS$ 100.52US$ 3.23US$ 100.5216.32%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.09US$ 3.12US$ 97.0912.35%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.09US$ 3.12US$ 97.0912.35%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.18US$ 3.12US$ 97.1812.46%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.18US$ 3.12US$ 97.1812.46%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 99.03US$ 3.18US$ 99.0314.60%%US$ 86.42

31.1 gramsNon-TaxableUS$ 99.03US$ 3.18US$ 99.0314.60%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2375.00%%US$ 86.42

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2375.00%%US$ 86.42 -

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72 -

30 gramsNon-TaxableUS$ 142.45US$ 4.75US$ 148.3974.31%%US$ 81.72

30 gramsNon-TaxableUS$ 142.45US$ 4.75US$ 148.3974.31%%US$ 81.72 -

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72 -

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72

30 gramsNon-TaxableUS$ 145.02US$ 4.83US$ 151.0677.45%%US$ 81.72 -

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2375.00%%US$ 86.42

31.1 gramsNon-TaxableUS$ 151.23US$ 4.86US$ 151.2375.00%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 118.02US$ 3.79US$ 118.0237.93%%US$ 85.57

31.1 gramsNon-TaxableUS$ 118.02US$ 3.79US$ 118.0237.93%%US$ 85.57 -

3.11 KGNon-TaxableUS$ 9,693.21US$ 3.12US$ 96.9417.35%%US$ 8,260.27

3.11 KGNon-TaxableUS$ 9,693.21US$ 3.12US$ 96.9417.35%%US$ 8,260.27 -

31.1 gramsNon-TaxableUS$ 132.15US$ 4.25US$ 132.1556.30%%US$ 84.55

31.1 gramsNon-TaxableUS$ 132.15US$ 4.25US$ 132.1556.30%%US$ 84.55 -

31.1 gramsNon-TaxableUS$ 97.38US$ 3.13US$ 97.3812.69%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.38US$ 3.13US$ 97.3812.69%%US$ 86.42 -

1 KGNon-TaxableUS$ 3,198.40US$ 3.20US$ 99.4818.60%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,198.40US$ 3.20US$ 99.4818.60%%US$ 2,696.90 -

3.11 KGNon-TaxableUS$ 9,687.51US$ 3.11US$ 96.8816.67%%US$ 8,303.43

3.11 KGNon-TaxableUS$ 9,687.51US$ 3.11US$ 96.8816.67%%US$ 8,303.43 -

31.1 KGNon-TaxableUS$ 88,552.02US$ 2.85US$ 88.557.19%%US$ 82,612.01

31.1 KGNon-TaxableUS$ 88,552.02US$ 2.85US$ 88.557.19%%US$ 82,612.01 -

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 98.74US$ 3.17US$ 98.7414.26%%US$ 86.42

31.1 gramsNon-TaxableUS$ 98.74US$ 3.17US$ 98.7414.26%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 104.97US$ 3.38US$ 104.9721.47%%US$ 86.42

31.1 gramsNon-TaxableUS$ 104.97US$ 3.38US$ 104.9721.47%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 111.20US$ 3.58US$ 111.2028.68%%US$ 86.42

31.1 gramsNon-TaxableUS$ 111.20US$ 3.58US$ 111.2028.68%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 105.86US$ 3.40US$ 105.8623.71%%US$ 85.57

31.1 gramsNon-TaxableUS$ 105.86US$ 3.40US$ 105.8623.71%%US$ 85.57 -

311 gramsNon-TaxableUS$ 1,183.51US$ 3.81US$ 118.3548.61%%US$ 796.37

311 gramsNon-TaxableUS$ 1,183.51US$ 3.81US$ 118.3548.61%%US$ 796.37 -

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.18US$ 3.12US$ 97.1812.46%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.18US$ 3.12US$ 97.1812.46%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 99.63US$ 3.20US$ 99.6317.60%%US$ 84.72

