Impact on Precious Metals Following a Trump Election Victory

Into 1st Qtr. 2025

10th November 2024

By David J Mitchell

Summary :

– Market volatility quick overview.

– Trump Policy Framework.

– Why Debt Does Matter

– Deflation, into Inflation and then Stagflation

– Why Silver Remains One of the Best Assets to Own Into 2032

Republican wins > Debt expansion and deficits spending > Debt monetization and debasement > Supply / demand metric

Asset markets have experienced heightened volatility following the recent U.S. election results, which saw the Republican Party achieve a clean sweep, winning the electoral vote, popular vote, the Senate, and likely securing a House majority (although marginal).

To provide context, as of October 30th this year, gold prices had surged by an impressive +35.7%, while silver reached a peak on October 22nd with gains of +46.5% for 2024.

Following the election, metal markets experienced a sharp correction, with silver prices seeing a notable decline on November 6th, while gold experienced a less severe drop. This reaction was somewhat anticipated due to the short-term overextension in metal prices. Pre-election surges had been driven by heightened uncertainty and the very contentious political climate, fuelled by intense rhetoric and polarization surrounding Trump. These factors amplified market concerns about potential outcomes and their aftermath. However, with the election process concluding smoothly, market conditions began to stabilize, reflecting a temporary easing of tensions.

This, coupled with robust post-election gains based on expected Trump policies (covered again below) in equities, Bitcoin, bond yields, and the U.S. dollar, exerted downward pressure on metal prices—giving the impression that “all is well in the world.”

Yet, it’s important to remember the core reasons for holding gold—and by extension, silver. These remain unchanged. The U.S. (and very much globally) continues to face massive budget deficits, an unsustainably rapidly growing national debt, and ongoing Federal Reserve (central bank) policies that actively debase the currency. These structural issues persist as a stark reminder of the enduring case for precious metals.

Additionally, silver holds further structural catalysts for revaluation, which will be explored later in this update.

Trump Policy Framework

At this point, Trump’s core policy priorities, which focus on stimulating economic growth and investment alongside providing tax relief, are heavily reliant on borrowing and deficit spending.

Numerous organizations have analysed their potential impacts, and there is widespread consensus that government spending and the national debt are likely to grow at a pace exceeding the baseline projections provided by the Congressional Budget Office (CBO) and the White House Office of Management and Budget (OMB).

According to a detailed analysis by the Committee for a Responsible Federal Budget (CRFB), the largest budgetary costs under a Trump administration would stem from the extension of certain provisions of the 2017 Tax Cuts and Jobs Act (TCJA), particularly individual and estate tax cuts. Additional proposed policies, such as exempting overtime income from taxation and eliminating taxes on Social Security benefits, would also contribute significantly to increased spending and debt accumulation.

While I will not delve into a full breakdown of Trump’s policy framework here, as it is highly complex, the overarching trend is clear: deficit spending and debt growth are poised to accelerate under his fiscal approach, further compounding existing budgetary challenges.

Why Debt Does Matter!

