All Roads Now Lead to Eventual Inflation / Debasement

Navigating Irreversible Trends and Safeguarding Your Wealth

By David Mitchell

30th December 2024

As we close out 2024, a year marked by significant upward movements in gold, silver, and U.S. stock markets, among other asset classes, the holiday season offers a valuable opportunity to reflect on the overarching longer-term trends shaping the global financial landscape. Understanding these macroeconomic forces is essential for evaluating what lies ahead and the implications they carry for various asset classes as we move into 2025 and beyond.

Why do I strongly believe that gold and precious metals will emerge as critically important asset classes in the coming years and the fact we have not seen their true bull market yet? Their significance is rooted in this unique economic and monetary cycle we are entering, which is poised to redefine global financial dynamics.

To fully capitalize on this opportunity, it is essential to recognize the importance of timing. Maximizing returns will require a strategic approach that aligns with this unfolding cycle, which is expected to extend through the remainder of this decade and into the early part of the next. These assets are set to play a pivotal role in navigating and thriving amidst the structural shifts ahead.

Let me attempt to explain the very complex picture I am looking at…..

|

Global macroeconomic trends are very much signalling an initial phase of deflationary pressure, a global market crash is highly likely, particularly impacting economic activity and the valuations of financialized assets such as stocks and real estate and domino affect into commodities, which is likely to unfold over the next 12 months. This phase, however, serves as a major precursor to a broader, multi-year overarching trend that is already unfolding in the background, with significant implications for global markets and investment portfolio strategies. |

Major global trends are now unfolding, driven by de-globalization, escalating geopolitical tensions, and extreme valuation disparities across asset classes. These shifts have exacerbated capital investment expenditure challenges, in particular across the global commodities complex and are accompanied by numerous other adverse developments. At the core of these issues lies a global debt crisis, characterized by unsustainable levels of debt, systemic mathematical insolvency, and the immense speculative leverage underpinning the global financial system.

Globalization Cycles Are Clear

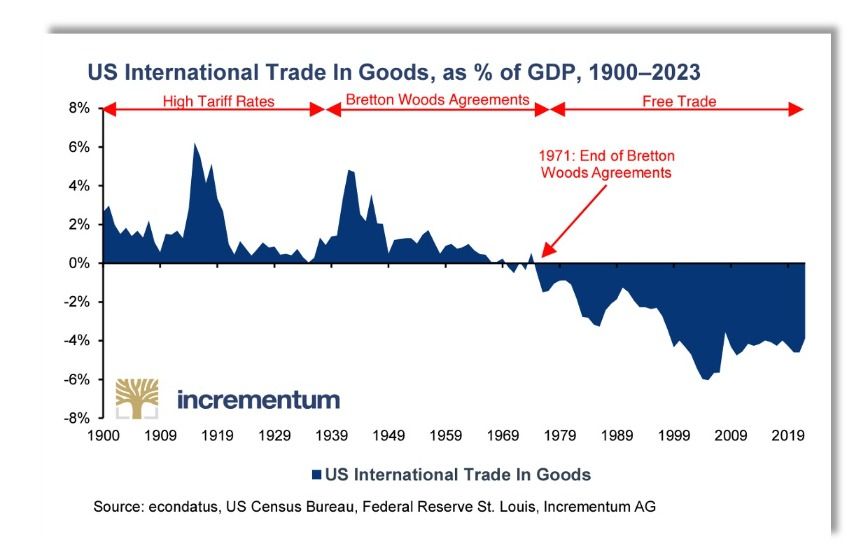

History, as it so often does, appears to be again repeating itself. A careful examination of past globalization cycles reveals similar patterns of acceleration, stalling, and eventual reversal, offering important lessons as we navigate the current landscape.

Each historical period of globalization stalling or outright reversing—such as the well recorded globalisation cycles of ‘1870 to 1914’, ‘1944 to 1971’, and ‘1989 to potentially 2020/24’ — has been marked by significant shifts in asset class valuations.

However, the most profound and recurring consequence has been the occurrence of substantial monetary debasements in our currencies at the end of a globalisation cycle, fundamentally reshaping economic and financial systems. So what should we expect to see moving forwards from today as an honest appraisal of trends that appear simply irreversible at present …..

In the context of the modern era spanning the last 155 years, we are currently in the third era of globalization, which began in 1989. While this era technically continues, it can be strongly argued that globalization has stalled since 2020 due to a clear shift towards industrial onshoring and the reversal of outsourced production trends. This particular wave of globalization gained significant momentum in 1994 when China pegged the Yuan to the US dollar, solidifying its role in the global financial system.

A crucial factor underpinning this cycle in globalization and offshore production has been China’s central role in the current global economic framework. Following the Asian Financial Crisis of 1997–1998, many other Asian economies adopted similar export-led growth strategies, leading to an exponential increase in US dollar reserves held by these offshore production hubs across the Asia-Pacific (APAC) region.

This dynamic has been instrumental in shaping the global trade and the financial landscape over the past few decades. The massive inflow of capital into the US system via treasury notes and other US assets has fuelled persistently low interest rates and drove equity stock prices to unprecedented heights, creating this prolonged era of economic expansion and asset market growth.

This framework is now increasingly unsustainable for China, as it faces immense challenges from its towering corporate and domestic debt and leverage levels, alongside a growing insolvency crisis. Additionally, China’s sovereign debt relative to its GDP is becoming a major concern. These domestic pressures are further exacerbated by the global debt burden overall, excessive leverage in the financial system, and the world’s decreasing willingness to absorb its excess export production capacity—particularly that generated by APAC and China itself. The situation is now poised to worsen with the escalation of trade tariff wars, further straining China’s economic model and global trade dynamics.

