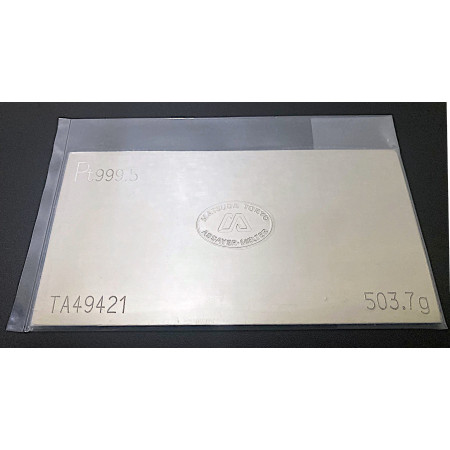

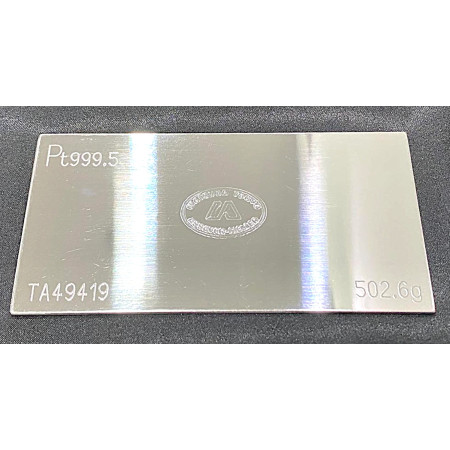

Platinum MATSUDA SANGYO 500 gram Plates 999.5% LPPM

Live Prices

Stock is Available Within Our Vaults (3 left)

Tax Status: Zero Tax / No GST

| Pick up from shop | Store in our vault | Back order |

|---|---|---|

|

In stock: 3 |

In stock: 3 |

Availability: Pending |

|

Delivery time: 1 Day |

Delivery time: 4 - 7 Days |

Delivery time: Pending |

Pricing Information

| Price per gram | Price per ounce | Price Premium | Spread |

|---|---|---|---|

| US$ 75.38 | US$ 2,343.95 | 8.06% | 10.58% |

IPM Buy-Back Prices

| IPM Buyback Price | Non-Vault Buyback Price |

|---|---|

| US$ 34,085.92 | US$ 34,017.75 |

Discount Tier Pricing

| Quantity | Prices |

|---|---|

| Buy 1 - 2 | US$ 37,994.69 |

| Buy 3 - 4 | US$ 37,918.70 |

| Buy 5 - 9 | US$ 37,861.71 |

| Buy 10 - 19 | US$ 37,785.72 |

| Buy 20+ | US$ 37,690.73 |

Product Information

- Product Details

- Specifications

- Tax Overview

- Storage

Platinum plates refined and produced to high grade 999.5% platinum has a weight variance of up to +/- 10 % in bar weight.

Each bar is unique in bar weight and of course the refinery registered bar number.

Matsuda Sangyo Co Ltd, a Japanese manufacturer of precious metal products, including silver, gold and platinum and their headquarters in the Shinjuku-ku district of Tokyo. Gold refining and bar manufacture take place at the company’s plant in the Mushashi Industrial Park in Iruma (Saitama Prefecture), 35 km north west of Tokyo.

ACCREDITATION

1993 Tokyo Commodity Exchange (TOCOM)

1995 London Good Delivery platinum and palladium bars (LPPM)

2000 London Bullion Market Association (LBMA)

2000 Member and manufacturer London Good Delivery silver bars (LBMA)

In 1957, however, it started to refine silver from scrap photographic materials, and in 1971 opened the plant in Iruma, which now refines gold, silver and platinum group metals. The company, incorporated as Matsuda Sangyo Co Ltd in 1992, began over-the-counter trading in 1999 listed on the Tokyo Stock Exchange

It focuses on three business categories: precious metals (refining and manufacture of industrial products), foodstuffs (importing, trading and processing) and the environment (products, equipment and services, including the collection and treatment of industrial waste throughout Japan).

In addition to three manufacturing plants and an R&D Centre in Japan (all based in Iruma), its customers are further serviced through 12 sales offices in Japan. The company has also opened plants (and offices) in Thailand (2003) and Malaysia (2009), and offices in Singapore (1992), Philippines (2004), China (2007), Vietnam (2011) and Taiwan (2011).

Weight:

500 grams

Purity:

999.5%

Refinery:

MATSUDA SANGYO

Tamper Proof Packing:

0

Storage

We Employ Third Party Storage To Guarantee Our Customers Holdings

With Our Vaulting Provider at 'Le Freeport' - Malca-Amit Class 'A' Vaulting

World Renowned Bonded Vaulting Facility

Allocated Metal Accounts involves the secure storage of specific numbered gold, silver, platinum, palladium or rhodium bars or coins, segregated within our vaults at ‘Le Freeport’ of Singapore and held as the property of and in the sole name of the account holder.

- Quarterly statements and vault storage invoices.

- Bespoke online vaulting portal giving you access to your inventory, live performances in 6 currencies, charts and reports.

- Fully Insured by Lloyds of London

- Independently Audited

Once the customer has made their order, the metals will be delivered into Le Freeport and we will forward on a "Delivered Inventory-In Report - Customer Copy" which comes directly from our vaulting provider themselves.

Effectively this means our storage clients are 'not' exposed to any credit or insolvency risks arising from the financial or monetary system. In fact they are not exposed even from the bankruptcy of our own company as customer holdings are segregated in their own family name.

Bespoke Solutions for high-volume orders

Explore our tailored solutions for high-volume orders or complete the form to schedule a call with one of our investment advisers.

Book a free call back