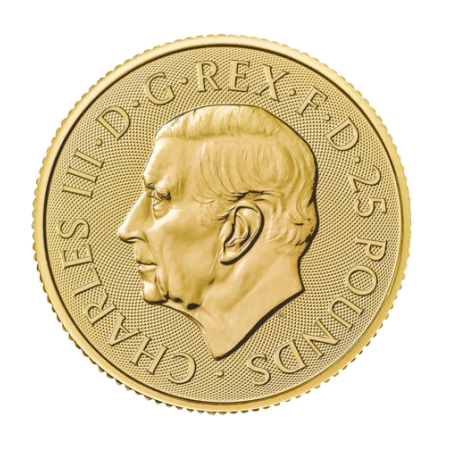

Royal Tudor Beasts 2024 Tudor Dragon 1/4 Oz Gold Bullion Coin

Live Prices

Stock is Available Within Our Vaults & Office (19 left)

Tax Status: Zero Tax / No GST

| Pick up from shop | Store in our vault | Back order |

|---|---|---|

|

In stock: 19 |

In stock: 5 |

Availability: Pending |

|

Delivery time: 1 Day |

Delivery time: 4 - 7 Days |

Delivery time: Pending |

Pricing Information

| Price per gram | Price per ounce | Price Premium | Spread |

|---|---|---|---|

| US$ 188.49 | US$ 5,881.00 | 14.75% | 13.87% |

IPM Buy-Back Prices

| IPM Buyback Price | Non-Vault Buyback Price |

|---|---|

| US$ 1,291.18 | US$ 1,288.59 |

Discount Tier Pricing

| Quantity | Prices |

|---|---|

| Buy 1 - 4 | US$ 1,476.15 |

| Buy 5 - 9 | US$ 1,473.20 |

| Buy 10+ | US$ 1,470.25 |

Product Information

- Product Details

- Specifications

- Tax Overview

- Storage

Country: UK, Mint: Royal Mint, Diameter: 22.00 mm, Weight: 7.776g, Purity: 0.9999% Au Fine Gold (24 karat)

Product Details

The 1/4 Oz Tudor Beasts - The Seymour Unicorn Gold BU Coin 2024 is a distinguished addition to the Tudor Beasts series, which pays tribute to the heraldic creatures of British royal history. Minted in 99.99% pure gold, this Brilliant Uncirculated (BU) coin showcases the majestic Seymour Unicorn, a symbol of purity, strength, and protection, inspired by Jane Seymour, the third wife of King Henry VIII.

Key Features:

- Metal: 99.99% pure gold (24 karat)

- Weight: 1/4 oz

- Year: 2024

- Finish: Brilliant Uncirculated (BU)

- Design: The obverse highlights the finely detailed Seymour Unicorn, with its flowing mane and powerful stance, while the reverse features the current British monarch’s portrait, encircled by a graceful inscription.

As part of a limited mintage, this coin is highly sought after by collectors and investors alike. Its historical background, combined with exceptional craftsmanship, makes it a standout piece for any collection or investment portfolio.

Weight:

7.8 grams

Diameter:

22.00 mm

Purity:

999.9 %

Refinery:

RMR

Tamper Proof Packing:

0

Storage

We Employ Third Party Storage To Guarantee Our Customers Holdings

With Our Vaulting Provider at 'Le Freeport' - Malca-Amit Class 'A' Vaulting

World Renowned Bonded Vaulting Facility

Allocated Metal Accounts involves the secure storage of specific numbered gold, silver, platinum, palladium or rhodium bars or coins, segregated within our vaults at ‘Le Freeport’ of Singapore and held as the property of and in the sole name of the account holder.

- Quarterly statements and vault storage invoices.

- Bespoke online vaulting portal giving you access to your inventory, live performances in 6 currencies, charts and reports.

- Fully Insured by Lloyds of London

- Independently Audited

Once the customer has made their order, the metals will be delivered into Le Freeport and we will forward on a "Delivered Inventory-In Report - Customer Copy" which comes directly from our vaulting provider themselves.

Effectively this means our storage clients are 'not' exposed to any credit or insolvency risks arising from the financial or monetary system. In fact they are not exposed even from the bankruptcy of our own company as customer holdings are segregated in their own family name.

Bespoke Solutions for high-volume orders

Explore our tailored solutions for high-volume orders or complete the form to schedule a call with one of our investment advisers.

Book a free call back