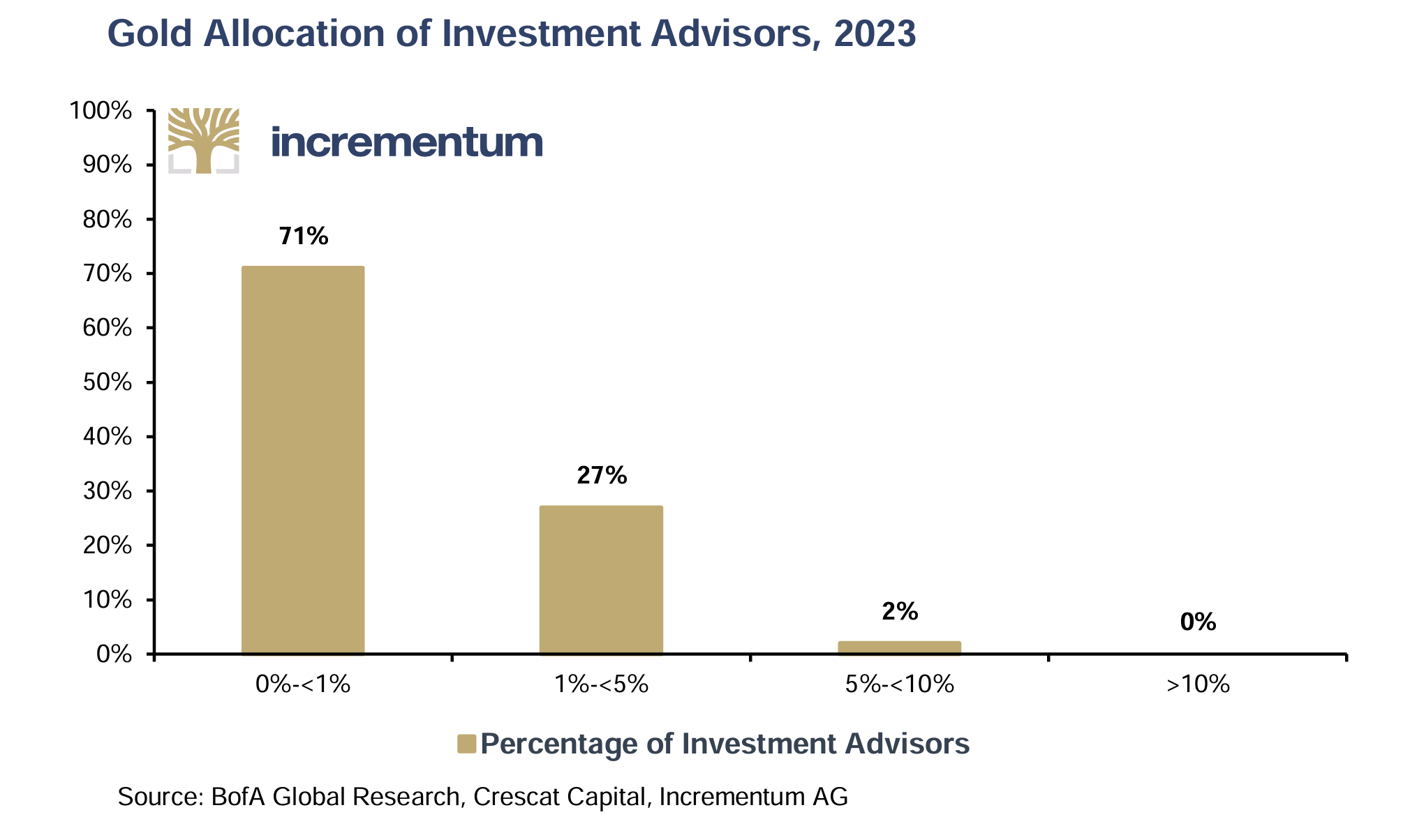

Over the past decade, I have frequently heard wealth managers claim that debt levels are inconsequential, seemingly captivated by the flawed allure of “Modern Monetary Theory” (MMT). This mindset has undoubtedly contributed to the reluctance of many Western value investors to consider gold as a viable asset. In stark contrast, the Middle-East, Far East and global central banks continue to embrace gold without hesitation as a priority diversification, recognizing its enduring value and stability as a cornerstone asset.

Ingoldwetrust have shockingly demonstrated this on many occasions over the years, but as a reminder …..

A bull market never ends with non-participation!

MMT Definition: The core principle of Modern Monetary Theory (MMT) proposes that governments operating under a fiat currency system—where they control the issuance of their currency—can and should create (or digitally expand) as much currency as necessary to support debt expansion. According to MMT, such governments cannot go bankrupt or become insolvent unless they choose to do so through a deliberate political decision. Proponents argue that debt monetization and currency debasement can effectively mitigate the long-term constraints of debt burdens, offering a means to sustain spending and economic activity.

