-

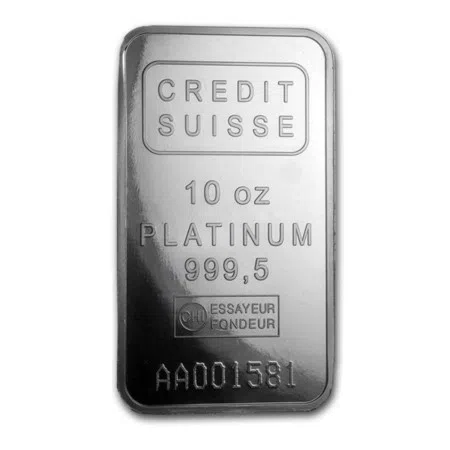

31.1 gramsNon-TaxableUS$ 2,461.12US$ 79.14US$ 2,461.1214.60%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,461.12US$ 79.14US$ 2,461.1214.60%%US$ 2,147.66 -

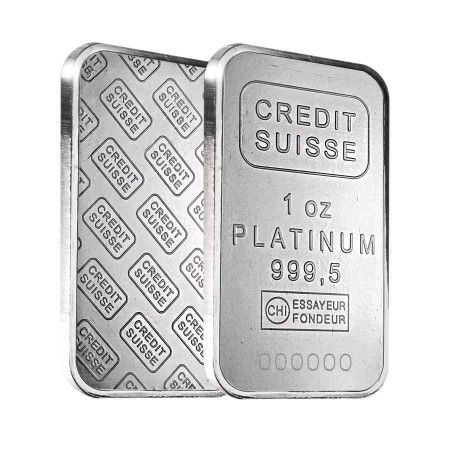

31.1 gramsNon-TaxableUS$ 2,508.13US$ 80.65US$ 2,508.1318.32%%US$ 2,119.74

31.1 gramsNon-TaxableUS$ 2,508.13US$ 80.65US$ 2,508.1318.32%%US$ 2,119.74 -

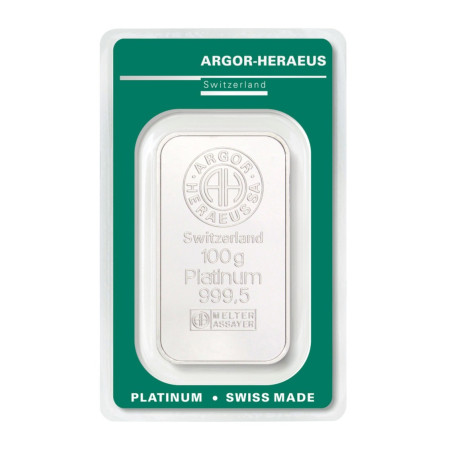

100 gramsNon-TaxableUS$ 7,503.26US$ 75.03US$ 2,330.2010.31%%US$ 6,802.06

100 gramsNon-TaxableUS$ 7,503.26US$ 75.03US$ 2,330.2010.31%%US$ 6,802.06 -

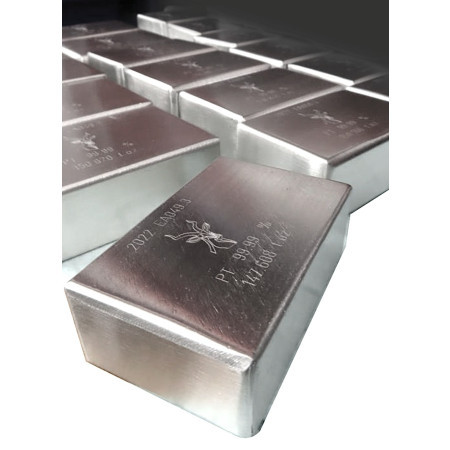

1 KGNon-TaxableUS$ 74,540.27US$ 74.54US$ 2,318.5210.82%%US$ 67,260.97

1 KGNon-TaxableUS$ 74,540.27US$ 74.54US$ 2,318.5210.82%%US$ 67,260.97 -

500 gramsNon-TaxableUS$ 37,662.40US$ 75.32US$ 2,342.1912.45%%US$ 33,492.37

500 gramsNon-TaxableUS$ 37,662.40US$ 75.32US$ 2,342.1912.45%%US$ 33,492.37 -

100 gramsNon-TaxableUS$ 7,791.84US$ 77.92US$ 2,419.8316.32%%US$ 6,698.47

100 gramsNon-TaxableUS$ 7,791.84US$ 77.92US$ 2,419.8316.32%%US$ 6,698.47 -

31.1 gramsNon-TaxableUS$ 2,613.73US$ 84.04US$ 2,613.7321.70%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,613.73US$ 84.04US$ 2,613.7321.70%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,640.11US$ 84.89US$ 2,640.1123.55%%US$ 2,136.92

