The Real Global Supply-Demand ‘Deficit’ in Platinum

David Mitchell, 26th January 2023

A shocking picture of above-ground stockpile availability of Platinum has transpired over the last 10 years, which the global research agencies have simply misreported or possibly even misrepresented with regards to the real and accurate picture.

Global research agencies appear to have concluded that ignoring China’s colossal import data of Platinum from their overall reported global supply-demand numbers was important, apparently owing to the fact they could not accurately report on what the Chinese were doing with these enormous Platinum imports.

China does not export industrial grade Platinum, in fact restrictions are in place halting the export of the metal entirely. China has significantly drained global above-ground supplies as these critical metals form part of the national security sovereign stock and provide the building blocks for many modern technologies. In particular, they are used for pollution controls and new energy sources, both of which are essential to sovereign national security and economic growth.

Our main focus has always been accurately forecasting how the relationship between global platinum imports and exports impacts above-ground stocks and the corresponding strain placed on future prices.

Stock = (Imports – Demand) – Exports

We have pushed forward many detailed research pieces pinpointing the severe risks and downgrades on the supply-side of the Platinum equation and at long last the research agencies are now picking up on this situation, having previously ignored this critical part of the equation (better late than never I guess).

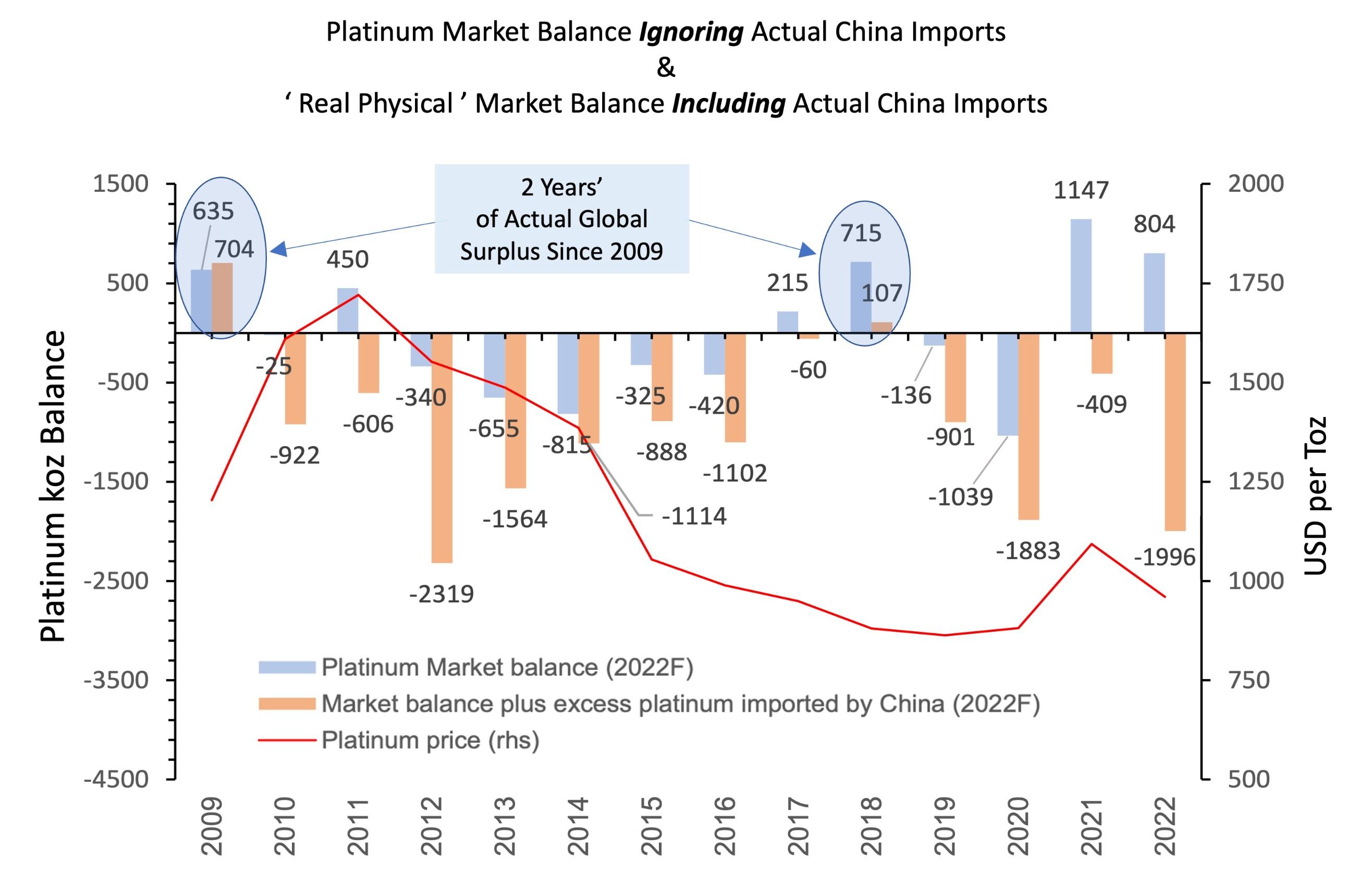

Various research agencies have reported a surplus with regards to the supply-demand data for Platinum over the years, however this is simply not the case whatsoever.

