-

31.2 gramsNon-TaxableUS$ 6,357.92US$ 203.78US$ 6,357.9224.32%%US$ 5,114.10

31.2 gramsNon-TaxableUS$ 6,357.92US$ 203.78US$ 6,357.9224.32%%US$ 5,114.10 -

31.1 gramsNon-TaxableUS$ 5,450.40US$ 175.25US$ 5,450.406.92%%US$ 5,097.71

31.1 gramsNon-TaxableUS$ 5,450.40US$ 175.25US$ 5,450.406.92%%US$ 5,097.71 -

311 gramsNon-TaxableUS$ 53,455.80US$ 171.88US$ 5,345.585.29%%US$ 50,771.12

311 gramsNon-TaxableUS$ 53,455.80US$ 171.88US$ 5,345.585.29%%US$ 50,771.12 -

311 gramsNon-TaxableUS$ 52,729.92US$ 169.55US$ 5,272.993.86%%US$ 50,771.12

311 gramsNon-TaxableUS$ 52,729.92US$ 169.55US$ 5,272.993.86%%US$ 50,771.12 -

31.1 gramsNon-TaxableUS$ 5,489.04US$ 176.50US$ 5,489.047.24%%US$ 5,118.31

31.1 gramsNon-TaxableUS$ 5,489.04US$ 176.50US$ 5,489.047.24%%US$ 5,118.31 -

129.3 gramsTaxableUS$ 24,164.09US$ 186.88US$ 5,808.6811.76%%US$ 21,622.17

129.3 gramsTaxableUS$ 24,164.09US$ 186.88US$ 5,808.6811.76%%US$ 21,622.17 -

129.9 gramsTaxableUS$ 24,276.22US$ 186.88US$ 5,807.7111.76%%US$ 21,722.51

129.9 gramsTaxableUS$ 24,276.22US$ 186.88US$ 5,807.7111.76%%US$ 21,722.51 -

101.5 gramsTaxableUS$ 18,968.72US$ 186.88US$ 5,818.6311.76%%US$ 16,973.32

101.5 gramsTaxableUS$ 18,968.72US$ 186.88US$ 5,818.6311.76%%US$ 16,973.32 -

101.4 gramsTaxableUS$ 18,984.08US$ 187.22US$ 5,823.3411.96%%US$ 16,956.60

101.4 gramsTaxableUS$ 18,984.08US$ 187.22US$ 5,823.3411.96%%US$ 16,956.60 -

119.8 gramsTaxableUS$ 22,388.69US$ 186.88US$ 5,815.2411.76%%US$ 20,033.54

119.8 gramsTaxableUS$ 22,388.69US$ 186.88US$ 5,815.2411.76%%US$ 20,033.54 -

101.5 gramsTaxableUS$ 19,002.80US$ 187.22US$ 5,829.0811.96%%US$ 16,973.32

101.5 gramsTaxableUS$ 19,002.80US$ 187.22US$ 5,829.0811.96%%US$ 16,973.32 -

132.3 gramsTaxableUS$ 24,724.74US$ 186.88US$ 5,817.5911.76%%US$ 22,123.85

132.3 gramsTaxableUS$ 24,724.74US$ 186.88US$ 5,817.5911.76%%US$ 22,123.85 -

15.6 gramsNon-TaxableUS$ 3,152.69US$ 202.10US$ 6,305.3824.55%%US$ 2,531.22

15.6 gramsNon-TaxableUS$ 3,152.69US$ 202.10US$ 6,305.3824.55%%US$ 2,531.22 -

31.1 gramsNon-TaxableUS$ 5,361.04US$ 172.38US$ 5,361.044.11%%US$ 5,149.20

31.1 gramsNon-TaxableUS$ 5,361.04US$ 172.38US$ 5,361.044.11%%US$ 5,149.20 -

31.1 gramsNon-TaxableUS$ 5,588.04US$ 179.68US$ 5,588.047.45%%US$ 5,200.69

31.1 gramsNon-TaxableUS$ 5,588.04US$ 179.68US$ 5,588.047.45%%US$ 5,200.69

Characteristics of 999 Gold

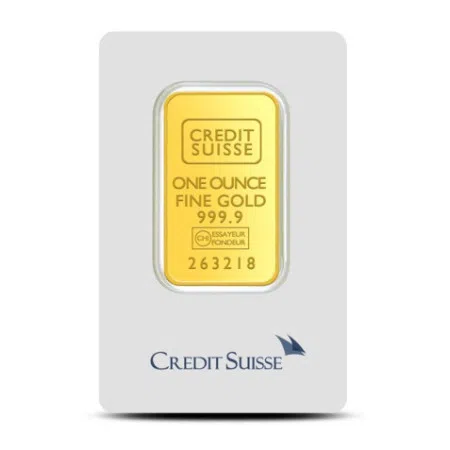

999 gold, also known as 24 Karat gold, boasts a purity level of 99.9%, making it the purest gold available. This high purity means it is free from other metals and alloys, making it a highly sought-after asset for both investors and jewellers. The distinct yellow colour, malleability, and ductility of 999 gold make it ideal for crafting intricate jewellery and investment-grade gold bullion.

999 gold differs from 916 gold (22 Karat), which contains 91.6% gold mixed with other metals, making 916 gold more durable but less pure. The superior purity of 999 gold makes it more desirable for investment purposes, often used in bullion and gold coins due to its high intrinsic value.

Difference Between Gold Types and Their Prices

Gold comes in various types, each with unique characteristics and prices:

- 24K Gold (999 Gold): The purest form, 999 gold is highly valued and used mainly for investment purposes. It commands the highest price per gram.

- 22K Gold (916 Gold): Contains 91.6% gold, it is slightly less pure but more durable, often used in jewellery.