31.1 gramsNon-TaxableUS$ 2,640.11US$ 84.89US$ 2,640.1123.55%%US$ 2,136.92 -

311 gramsNon-TaxableUS$ 23,984.08US$ 77.12US$ 2,398.4111.79%%US$ 21,455.08

311 gramsNon-TaxableUS$ 23,984.08US$ 77.12US$ 2,398.4111.79%%US$ 21,455.08 -

50 gramsNon-TaxableUS$ 3,936.10US$ 78.72US$ 2,444.7815.73%%US$ 3,401.03

50 gramsNon-TaxableUS$ 3,936.10US$ 78.72US$ 2,444.7815.73%%US$ 3,401.03 -

31.1 gramsNon-TaxableUS$ 2,752.17US$ 88.49US$ 2,752.1728.15%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,752.17US$ 88.49US$ 2,752.1728.15%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,505.42US$ 80.56US$ 2,505.4218.19%%US$ 2,119.74

31.1 gramsNon-TaxableUS$ 2,505.42US$ 80.56US$ 2,505.4218.19%%US$ 2,119.74 -

31.1 gramsNon-TaxableUS$ 2,746.62US$ 88.32US$ 2,746.6227.89%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,746.62US$ 88.32US$ 2,746.6227.89%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,774.36US$ 89.21US$ 2,774.3629.18%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,774.36US$ 89.21US$ 2,774.3629.18%%US$ 2,147.66 -

100 gramsNon-TaxableUS$ 7,420.02US$ 74.20US$ 2,304.357.99%%US$ 6,871.12

100 gramsNon-TaxableUS$ 7,420.02US$ 74.20US$ 2,304.357.99%%US$ 6,871.12 -

31.1 gramsNon-TaxableUS$ 2,494.68US$ 80.21US$ 2,494.6816.16%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,494.68US$ 80.21US$ 2,494.6816.16%%US$ 2,147.66 -

4.66 KGNon-TaxableUS$ 336,916.01US$ 72.30US$ 2,248.816.83%%US$ 315,366.95

4.66 KGNon-TaxableUS$ 336,916.01US$ 72.30US$ 2,248.816.83%%US$ 315,366.95 -

31.1 gramsNon-TaxableUS$ 2,580.33US$ 82.97US$ 2,580.3321.73%%US$ 2,119.74

31.1 gramsNon-TaxableUS$ 2,580.33US$ 82.97US$ 2,580.3321.73%%US$ 2,119.74 -

1.56 KGNon-TaxableUS$ 116,727.86US$ 75.06US$ 2,334.5611.48%%US$ 104,711.66

1.56 KGNon-TaxableUS$ 116,727.86US$ 75.06US$ 2,334.5611.48%%US$ 104,711.66 -

31.1 gramsNon-TaxableUS$ 2,517.06US$ 80.93US$ 2,517.0617.20%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,517.06US$ 80.93US$ 2,517.0617.20%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,460.43US$ 79.11US$ 2,460.4314.56%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,460.43US$ 79.11US$ 2,460.4314.56%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,482.21US$ 79.81US$ 2,482.2115.58%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,482.21US$ 79.81US$ 2,482.2115.58%%US$ 2,147.66 -

500 gramsNon-TaxableUS$ 38,180.84US$ 76.36US$ 2,374.4310.69%%US$ 34,493.69

500 gramsNon-TaxableUS$ 38,180.84US$ 76.36US$ 2,374.4310.69%%US$ 34,493.69 -

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66 -

500 gramsNon-TaxableUS$ 38,878.97US$ 77.76US$ 2,417.8512.71%%US$ 34,493.69

500 gramsNon-TaxableUS$ 38,878.97US$ 77.76US$ 2,417.8512.71%%US$ 34,493.69 -

31.1 gramsNon-TaxableUS$ 2,484.97US$ 79.90US$ 2,484.9715.71%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,484.97US$ 79.90US$ 2,484.9715.71%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,553.33US$ 82.10US$ 2,553.3320.46%%US$ 2,119.74