The blue bars below highlight the supply-demand numbers pushed out by many of the research agencies. However, if you include the all-important Platinum import data into China (which is not being re-exported out of China) the global supply-demand picture radically changes.

The likes of CPM group and SFA Oxford make a viable case for strategic above-ground stockpile builds, however they completely fail to recognise what is available to market demand, i.e. liquid available stock; and this has been shrinking very quickly!

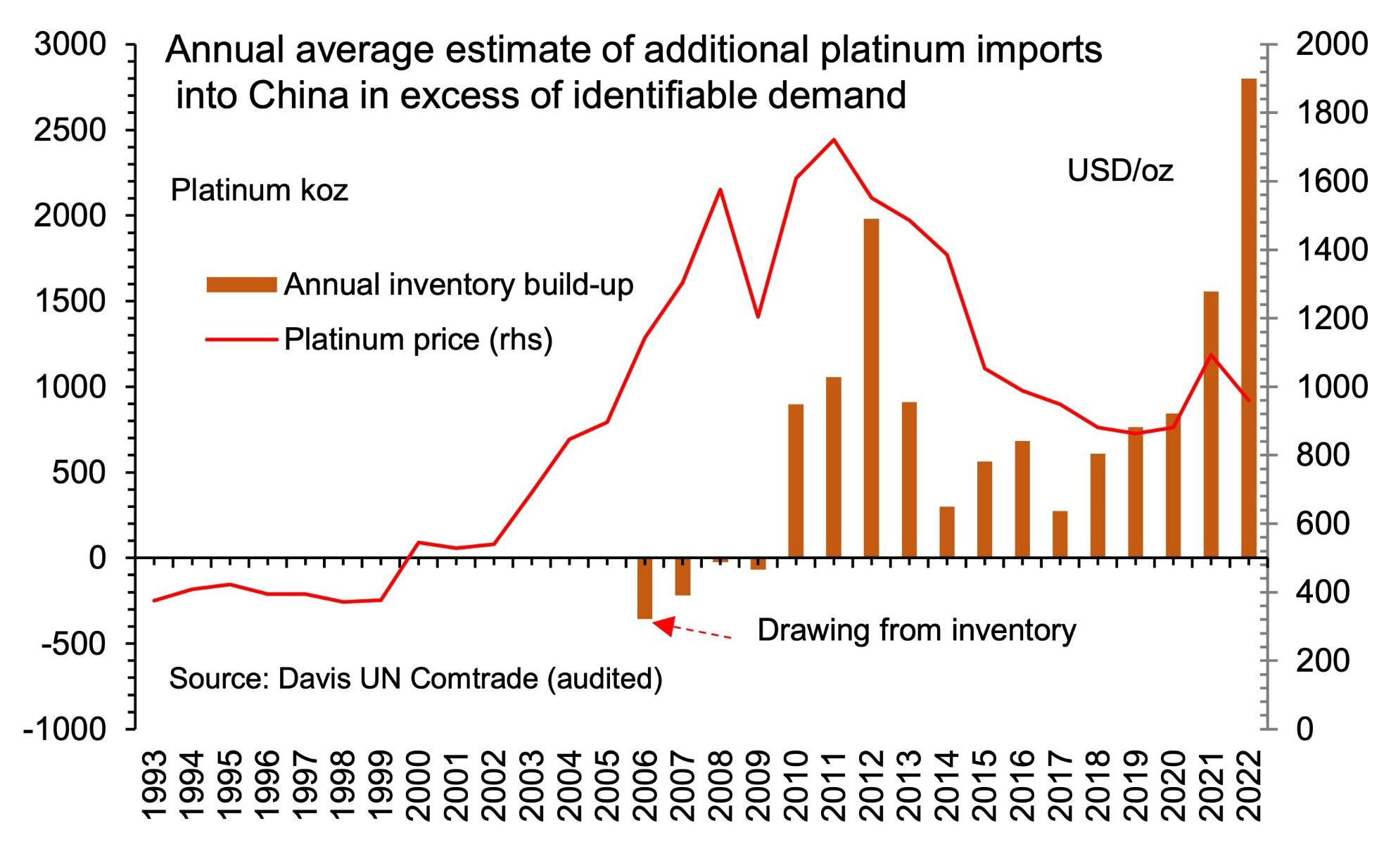

China has obviously built up stockpiles of Platinum over and above recognised industrial end usage (see chart below), but again, this stock is unavailable to the rest of the world.

CLICK HERE to download the full report

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery across the world.

Consider the safest option of segregated, allocated vault storage at Le Freeport Singapore with Indigo Precious Metals.

Disclaimer : The information contained in this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.