The Golden Constant: A Core Asset in Volatile Times

Why Indigo

Indigo Precious Metals offers direct vaulted exposure to Critical Metals and physically audited gram-saving programs.

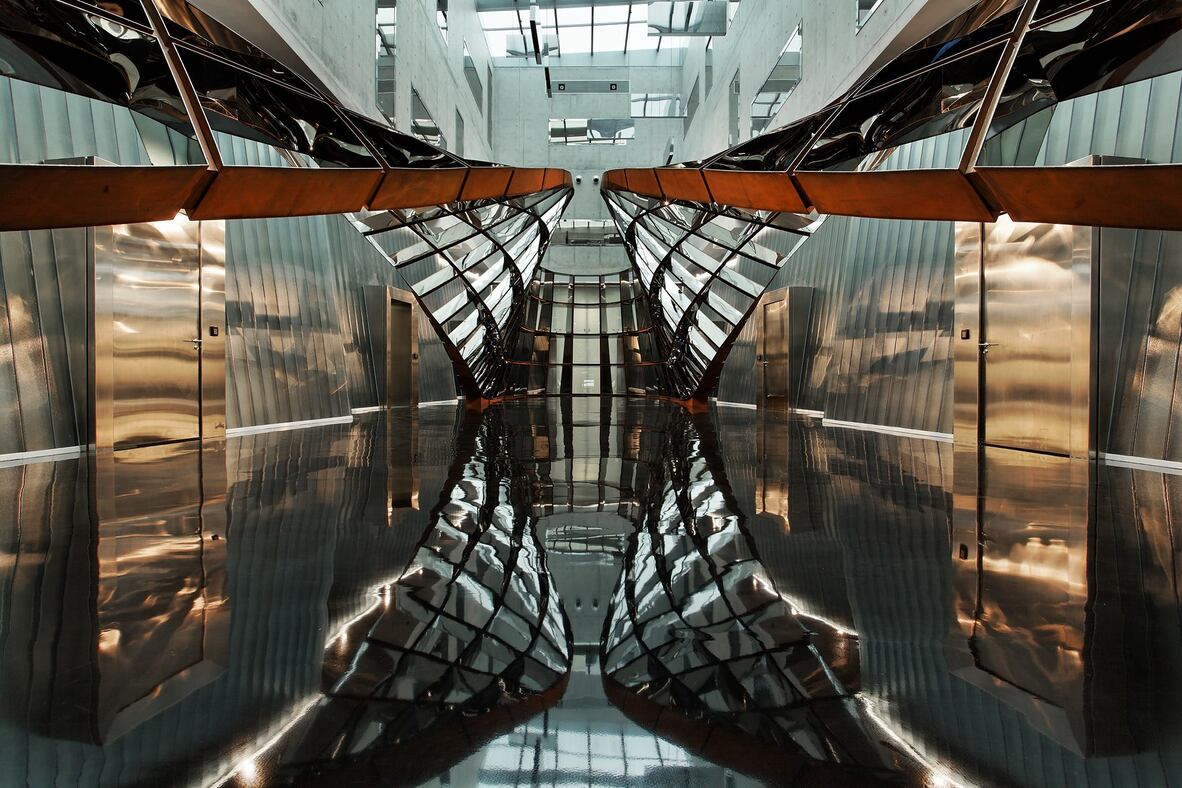

Our services provide a seamless asset diversification opportunity, with options for direct delivery or fully allocated storage at Le Freeport, Singapore—one of the world's most secure vaulting facilities.

Benefits of IPM

Price

We hold distributor contracts with the refiners themselves, hence there is no third party that has become between the origination and creation of these products and to the customers themselves.

Simplicity

We pride ourselves on our relationships with our customer base, hence when developing our customer focused business plan we have concentrated on one single element above all else - simplicity.

Experience

The team at IPM Group has many decades of experience in the banking industry working directly in investment and trading, across many asset class markets on behalf of the banks and bank clients.

Cost Advantages

The cost of the products to the retail investment market relies heavily on the bullion dealer’s business model, funding costs and funding availability, overall cost expenditure to run the business (at the highest quality).

Location

Headquartered within ultra-secure Le Freeport bonded vaults in Singapore, while also maintaining strategic bullion vault contract partnerships across London, Switzerland, Hong Kong, and Australia, regions that formally recognize physical precious metals as standalone investment-grade assets.

Additional Services

Customers can obtain the latest investment news, live pricing, and exclusive offers through our e-commerce site and email newsletters.

Additional Services

No Third-Party Liability – Secure Ownership & Global Trends

With allocated bullion storage at Le Freeport, Singapore, your metals are fully owned by you, free from third-party liability or counterparty risk. This ensures absolute security and direct control over your investment.

Physical Metals Over Paper – True Ownership, No Counterparty Risk

Physical gold is a tangible asset with zero counterparty risk, unlike paper gold, which depends on banks and financial institutions.

In times of crisis, paper gold is just a trading product—only physical bullion ensures real, long-term wealth preservation.

Wealth Preservation – Gold & Silver as Timeless Stores of Value

Money serves as a medium of exchange, unit of account, and store of value. Throughout history, various items—seashells, salt, nails, cigarettes, and even stone wheels—have been used as currency.

Yet, gold and silver have remained the most trusted and universally accepted stores of value, standing the test of time as the foundation of true wealth preservation.

How to buy

Allocated Storage

An Allocated Metal Account ensures the secure, segregated storage of individually numbered gold, silver, platinum, palladium, or rhodium bars and coins at Le Freeport, Singapore. These assets are held in the account holder’s name as their direct property.

Customers receive quarterly statements and vault storage invoices, guaranteeing full transparency and security.

The Golden Constant: A Core Asset in Volatile Times

Silver's Spotlight: A Rising Force in Precious Metals

While gold continues to draw attention in times of market volatility, a quieter but equally compelling story is unfolding for its industrial sibling: silver. Often underestimated, silver is now building a case for outperformance — driven not just by monetary demand, but by powerful, long-term shifts in global technology and supply dynamics.

Platinum Market Update – Crisis Unfolding

We are witnessing a major dislocation unfolding in the platinum market. Over the past few weeks, platinum has surged sharply — now up +49% year-to-date, with +28% of that gain occurring in June alone.

Featured Product Categories

Bespoke Solutions for high-volume orders

Explore our tailored solutions for high-volume orders or complete the form to schedule a call with one of our investment advisers.

Book a free call back