To put it in perspective, for every 17–18 ounces of gold mined, only one ounce of platinum is extracted. Platinum occurs in far lower concentrations in the earth’s crust, making its rarity remarkable. Yet, despite this, it currently trades at a deep discount to gold — a pricing anomaly savvy investors shouldn’t ignore.

Currently, the annual demand for platinum stands at 8 million Troy ounces, while the annual supply is only 7 million Troy ounces, resulting in a global annual supply-demand deficit of 1 million Troy ounces.

Additionally, there exists a paper position exceeding 3 million Troy ounces in contracts without any physical backing. This disparity has led to heightened demand for physical platinum, driving short-term interest rates above 35%, a clear fundamental macro position not to be ignored!

Looking to capitalise on this mispricing? Explore our platinum bullion range now atIndigo Precious Metals.

From Premium to Discount — And Why That Won’t Last

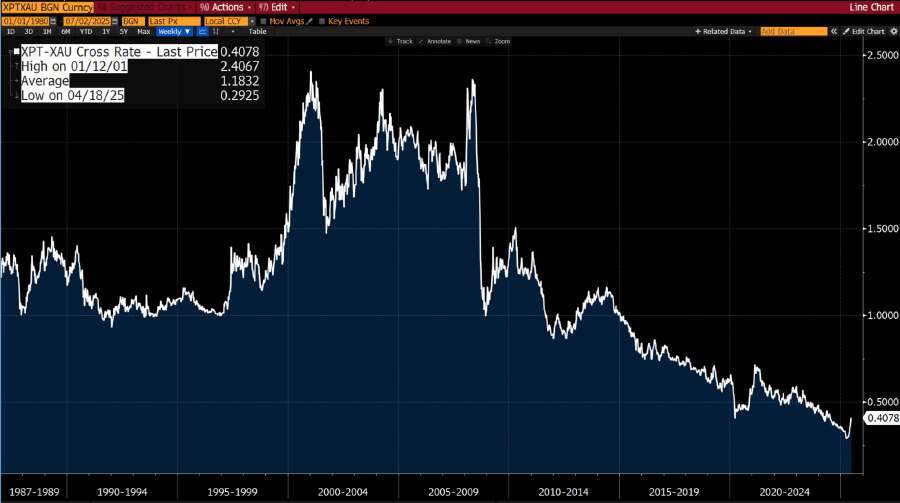

Historically, platinum often traded at a premium to gold, or at the very least, on par. But since 2015, that dynamic has reversed. Today, platinum is priced at a substantial discount — one so large, it could double from here and still not match gold’s price. Even at parity value to gold, we believe platinum would still be very undervalued.

As the gold bull market continues, we believe investors will re-evaluate platinum’s role as not only a monetary metal and a powerful inflation hedge but more importantly a significant wealth preservation asset due to its extreme rarity.

If you’re looking for a cheaper entry point into real asset investing, platinum is it — and Indigo Precious Metals makes accumulating it simple and secure.

Rising Investment Demand

While industrial use remains critical, it’s investment demand that could drive the biggest gains ahead. Just 8% of platinum demand currently comes from investors — but in 2024, that demand surged 77%.

As awareness spreads, and more investors seek hard assets amid inflation and monetary debasement, physical platinum is poised to break out.

A Supply Crisis in the Making

What’s fueling platinum’s potential isn’t just demand — it’s a severe supply crunch.

According to the World Platinum Investment Council, the platinum market has posted three consecutive years of major deficits:

-

2023: – 896,000 oz

-

2024: – 992,000 oz

-

2025 (projected): – 966,000 oz

Above-ground inventories are projected to hit just 2.5 million ounces in 2025 — a historic low. If deficits continue, global stocks could be completely depleted within three years. When supply vanishes and demand grows, prices don’t just rise — they surge.

Why Supply Won’t Catch Up Quickly

Unlike other commodities, platinum’s supply can’t quickly respond to price. Over 80% of mined platinum comes from South Africa, where producers face energy issues, mismanagement, and structural instability.

Mine supply for 2025 is already down 6%, and Q1 2025 saw a 13% drop — the lowest output since 2020. Recycling, once a safety valve, is barely moving the needle.

Even if prices spike, new supply will lag for years — giving buyers who move early a serious edge.

Your Move: Invest in Platinum with Indigo Precious Metals

At Indigo Precious Metals, we make platinum investment accessible — from 1 oz coins to 1 Kilo bars, all fully insured and stored in secure global vaults.

Don’t wait until platinum catches up to gold — because by then, the window may have closed.

Buy smart. Buy secure. Buy platinum — with Indigo Precious Metals.