Gold Hits New Record High

On Tuesday, gold surged to new record highs, climbing above US $3,750 per ounce. The rally has been supported by investor bets on further U.S. Federal Reserve rate cuts, with markets increasingly expecting Chair Jerome Powell to adopt a dovish tone in upcoming speeches.

According to reports, traders are pricing in the likelihood of at least one more 25 basis point rate cut before the end of 2025. Lower interest rates typically weaken the U.S. dollar and reduce the opportunity cost of holding non-yielding assets such as gold, making the metal more attractive to investors.

The recent price action highlights gold’s enduring role as a safe haven asset. Against a backdrop of geopolitical uncertainty, stubborn inflationary pressures, and volatile equities, institutional and retail investors alike are moving capital into gold.

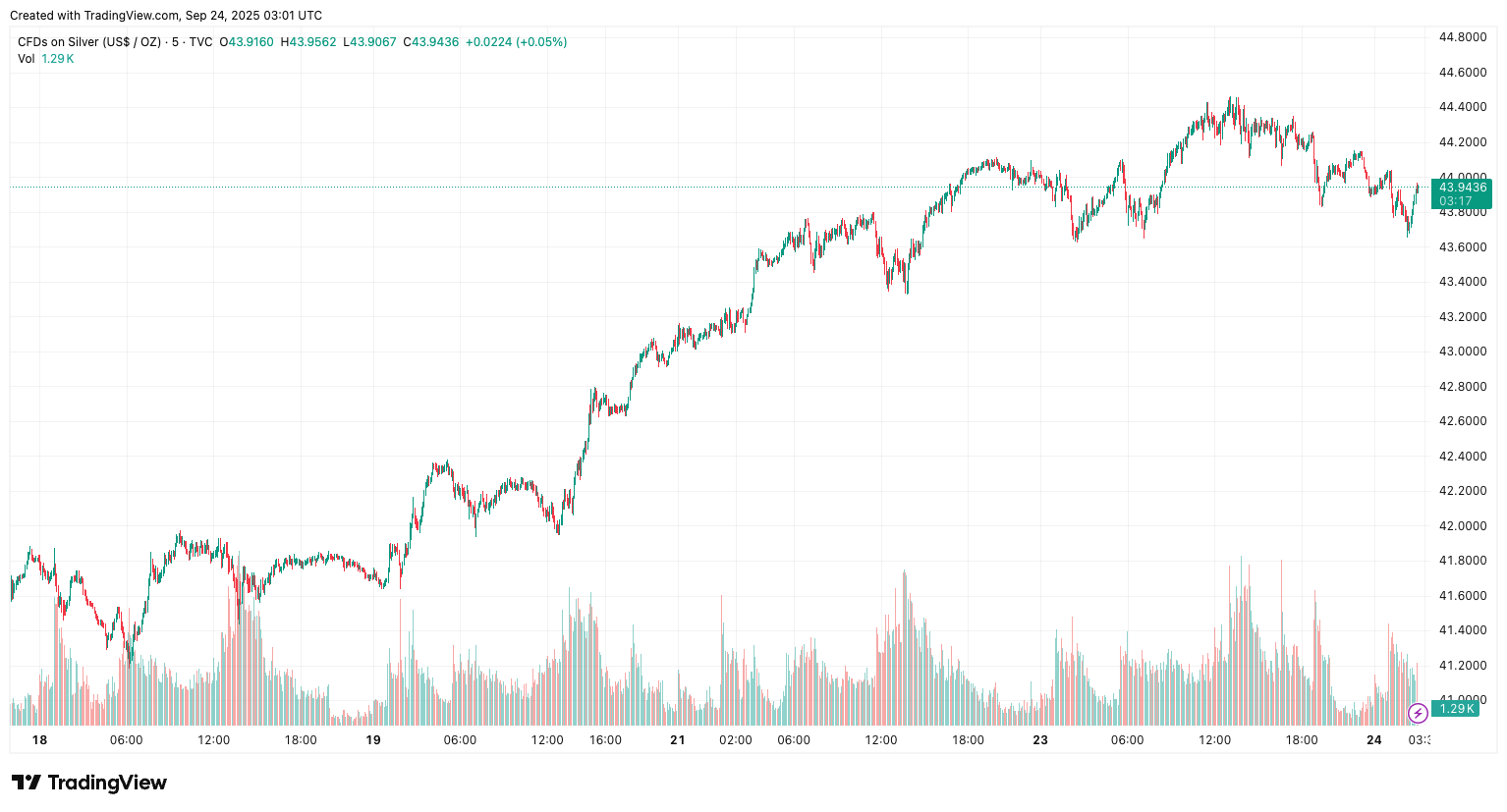

Silver Breaks Through US $44.22 Resistance

Silver has also been making headlines. On Monday, the metal broke through multi-year resistance at US $44.22, a level that had capped price gains for years. This breakout markedsilver’s strongest rally since the last major bull market, with prices climbing to their highest levels since the early 2010s.

Several factors are driving the silver rally:

-

Supply Tightness: Lease rates remain elevated, while Exchange for Physical (EFP) premiums are at record highs, pointing to persistent shortages in physical silver supply.

-

Industrial and Investment Demand:Silver plays a dual role as both an industrial and a monetary metal. Investment demand is growing alongside a recovery in industrial demand for electronics, solar panels, and renewable energy technologies.

-

Relative Undervaluation: Compared with gold, silver is still relatively undervalued, which is attracting new buyers looking to diversify.

For long-term investors, silver’s breakout above a key technical level could mark the beginning of a sustained bull phase.

Platinum Approaches US $1,500

While gold and silver are leading headlines, platinum has also seen significant strength. The metal is now trading close to US $1,500 per ounce, supported by both tightening supply and recovering demand.

Global platinum supply is projected to decline by 3% in 2025 to around 7.03 million ounces. Longer term, analysts warn that production from platinum-group metals could fall as much as 20% by 2030. Meanwhile, investment demand is growing, offsetting softer industrial and automotive demand.