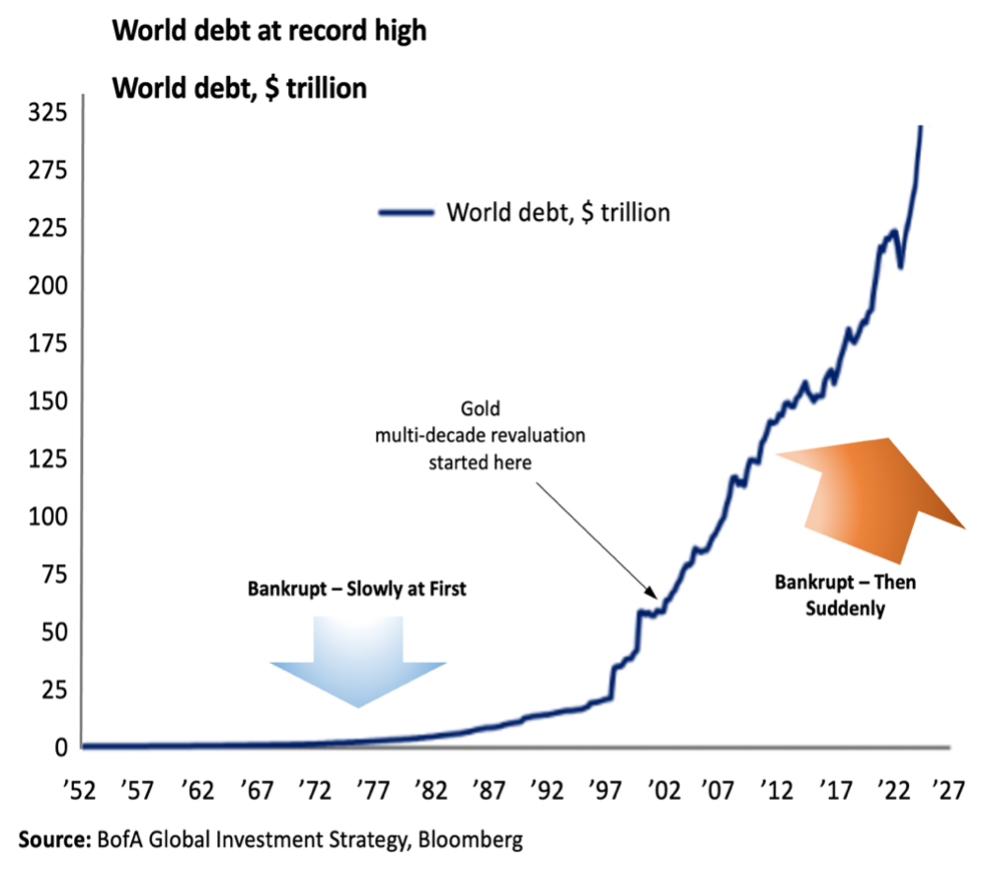

I have taken a contrarian perspective to MMT and the global debt crisis, developing a multi-decade macroeconomic blueprint starting in the mid-2000s. This framework outlined the inevitable cycles we would face from 2003 into 2032, culminating in a final phase of global monetary debasement. This impending crisis, projected to fully unfold into 2030s, has the potential to profoundly destabilize the global financial system.

Investors who have followed these insights (available to Indigo invested clients) have seen the accuracy of these projections play out.

At the heart of this systemic issue lies the global debt crisis, a “cancerous core” that continues to metastasize. In 2002, global GDP stood at approximately $34.9 trillion, while global debt was recorded at $58 trillion, resulting in a Debt-to-GDP ratio of 165%. Fast forward to late 2024, global debt has skyrocketed to over $330 trillion (near 6 X the level in 2002), while global GDP is estimated at $100 trillion. This equates to a staggering Debt-to-GDP ratio of over 330%, underscoring the unsustainable trajectory of debt accumulation.

The warning signs are clear: the global financial system is teetering under the weight of unprecedented leverage.

The simple fact is the gold bull market will continue to be repriced higher over time and not come to a sudden halt, until the global debt crisis is addressed and resolved, as currencies need to be debased and debt monetised as the debt burden continues to rope-burn the neck of the global economy.

The likelihood of a major global recession in 2025 is high. In such a scenario, global debt levels are expected to escalate rapidly, as recessions inherently fuel debt expansion. Economic downturns typically prompt governments, businesses, and households to rely heavily on borrowing to mitigate financial pressures, further exacerbating the already precarious global debt landscape.

Deflation, into Inflation and then Stagflation

The current economic environment is defined by a contracting money supply, a prolonged period of excessively high interest rates, and a broad downturn across economic indicators over the past ten months. My economic blueprint signals the onset of severe recessionary pressures in 2025, compounded by intense deflationary forces.

More critically, this will likely be followed by a re-acceleration of inflation, driven by aggressive interventions from global sovereign treasuries and central banks. These efforts are expected to pave the way into stagflation and usher in one of the most significant super-cycles in commodities, with precious metals at the forefront.

This phenomenon is complex and warrants a dedicated, in-depth analysis for investors to fully grasp the scale and implications of what is likely to become the largest commodity super-cycle in modern economic history. I will work to produce this article in early 2025.