31.1 gramsNon-TaxableUS$ 2,553.33US$ 82.10US$ 2,553.3320.46%%US$ 2,119.74 -

31.1 gramsNon-TaxableUS$ 2,484.70US$ 79.89US$ 2,484.7015.69%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,484.70US$ 79.89US$ 2,484.7015.69%%US$ 2,147.66 -

311 gramsNon-TaxableUS$ 23,612.61US$ 75.92US$ 2,361.2612.19%%US$ 21,047.02

311 gramsNon-TaxableUS$ 23,612.61US$ 75.92US$ 2,361.2612.19%%US$ 21,047.02 -

31.1 gramsNon-TaxableUS$ 2,707.23US$ 87.05US$ 2,707.2326.06%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,707.23US$ 87.05US$ 2,707.2326.06%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,472.31US$ 79.50US$ 2,472.3115.12%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,472.31US$ 79.50US$ 2,472.3115.12%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,580.44US$ 82.97US$ 2,580.4421.73%%US$ 2,119.74

31.1 gramsNon-TaxableUS$ 2,580.44US$ 82.97US$ 2,580.4421.73%%US$ 2,119.74 -

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,514.82US$ 80.86US$ 2,514.8217.10%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,584.98US$ 83.12US$ 2,584.9820.36%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,584.98US$ 83.12US$ 2,584.9820.36%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,526.21US$ 81.23US$ 2,526.2119.18%%US$ 2,119.74

31.1 gramsNon-TaxableUS$ 2,526.21US$ 81.23US$ 2,526.2119.18%%US$ 2,119.74 -

3.1 gramsNon-TaxableUS$ 288.47US$ 93.05US$ 2,884.7034.75%%US$ 214.07

3.1 gramsNon-TaxableUS$ 288.47US$ 93.05US$ 2,884.7034.75%%US$ 214.07 -

1 KGNon-TaxableUS$ 74,471.68US$ 74.47US$ 2,316.387.84%%US$ 69,056.44

1 KGNon-TaxableUS$ 74,471.68US$ 74.47US$ 2,316.387.84%%US$ 69,056.44 -

31.1 gramsNon-TaxableUS$ 2,427.56US$ 78.06US$ 2,427.5613.60%%US$ 2,136.92

31.1 gramsNon-TaxableUS$ 2,427.56US$ 78.06US$ 2,427.5613.60%%US$ 2,136.92 -

31.1 gramsNon-TaxableUS$ 2,519.29US$ 81.01US$ 2,519.2917.30%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,519.29US$ 81.01US$ 2,519.2917.30%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,751.98US$ 88.49US$ 2,751.9829.43%%US$ 2,126.18

31.1 gramsNon-TaxableUS$ 2,751.98US$ 88.49US$ 2,751.9829.43%%US$ 2,126.18 -

31.1 gramsNon-TaxableUS$ 2,707.23US$ 87.05US$ 2,707.2328.63%%US$ 2,104.70

31.1 gramsNon-TaxableUS$ 2,707.23US$ 87.05US$ 2,707.2328.63%%US$ 2,104.70 -

31.1 gramsNon-TaxableUS$ 2,476.05US$ 79.62US$ 2,476.0515.29%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,476.05US$ 79.62US$ 2,476.0515.29%%US$ 2,147.66 -

31.1 gramsNon-TaxableUS$ 2,474.55US$ 79.57US$ 2,474.5515.22%%US$ 2,147.66

31.1 gramsNon-TaxableUS$ 2,474.55US$ 79.57US$ 2,474.5515.22%%US$ 2,147.66 -

500 gramsNon-TaxableUS$ 38,289.34US$ 76.58US$ 2,381.1814.32%%US$ 33,492.37

500 gramsNon-TaxableUS$ 38,289.34US$ 76.58US$ 2,381.1814.32%%US$ 33,492.37 -

100 gramsNon-TaxableUS$ 7,890.59US$ 78.91US$ 2,450.4914.84%%US$ 6,871.12

100 gramsNon-TaxableUS$ 7,890.59US$ 78.91US$ 2,450.4914.84%%US$ 6,871.12

Platinum, one of the rarest elements on earth, holds significant value as an investment asset. Its unmatched durability and corrosion resistance make it a precious metal and a crucial component in various industries, like automotive and electronics. The platinum price in Singapore and worldwide is determined by numerous factors, including its rarity, global economic conditions, industrial demand, and investor sentiment. The current price of platinum reflects these complex dynamics, offering exciting opportunities for discerning investors.