31.1 gramsNon-TaxableUS$ 99.63US$ 3.20US$ 99.6317.60%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2911.57%%US$ 83.62

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2911.57%%US$ 83.62 -

31.1 gramsNon-TaxableUS$ 94.26US$ 3.03US$ 94.269.08%%US$ 86.42

31.1 gramsNon-TaxableUS$ 94.26US$ 3.03US$ 94.269.08%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.77US$ 3.14US$ 97.7713.14%%US$ 86.42 -

3.11 KGNon-TaxableUS$ 9,757.62US$ 3.14US$ 97.5918.74%%US$ 8,217.91

3.11 KGNon-TaxableUS$ 9,757.62US$ 3.14US$ 97.5918.74%%US$ 8,217.91 -

31.1 gramsNon-TaxableUS$ 97.85US$ 3.15US$ 97.8513.23%%US$ 86.42

31.1 gramsNon-TaxableUS$ 97.85US$ 3.15US$ 97.8513.23%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 95.80US$ 3.08US$ 95.8010.86%%US$ 86.42

31.1 gramsNon-TaxableUS$ 95.80US$ 3.08US$ 95.8010.86%%US$ 86.42 -

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72 -

31.1 gramsNon-TaxableUS$ 92.16US$ 2.96US$ 92.169.00%%US$ 84.55

31.1 gramsNon-TaxableUS$ 92.16US$ 2.96US$ 92.169.00%%US$ 84.55 -

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72

31.1 gramsNon-TaxableUS$ 93.29US$ 3.00US$ 93.2910.11%%US$ 84.72 -

311 gramsNon-TaxableUS$ 1,023.91US$ 3.29US$ 102.3918.49%%US$ 864.15

311 gramsNon-TaxableUS$ 1,023.91US$ 3.29US$ 102.3918.49%%US$ 864.15 -

311 gramsNon-TaxableUS$ 1,023.91US$ 3.29US$ 102.3918.49%%US$ 864.15

311 gramsNon-TaxableUS$ 1,023.91US$ 3.29US$ 102.3918.49%%US$ 864.15 -

100 gramsNon-TaxableUS$ 304.54US$ 3.05US$ 94.5812.02%%US$ 271.87

100 gramsNon-TaxableUS$ 304.54US$ 3.05US$ 94.5812.02%%US$ 271.87 -

1 KGNon-TaxableUS$ 3,392.43US$ 3.39US$ 105.5225.79%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,392.43US$ 3.39US$ 105.5225.79%%US$ 2,696.90 -

1 KGNon-TaxableUS$ 3,131.99US$ 3.13US$ 97.4216.13%%US$ 2,696.90

1 KGNon-TaxableUS$ 3,131.99US$ 3.13US$ 97.4216.13%%US$ 2,696.90 -

31.1 KGNon-TaxableUS$ 88,907.65US$ 2.86US$ 88.915.99%%US$ 83,882.96

31.1 KGNon-TaxableUS$ 88,907.65US$ 2.86US$ 88.915.99%%US$ 83,882.96

Silver Value in Singapore

The silver market in Singapore is a crucial part of the precious metals landscape, reflecting both global trends and local demand. Understanding silver prices is vital for investors and consumers alike, as silver is used in various industrial applications and as a store of value. The current silver market in Singapore is dynamic, with prices influenced by a range of factors, making it essential to stay informed about the latest trends and movements.

Silver Value in Singapore

The silver market in Singapore is a crucial part of the precious metals landscape, reflecting both global trends and local demand. Understanding silver prices is vital for investors and consumers alike, as silver is used in various industrial applications and as a store of value. The current silver market in Singapore is dynamic, with prices influenced by a range of factors, making it essential to stay informed about the latest trends and movements.