Adding to the bullish outlook, jewellery demand—particularly from China—is expected to grow by 11% this year, according to the World Platinum Investment Council. Together, these factors suggest that platinum prices may need a significant revaluation to balance the market.

The Bigger Picture: Monetary Metals as a Macro Trade

What ties these moves together is the increasing recognition that precious metals remain the most compelling macro trade of this decade. With gold at record highs, silver breaking long-standing resistance, and platinum facing structural supply deficits, the case for holding physical bullion has rarely been stronger.

Investors are also aware of the limitations of paper-based products such as ETFs or futures contracts. While these instruments offer exposure to price movements, they do not provide the same level of wealth preservation and security as owning physical gold and silver bullion.

For wealth managers and individual investors alike, the revaluation currently underway could extend over the next five to seven years, delivering returns that may surprise even seasoned market participants.

What This Means for Investors

Gold remains the cornerstone of any precious metals portfolio. Its record-breaking rally underscores its safe-haven status and its ability to protect wealth during monetary easing cycles.

Silver offers a unique blend of monetary and industrial demand, with the recent breakout above US $44.22 signaling potential for further gains.

Platinum presents a compelling long-term opportunity due to tightening supply and a rebound in jewellery and investment demand.

For those seeking to hedge against inflation, diversify away from financial markets, or preserve wealth across generations, physical precious metals remain unmatched.

Final Thoughts

The current momentum across gold, silver, and platinum highlights a turning point for precious metals markets. As central banks shift policy and supply shortages deepen, investors are increasingly positioning themselves in bullion.

Whether you are an experienced trader or new to the sector, now is the time to explore opportunities in physical gold, silver, and platinum bullion.

Take advantage of today’s historic market shifts. Visit Indigo Precious Metals to explore a full range of investment-grade bullion and start building your position in gold, silver, and platinum today.