Platinum Price Performance

Platinum’s price performance has shown interesting patterns over the years, frequently influenced by its diverse applications across various sectors. Key among these factors is the supply-demand dynamics. Platinum is a critical resource in several industries, including the automotive industry, for catalytic converters, jewellery, and numerous industrial applications. As such, the state of these sectors can greatly affect platinum demand and, consequently, its price.

Geopolitical tensions and macroeconomic conditions also significantly impact platinum prices in Singapore. For instance, political instability in countries that are major platinum producers can disrupt mining activities, leading to supply shortages and potential price increases. Similarly, a robust global economy often bolsters industrial demand for platinum, which can exert upward pressure on prices.

Moreover, investor sentiment towards precious metals and other safe-haven assets plays a vital role in shaping the trajectory of platinum prices. In times of market volatility or economic uncertainty, investors often turn to assets like platinum, thereby increasing demand and potentially driving up prices.

Finally, currency fluctuations, particularly those involving the U.S. dollar, which is the standard currency for most commodities trading, can influence platinum prices. A weaker U.S. dollar makes platinum cheaper for investors holding other currencies, thereby increasing demand and potentially elevating prices.

Understanding these factors is crucial as the price of platinum per gram in Singapore and globally reflects these complex dynamics, offering a fascinating landscape for discerning investors.

Price of Platinum Today

The current price of platinum varies by weight, with larger quantities often commanding lower prices per gram due to economies of scale. This variability stems from the costs associated with refining, handling, and storing platinum. Moreover, market trends, geopolitical issues, and the strength of the Singapore dollar against other currencies can also impact the price of platinum today.

Platinum Price Trends

The performance of platinum prices exhibits an intriguing blend of cyclical and counter-cyclical behaviours, often influenced by economic conditions and the platinum mining environment. Unlike gold prices, platinum’s counter-cyclical nature is not always dependable. Sometimes it follows economic cycles, whereas, at other times, it moves in the opposite direction.

This characteristic stems from platinum’s status as a commodity, which brings with it the inherent price volatility associated with the commodities market. Major factors impacting the platinum price include the supply-demand dynamics in sectors that use platinum, geopolitical conditions affecting platinum mining, investor sentiment towards precious metals, and fluctuations in the U.S. dollar.

Expert Opinions and Reviews

The landscape of platinum investing is dynamic and multifaceted, and the insights from experts in the field can prove to be invaluable. Many seasoned investors see platinum as a versatile and potent asset, especially in times of economic instability. They emphasise platinum’s historical performance, intrinsic worth, and capability to enhance diversification in an investment portfolio.

Nevertheless, the range of viewpoints mirrors the complexity of the platinum market and the multitude of factors that can shape prices, including the current platinum price in Singapore. For example, certain experts might concentrate on global economic trends, while others could focus on the supply-demand dynamics of the platinum industry. This diversity of perspectives underscores the significance of contemplating expert insights in relation to one’s investment strategy and risk appetite.

Gaining a broad perspective on platinum investment requires considering expert opinions and reviews. Our team at Indigo Precious Metals constantly keeps a pulse on the market, providing you with the latest insights and advice on our high-quality platinum products and bullion savings that’ll cater to your investment needs. We also offer state-of-the-art storage facilities to ensure the safety and security of your platinum investments.

What is the historical performance of platinum as an investment?

Platinum’s historical performance is characterised by periods of price appreciation, reflecting its intrinsic value and utility in various industries. It has proven to be a useful asset for diversifying portfolios.

What factors can cause the price of platinum to fluctuate?

The price of platinum can fluctuate due to several factors, including global economic trends, supply and demand dynamics, investor sentiment, and geopolitical developments.

How often is the live platinum price updated on this website?

The live platinum price on our website is updated in real-time, ensuring you always have the most current and accurate data at your fingertips.

What is the difference between the spot price and the future price of platinum?

The spot price of platinum is the current price at which it can be bought or sold for immediate delivery, whereas the future price is what traders anticipate it will be at a specified future date.

How can I use the information on this page to make informed decisions about investing in platinum?

Information on this page, including the current price of platinum, market trends, and expert opinions, can help you understand the platinum market better and make informed decisions about your platinum investments.

What is the relationship between the price of platinum and inflation?

The relationship between the price of platinum and inflation is complex. Generally, in times of high inflation, investors may turn to platinum as a store of value, potentially driving prices up.

How volatile are platinum prices to market sentiment and investor demand?

Platinum prices can be quite sensitive to market sentiment and investor demand. Rapid changes in these factors can lead to increased volatility in the platinum market.