Factors Influencing Silver Prices

Global Economic Conditions: The global economy significantly impacts silver prices. Unlike gold, silver’s price is heavily influenced by its industrial demand. During economic expansions, the demand for silver in manufacturing, electronics, and renewable energy projects increases, driving up prices. Conversely, economic slowdowns can reduce industrial demand, leading to lower silver prices.

Geopolitical Events: Geopolitical events can cause volatility in silver prices, though the effect is often more nuanced than with gold. For example, trade tensions or disruptions in major silver-producing countries can lead to supply shortages, pushing prices higher. Additionally, silver, like gold, benefits from its status as a safe-haven asset during times of political instability.

Inflation and Interest Rates: Silver prices react to inflation and interest rate changes, albeit differently from gold. High inflation erodes purchasing power, increasing the appeal of silver as a hedge. However, since silver is more affordable than gold, it is more accessible to retail investors during inflationary periods. Lower interest rates reduce the opportunity cost of holding non-yielding assets like silver, potentially driving up demand.

Supply and Demand: Silver supply and demand dynamics are crucial in determining prices. Silver mining production, recycling rates, and industrial demand all play roles. For instance, technological advancements in solar energy and electronics increase demand for silver, impacting its price per gram. Conversely, a surge in mining output without a corresponding increase in demand can lead to price drops.

Currency Fluctuations: Currency fluctuations, particularly of the US dollar, influence silver prices. A weaker US dollar typically makes silver cheaper for foreign buyers, increasing demand and pushing up prices. In Singapore, the strength of the Singapore dollar (SGD) against the US dollar can similarly affect local silver prices, with a stronger SGD making silver more affordable for Singaporean buyers.

Historical Silver Prices

Over the past decade, silver prices have experienced notable volatility, driven by economic cycles, technological advancements, and geopolitical events. For instance, in 2011, silver prices surged to nearly SGD 1.60 per gram due to heightened investor interest and economic uncertainty. Similarly, the COVID-19 pandemic in 2020 caused a significant rise in silver prices, peaking at around SGD 1.20 per gram, fueled by increased industrial demand and a surge in investor interest as a safe-haven asset.

Comparing silver price trends in Singapore with global trends reveals a strong correlation, as local prices closely follow international movements. This alignment underscores the interconnected nature of the global silver market.

