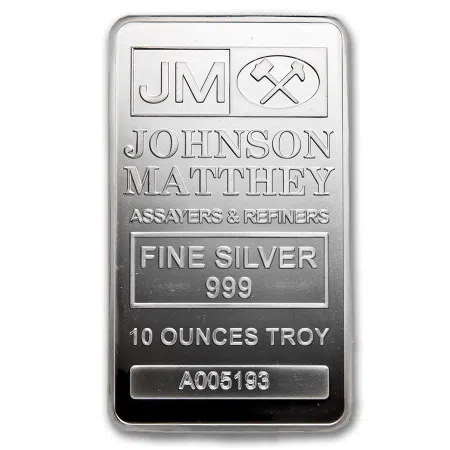

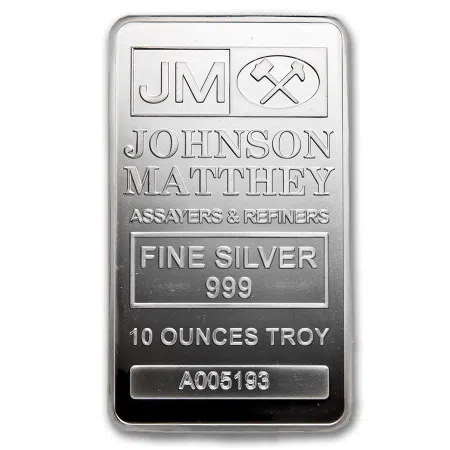

10 oz Johnson Matthey Silver Minted Bar

Live Prices

Out of stock

| Pick up from shop | Store in our vault | Back order |

|---|---|---|

|

In stock: 0 |

In stock: 0 |

In stock: 0 |

|

Delivery time: Pending |

Delivery time: Pending |

Delivery time: Pending |

Pricing Information

| Price per gram | Price per ounce | Price Premium | Spread |

|---|---|---|---|

| US$ 3.45 | US$ 107.21 | 30.16% | 30.58% |

IPM Buy-Back Prices

| IPM Buyback Price | Non-Vault Buyback Price |

|---|---|

| US$ 821.06 | US$ 819.42 |

Discount Tier Pricing

| Quantity | Prices |

|---|---|

| Buy 1 - 9 | US$ 1,079.69 |

| Buy 10 - 24 | US$ 1,077.53 |

| Buy 25 - 49 | US$ 1,075.37 |

| Buy 50+ | US$ 1,072.13 |

Product Information

- Product Details

- Specifications

- Tax Overview

- Storage

10 oz Johnson Matthey Silver Minted Bar (with Certificate of Authenticity)

Johnson Matthey is widely regarded as one of the most trusted and recognizable names among LBMA good-delivery refiners. Founded in 1817 by Percival Norton Johnson as a gold assaying business, the company gained prominence when George Matthey joined in 1851, prompting the name change to Johnson & Matthey. Just a year later, in 1852, the firm was appointed as the official assayer and refiner for the Bank of England.

This 10 oz Silver bar represents one of the last newly produced Silver bars ever available from the world-renowned refiner, Johnson Matthey. For over 160 years, the company’s Silver bars and other precious metals products dominated the global bullion market. However, in March 2015, Johnson Matthey ceased producing Gold and Silver bars, selling its final two refining facilities to Asahi Holdings of Japan.

Today, Johnson Matthey no longer manufactures bullion and has transitioned its focus to becoming a leader in specialty chemicals, particularly in environmental technologies and automotive catalysts.

Despite this shift, Johnson Matthey bullion remains highly sought after. Known for their exceptional purity, weight, and craftsmanship, their bars are a top choice among investors and collectors worldwide.

Bar Highlights:

- Contains 10 oz of .999 fine Silver.

- Obverse: JM logo, weight, purity and unique serial number.

- Reverse: May feature diagonally-oriented, repeating JM hallmarks or may be blank.

- Guaranteed by Johnson Matthey.

Weight:

311 grams

Thickness:

6.7 mm

Purity:

0.999%

Tamper Proof Packing:

0

Storage

We Employ Third Party Storage To Guarantee Our Customers Holdings

With Our Vaulting Provider at 'Le Freeport' - Malca-Amit Class 'A' Vaulting

World Renowned Bonded Vaulting Facility

Allocated Metal Accounts involves the secure storage of specific numbered gold, silver, platinum, palladium or rhodium bars or coins, segregated within our vaults at ‘Le Freeport’ of Singapore and held as the property of and in the sole name of the account holder.

- Quarterly statements and vault storage invoices.

- Bespoke online vaulting portal giving you access to your inventory, live performances in 6 currencies, charts and reports.

- Fully Insured by Lloyds of London

- Independently Audited

Once the customer has made their order, the metals will be delivered into Le Freeport and we will forward on a "Delivered Inventory-In Report - Customer Copy" which comes directly from our vaulting provider themselves.

Effectively this means our storage clients are 'not' exposed to any credit or insolvency risks arising from the financial or monetary system. In fact they are not exposed even from the bankruptcy of our own company as customer holdings are segregated in their own family name.

Featured Products

Bespoke Solutions for high-volume orders

Explore our tailored solutions for high-volume orders or complete the form to schedule a call with one of our investment advisers.

Book a free call back