Platinum stands apart from gold and silver in structural terms. While gold and silver volumes are largely intermediated through global warehouse exchanges in London, Europe, the U.S., and China, platinum flows far more directly from producers to end-users. This makes the market structurally less liquid, more vulnerable to disruption, and ultimately more explosive when imbalances arise.

Structural Supply Challenges

Platinum supply is facing compounding headwinds that are unlikely to abate:

-

South Africa’s collapse as a stable producer, driven by political dysfunction and systemic state failure.

-

Severe energy shortages and widespread infrastructure breakdowns.

-

Organised crime and asset stripping, undermining mining operations.

-

Collapse in capital investment and financing, leaving producers unable to sustain output.

-

Years of depressed PGM basket pricing, placing the entire industry under acute financial strain.

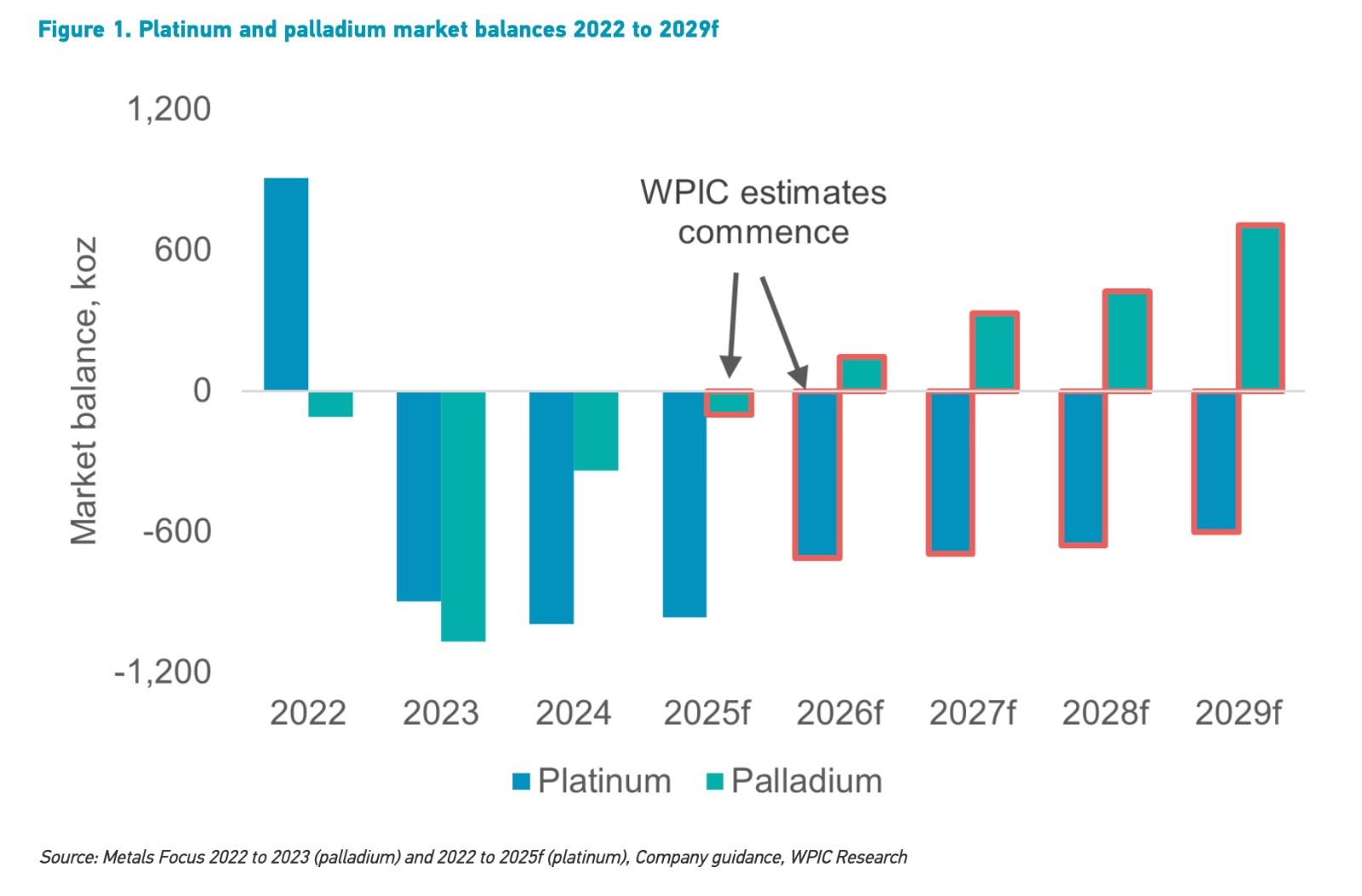

Persistent Market Deficits

The platinum investment case is anchored in the reality that the substantial market deficits of 2023 and 2024 will persist through the remainder of this decade. Even as global growth forecasts continue to be downgraded and macro data turns increasingly negative, platinum prices have already risen by +50% year-to-date.

This price strength reflects deep, entrenched structural deficits, shrinking above-ground stocks, geographic dislocations between supply and demand, and accelerating consumption from China’s jewellery market. At the same time, de-dollarisation flows that first supported gold have broadened into platinum and silver, creating powerful “catch-up trades” within the white metals.

China’s Dominance in Demand

China remains one of the critical demand drivers. So far in 2025, China has absorbed 46% of all global mine and recycling supply. These are not cyclical flows—they represent structural deficits. The platinum forward curve remains in persistent backwardation, with very elevated lease rates further confirming systemic imbalance in supply-demand dynamics.

Price Inelasticity and Long-Term Deficits

Despite the sharp rally, we do not believe platinum’s fundamentals have materially shifted. Both supply and demand remain highly price inelastic in the short term. Our research continues to forecast market deficits from 2026 into 2030 and beyond, broadly in line with our long-term analysis.

Conclusion

Platinum’s price trajectory will ultimately need to rise to elevated levels that enforce demand destruction in industrial usage to force a rebalancing of global supply-demand structure. In fact higher prices will not materially lift supply in the near to medium term, as ore-grade exhaustion, underinvestment, and the enormous capital requirements of new projects impose long lead times.

In fact, investment demand—both financial speculation and jewellery consumption—is set to intensify the annual deficits further. For these reasons, platinum remains our highest long-term conviction trade, with structural forces positioning it for a once-in-a-generation revaluation into the end of this decade.