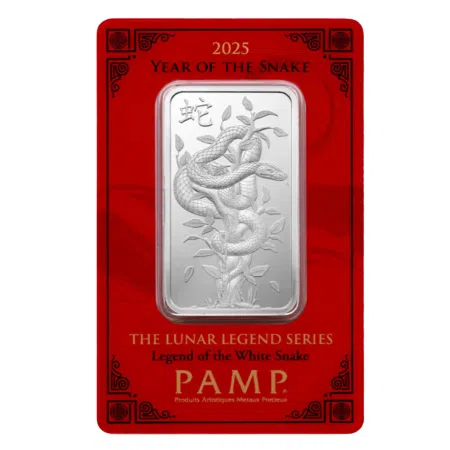

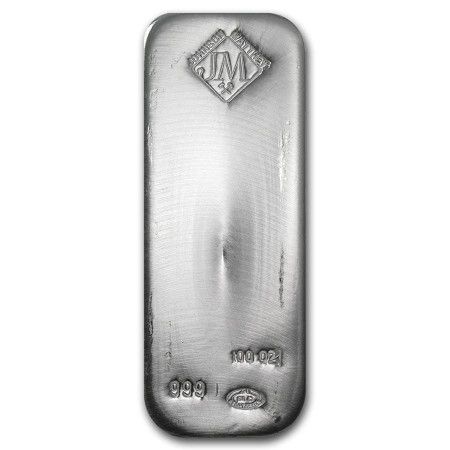

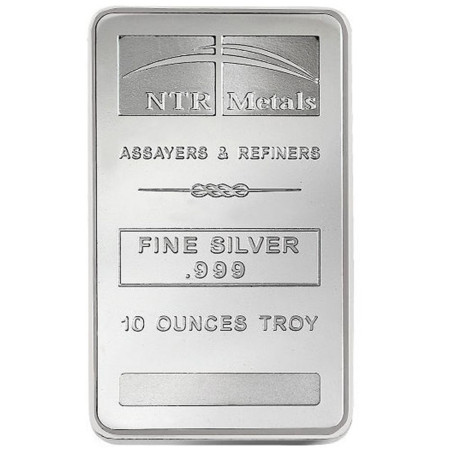

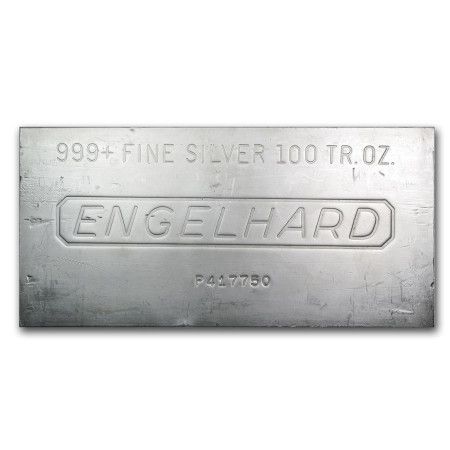

Silver Investment Options

Investors in Singapore have multiple options for investing in silver

Each investment option has its pros and cons, and investors should choose based on their risk appetite, investment horizon, and financial goals.

Silver Price Forecast

Expert predictions and forecasts suggest that silver prices will continue to be influenced by the same factors that have historically driven the market. Economic conditions, technological advancements, and changes in industrial demand are expected to play significant roles. Here are the most recent forecasts from market experts:

In 2024, silver prices are anticipated to rise due to geopolitical tensions, the US presidential election, and potential Federal Reserve rate cuts. Ongoing conflicts and political uncertainties are likely to push investors towards safe-haven assets like silver.

A Trump victory could create market instability, boosting silver demand, while a Biden re-election might offer stability. Interest rate cuts by the Federal Reserve would further enhance silver’s appeal to investors.

Forecasts for 2024 vary: a median price of SGD 1.08 per gram (Reuters), SGD 1.50 per gram (Investing Haven), SGD 1.17 per gram (Capital Economics and Physical Gold), and SGD 1.30 per gram (JP Morgan, Commerzbank, and Saxo Bank).

For 2025, predictions range from SGD 1.50 to SGD 2.20 per gram (Investing Cube. By 2030, PricePrediction.net’s AI tool forecasts SGD 14.80 per gram, driven by increased industrial demand. Potential shortages by 2050 are expected to drive prices even higher due to strong demand from the solar sector.

Using forecasts in investment decisions can help investors strategise their silver investments. While predictions can provide insights, it is essential to remain cautious and consider multiple sources before making investment decisions.

Buying and Selling Silver in Singapore

Singapore offers various channels to buy and sell silver, ensuring competitive rates and reliable transactions. Popular locations include bullion dealers, banks, and online platforms such as Indigo Precious Metals. To buy silver at the best price, it’s advisable to stay updated on rates and market trends. When selling silver, timing is likewise crucial to maximise returns. Monitoring the silver price in SGD and choosing the right moment to sell can significantly impact the profitability of your investment.

Comparison with Other Precious Metals

While gold is often the preferred choice for investors, other precious metals like silver, platinum, and palladium also hold significant value. Each metal has its unique characteristics and market dynamics.

Silver, for instance, is more volatile but can offer higher returns during bull markets due to its extensive industrial demand. Compared to gold, silver’s lower price point makes it more accessible to retail investors. However, during economic downturns, silver may underperform compared to gold, which is viewed as a more stable safe-haven asset. Silver’s broad industrial applications ensure steady demand, making it a valuable component of a diversified investment portfolio.

Check up on gold prices in Singapore or the current price of platinum. Alternatively, buy palladium online to diversify your portfolio further.