Why Silver Remains One of the Best Assets to Own Into 2032

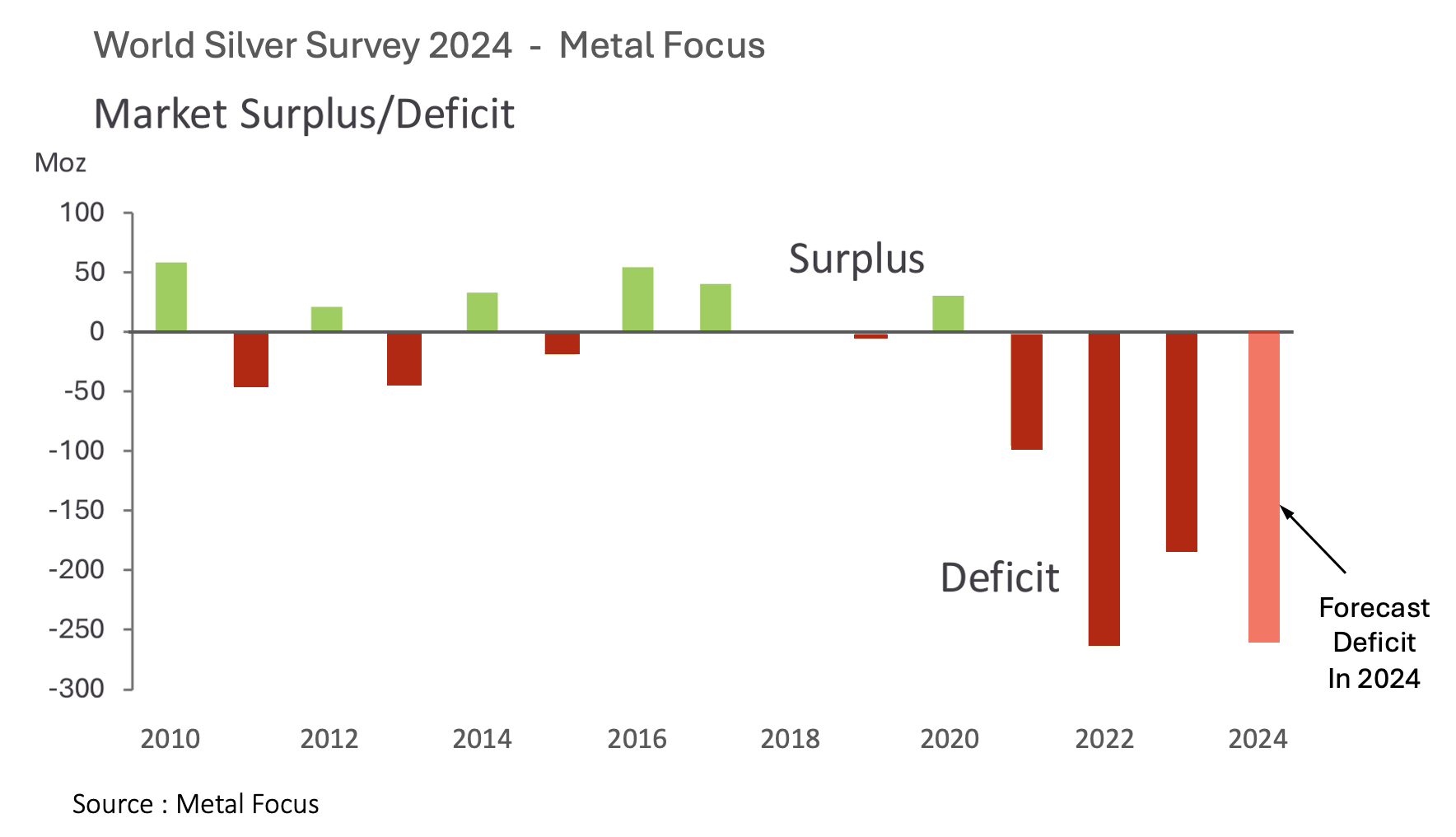

Global supply, which includes mine production and recycling, has fallen short of meeting demand over the past four years. Demand encompasses industrial fabrication, jewellery, coins, and investment bars. This persistent supply-demand imbalance over the last 4-years has resulted in a significant global deficit, highlighting the growing pressure on precious metal resources.

Industry experts and research analysts have acknowledged that by the end of this decade, current trends in growing industrial demand combined with declining supply will lead to a critical shift. Industrial fabrication alone is projected to fully consume all global production and recycling output, leaving no available supply for other key sectors such as jewellery, coins, and investment bars. This scenario underscores the mounting pressure on global resources and the potential for significant market disruptions in the silver price higher.

It will be very interesting where silver needs to be to force a re-balancing of supply-demand at the end of this decade, I would suggest dramatically higher than today.

In the short term, silver prices are anticipated to consolidate within the $30 to $32.50 range. However, as we move into the coming months and into the new year, silver prices are expected to trend higher, targeting the $35.50 level. While there is significant resistance around this price point, the upward momentum suggests that prices are likely to break through this barrier as market conditions evolve and the present negative global macro position re-asserts itself.

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery across the world.

Consider the safest option of segregated, allocated vault storage at Le Freeport Singapore with Indigo Precious Metals.

Disclaimer : The information contained in this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.