14 Jan 2026

The Global Resource War: Silver, Leverage, and Why Paper Selling Keeps Failing

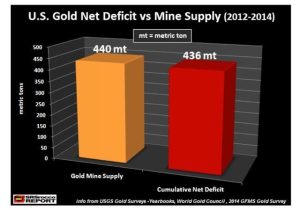

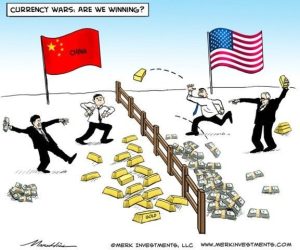

Across a rapid sequence of market updates from 6–12 January, David’s commentary consistently points to the same conclusion: paper-driven volatility has not weakened the underlying bull market in precious metals.…