- 18K Gold: Composed of 75% gold, this type balances purity and durability, making it popular for fine jewellery.

- Rose Gold: An alloy of gold and copper, typically 18K or 14K, known for its pinkish hue.

- White Gold: An alloy of gold and white metals like palladium, often rhodium-plated for a shiny finish, popular in jewellery.

Factors Influencing 999 Gold Prices

Refining Costs: The process of refining gold to 999 purity involves advanced technology and significant costs, which are factored into the final price of 999 gold in Singapore.

Regulatory Policies: Government regulations and policies regarding gold import, export, and trading significantly affect 999 gold prices too. Changes in these policies can lead to price fluctuations.

Industrial Demand: The use of 999 gold in high-tech industries, such as electronics and medical devices, influences its price. High demand from these sectors can drive up the 999 gold price per gram.

Local Market Dynamics: Local market demand and supply conditions, influenced by consumer preferences and cultural factors, directly impact the 999 gold rates in Singapore.

Investment Trends: Shifts in global investment trends towards gold-backed securities and ETFs can impact the demand for physical 999 gold, influencing its price in the market.

Investing in 999 Gold

Investing in 999 gold provides numerous benefits, including a hedge against inflation, economic instability, and currency fluctuations. Its high purity ensures significant value retention over time.

Investment options for 999 gold include gold bars, coins, and ETFs, each offering unique benefits.

Physical gold provides tangible assets, while ETFs offer liquidity and ease of trade. However, investors should consider market volatility, storage costs, and the need for diversification. While 999 gold is a stable asset, balancing it with other investments is essential.

How to Buy 999 Gold

When buying 999 gold, it’s crucial to purchase from reputable dealers and certified vendors like Indigo Precious Metals. Look for established brands with positive customer reviews to ensure authenticity. Verify the purity and weight through certifications and assay marks, and always request a receipt and certification for each purchase to guarantee the gold’s authenticity. Proper certification, such as a hallmark indicating its purity, adds an extra layer of security to your investment.

Selling 999 Gold

To sell 999 gold, approach reputable dealers, jewellers, or certified online platforms. Choose buyers with transparent pricing policies to get the best value. Monitor market trends and sell when prices are high. Obtain multiple quotes to ensure you get the best price for your 999 gold. Staying informed about market conditions and geopolitical events that can influence gold prices in general is also crucial for timing your sale strategically, and maximising returns.

Learn More about Gold Prices

Factors such as global economic conditions, geopolitical events, and market demand must also be taken into consideration when trading 999 gold. For detailed insights into how these elements affect gold prices in general, visit our page on today’s gold rates in Singapore.

There, you will find in-depth information on historical trends, current market analysis, and expert forecasts. Understanding the broader gold market can provide valuable context and enhance your 999 gold investment strategy, ensuring you are well-prepared to navigate the complexities of gold trading.