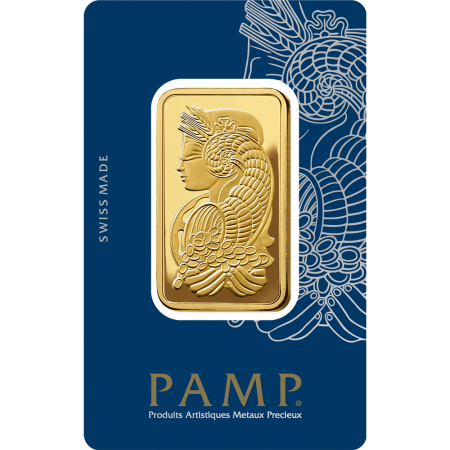

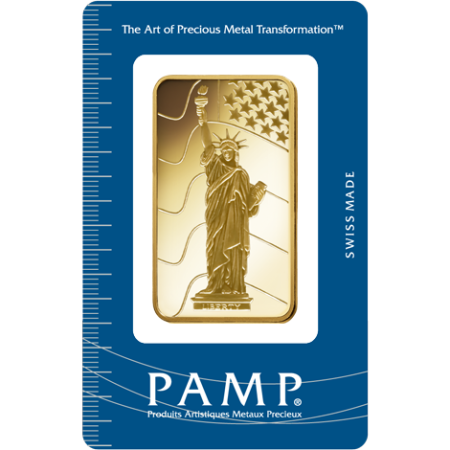

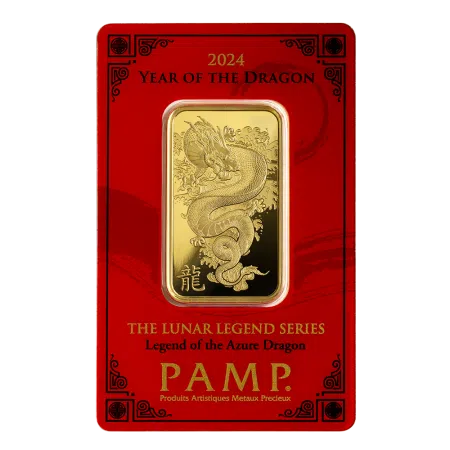

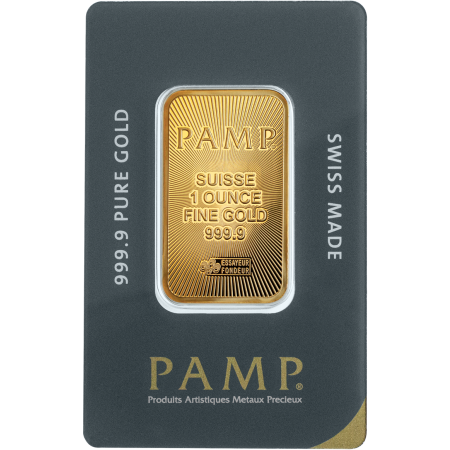

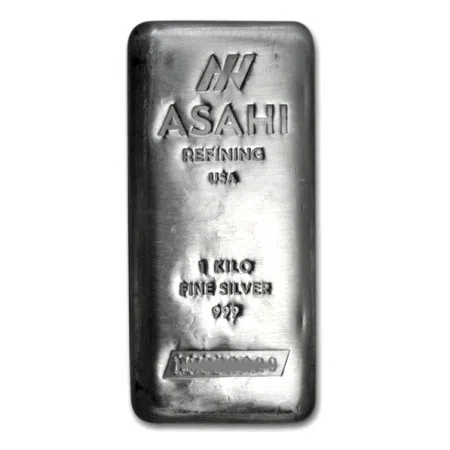

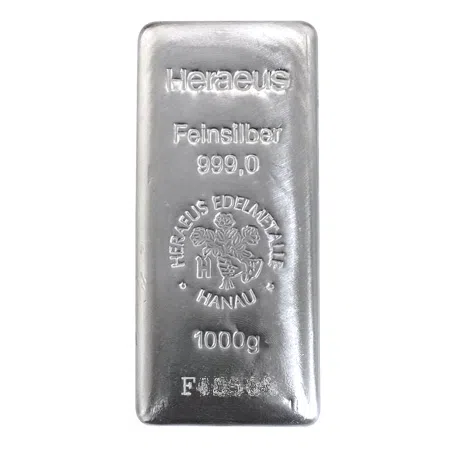

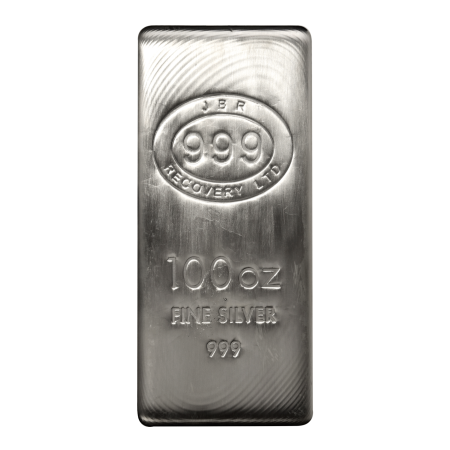

Indigo Precious Metals offers market-leading pricing on a diverse range of investment-grade bars and coins in Gold, Silver, Platinum, Palladium, Rhodium. Our commitment to excellence ensures investors access high-quality assets at the most competitive rates, optimizing portfolio stability and growth.

Indigo also provides clients with access to Critical Earth Metals in various industrial-grade formats, offering a unique opportunity to diversify into these essential and high-demand resources.

All our products are of the highest quality and purity, investment grade bullion available for secure segregated A class vaulting in Singapore, fully insured delivery worldwide or self-collection.

Our wide range of investment precious metals from around the world come in various weights and types from minted to cast bars and coins.

Reviews

Based on 219 reviews

Bespoke Solutions for high-volume orders

Explore our tailored solutions for high-volume orders or complete the form to schedule a call with one of our investment advisers.

Book a free call back

Indigo Bullion Gram Savings

- Enroll with Indigo Precious Metals Bullion Gram Saving Plan to invest in Gold, Silver, Platinum or Rhodium with low premiums and favourable sell-back terms

- Build your savings and convert grams into physical bars at no extra cost.

- Start securing your financial future today

Build your savings in precious metals and convert grams into physical bars at no extra cost. Start securing your financial future today.

Indigo Vaulting Solutions

World Class Segregated Vaulting Solution with tailored vaulting system portal access at your fingertips

Secure Storage

Segregated Storage – Experience true ownership with our Segregated Storage service. Your metals are stored in isolation—never pooled—under your name, ensuring legal title remains exclusively yours at all times. A solution crafted for those who demand nothing less than full accountability and peace of mind.

Zero Solvency Risk

Clients have no exposure to any insolvency or counterparty risk arising from failures within the financial system or indeed our company itself. Vaulting solutions remain external with premier third party vaulting agents outside the banking system.

Indigo Bullion Jewellery

- Wearable Wealth: Where Elegance Meets Investment.

- Fine Jewellery with Real Bullion Value.

- Pure Bullion, Exquisite Craftsmanship.