The key takeaway here is that national savings are increasingly being channelled toward domestic priorities, a trend that is already evident. This global movement signals a significant repatriation of global capital that is slowly underway, reflecting a broader shift in focus towards strengthening internal economic foundations.

According to research foreign entities own approximately $60 trillion in American assets, a mind-blowing number.

Global System into the end of this Decade ?

Under increasing pressure from aggressive U.S. policies, China is expected to further distance itself from the existing global financial framework. The country is expected to pursue a truly independent monetary policy, granting it greater flexibility to address domestic economic challenges. This shift will enable China to reduce its massive domestic debt burden through inflation-driven debt monetization. This direction has significant consequences and would essentially eliminate its focus on its peg to the US$, as a result, we must expect a multi-year devaluation trend of China’s currency.

This trajectory appears far from surprising to our Chinese friends, evidence of which lies in China’s sustained and substantial accumulation of physical gold using its US dollar reserves, amassed over decades of export-driven growth. This strategic buildup of global monetary gold asset reserves, a deliberate effort to diversify against its coming currency debasement. While their official rhetoric may suggest otherwise, their actions—steadily bolstering gold reserves—speak volumes about their long-term intentions.

The message is clear: ignore what they say, follow what they do and their strategy in action.

The global financial system is obviously on the same path, evolving into one that allows individual nations to manage and reduce their debt burdens through controlled inflation (debt monetisation). We can clearly see this by western nations seemingly unfazed by their enormous fiscal deficit spending and gigantic debt accumulation, they already have a plan.

This overall framework would facilitate large inflationary policies and supported by lower domestic interest rates by leveraging national savings. To achieve this, governments will introduce stronger capital controls, alongside eventual yield curve controls.

What Assets To Buy and Hold?

Gold and precious metals remain essential assets to hold during this ongoing cycle of debt monetization. They stand out as the ultimate monetary investment, offering unmatched stability and value preservation. This recommendation is grounded not only in the expectation of a significant breakdown in the current global monetary system but also in the relentless expansion and devaluation of paper-based fiat currencies.

Historical parallels reinforce this perspective. Following the collapse of the Bretton Woods system in 1971, gold prices surged dramatically from $30 per ounce to $850 per ounce by 1980 or 28 X your investment, silver moved approximately 33 X your investment.

History consistently demonstrates that during periods of structural shifts in the global financial system, gold and precious metal prices experience sharp and sustained increases.

While we have not yet reached this critical inflection point, the current trajectory strongly indicates that it is now only a matter of time before such a major transition occurs, further solidifying gold’s role as a cornerstone of financial security.

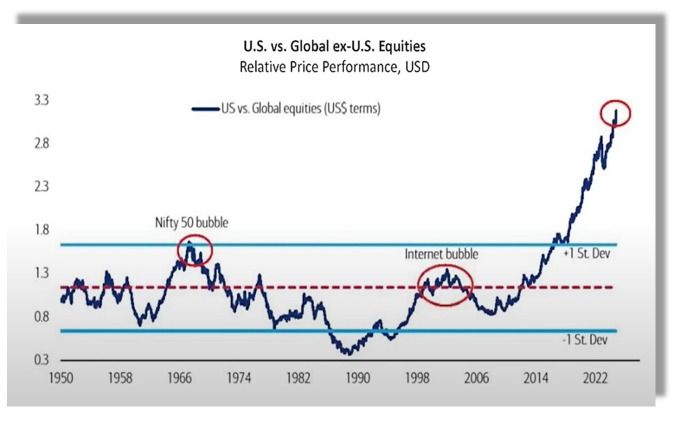

Global equities are an interesting asset class to concentrate on, driven by all-time geographical valuation disparities. This can be clearly seen below in the ratio chart below…

This enormous accumulation of US$ asset reserves over the last 2 decades-plus has steered valuations in the US markets to ludicrous extremes versus the rest of the world, and de-globalisation trends underway, reshoring of production, and local government demand for its reserve accumulation back home points to a significant trend reversal in the chart above.

The liquidation of the primary asset class that has dominated sovereign reserve asset management in recent years, namely large-cap U.S. equities, particularly those within the S&P 500, will prompt money managers and portfolio strategists to explore more attractive valuation opportunities in other markets.

Japan’s stock markets stand out with valuation metrics currently priced at levels reminiscent of previous crisis lows, offering very compelling opportunities. Similarly, emerging markets such as Brazil present significant undervaluation, largely due to the commodity sector facing severe price distortions and prolonged underinvestment in capital expenditures.

China’s stock markets also exhibit long-term valuation prospects that are highly appealing, with indicators suggesting a strong investment prognosis. These underappreciated markets represent a fertile ground for capital rotation and reallocation, providing a chance to capitalize on undervalued assets in a shifting global economic landscape.

The bond market, particularly U.S. government long-dated debt such as the 10-year Treasury, presents a compelling medium-term buy-and-hold opportunity. Several key factors support this thesis:

- Deteriorating macroeconomic indicators, signalling slower economic growth and potential recessionary pressures in 2025.

- The enormous burden of servicing the “Mount Everest” of national debt, which continues to escalate.

- Anticipated rate cuts by the Federal Reserve in 2025, as economic conditions soften further.

- Overvalued stock market levels, which appear increasingly disconnected from economic fundamentals.

Against this backdrop, longer dated U.S. Treasuries stand out as an attractive option, offering a sizeable opportunity for investors seeking both stability and potential capital appreciation as yields decline in response to easing monetary policy and economic headwinds over the next 12 months.

I wish you all a healthy happy New Year.