Light At The End of The Tunnel

A new dawn for the next stage of the bull market in precious metals is breaking over the horizon.

by David. J. Mitchell, Founding Partner – Auctus Metal Portfolios & IPM Group

CLICK HERE to download the full report in pdf format

I believe we have finally come to the end of this very long and extremely frustrating (for all concerned) near 3-year price consolidation in precious metals.

Pardon the analogy, but a new dawn in the next stage of the bull market in precious metals is breaking over the horizon. This is very much how the markets are clearly developing.

In this article I will explain why the markets are pointing in this direction, covering:

- Why invest in precious metals like gold, platinum ans silver in the first place.

- The essentials of debt dynamics and what this means to the value of currencies and asset prices.

- Black Swan risks facing our macroeconomic landscape today.

- Conclusion, why the dawn is breaking on a new bull market for precious metals.

Clients, including ourselves being heavily invested in this asset class, often express extreme frustration regarding the price action and consolidation patterns observed over the past 2.5 to 3 years. It is often questioned why precious metals have not exhibited significant positive price movement, despite the substantial body of hard data and economic realities supporting their expected revaluation and forecats. Some may even argue that if the data is indeed correct and prices have not responded accordingly, then might it be advisable to sell down these investments?

A more accurate perspective, however, suggests otherwise. If the expected price movement has not materialized thus far, but the accumulating data becomes increasingly compelling, this does not undermine the investment allocation. Rather, it strengthens the statistical evidence supporting the investment thesis.

An extensive examination of historical market prices and events consistently reveals that markets can persistently exhibit irrational behaviour in relation to real-world dynamics. However, it is important to recognize that this irrationality can only endure until such point where it no longer does. Price movements will then start to intensify within increasingly shorter time frames, to rectify long-standing market imbalances.

There is a famous quote attributed to the Great Depression-era economist John Maynard Keynes – “Markets can remain irrational longer than you can remain solvent”. It essentially signifies that in the short-term (and even the medium-term), markets possess the capacity to behave in any manner, without necessarily adhering to predictable price moves that are required to re-balance supply and demand imbalances (following raw data that supports the development of new price trends).

This can be especially true when considering governments and central banks play such a hard hand in manipulating asset market valuations and capital flows!

But no price, capital imbalance or, indeed, any market manipulation can ever stay unrectified. History has proven this time and time again.

So, What Prompted All Our Initial Investments Into Precious Metals?

It became abundantly evident that a monetary debasement crisis was looming. This forecast has since been substantiated to a remarkable extent, with even more challenging times expected in the coming years due to the continued severity and scale of the monetary debasement.

Over the past 12 years, asset classes have been marred by significant capital imbalances. Investment capital has been drawn towards debt markets, property and stock market valuations leading to extreme inflated overvaluations. meanwhile, the ‘real economy’, encompassing both commodities and the infrastructure surrounding commodities, has faced substantial capital shortfalls. These capital flow imbalances were primarily influenced by policy makers and central banks who, as ever, are driven by strong political agendas. Hence, a realisation of the present status quo, absolutely demands diversification.

Moreover, there has been an unprecedented shift in global political perspectives, with widespread support for the decarbonization of energy production. This shift necessitates extensive infrastructure development on a global scale over several decades, consequently driving demand for vast quantities of specific commodities and in particular precious metals, which we have seen in hard data.

Therefore, we are already witnessing substantial global supply-demand deficits or indeed extreme tightness emerging in precious metals and across the commodities complex, with the anticipation of a continued surge (akin to a formidable tsunami) in real-world demand over the next 5 years.

Precious metals have historically served as a crisis hedge, and the current macro landscape provides a unique array of developments and the possibility of black swan events, that clearly highlight the current undervaluation across the precious metals sector. This undervaluation is unparalleled historically and the investment opportunity underscores the enduring relevance of precious metals as a safe and reliable investment class.

Considerable analysis and in-depth historical research, conducted by reputable hedge funds including Bridgewater (Ray Dalio), as well money managers and financial institutions, have revealed that optimal investment portfolio weightings ought to include approximately a 10% weighting in precious metals. This allocation split has enabled such portfolios to consistently demonstrate superior performances over long periods versus the presently popular portfolio breakdown of bonds and equities only.

To illustrate this point, let's take Gold as an example. Since 1970, the price of Gold has shown an average yearly compound rate of return of +7.8%. This significant growth clearly supports the notion that the inclusion of precious metals in one's portfolio can be highly beneficial.

Now a 5% to 10% diversification in a normal economic cycle is probably about right, BUT this is not the normal economic cycle we are in today.

In my opinion, a 10% diversification is too low, and a more conservative and realistic diversification is likely closer to 20% or 25% at least.

The Essentials of Debt Economics

When the debt burdens of sovereign countries, states, corporations and households surpass the GDP of their respective nations at every level, and deficits in debt continue to expand and compound well beyond any realistic growth expectations necessary to sustain the debt (while productivity growth declines), it becomes not only necessary, but absolutely crucial for real interest rates to remain negative. This economic phenomenon is commonly referred to as financial repression and it manifests itself with ‘real’ negative nominal yields.

As Ray Dalio recently stated … The largest amounts of debt, the fastest rates of debt growth, and the greatest amounts of central bank printing of money and buying of debt since 1930-45.

In an unprecedented manner over the last 12 months, economies in the Western world have embarked on a policy of aggressively increasing interest rates at an unparalleled pace. Driven by the aim of combating inflation (a monetary phenomenon that was self-created by central banks in the first place). However, this approach further accelerates the growth of debt, as servicing the growing debt mountain becomes more costly. Consequently, it leads to a greater reliance on borrowing to maintain net income levels in support of the debt.

To avert an eventual crash and depression of the economic system, it is vital in the medium to longer-term to sustain larger increments of negative nominal yields in ‘real’ interest rates. Failure to achieve this delicate balance, which has historical significance, poses a momentous risk of destabilising the entire economic framework itself.

This approach is extremely bullish for precious metals in today’s larger picture. Gold is money and cannot simply be devalued as supply is limited. The same applies to other important precious metals, such as platinum and silver, for which prices are also experiencing significant tailwinds due to the fact that global industrial demand is significantly outpacing actual supply.

Part 2

Potential ‘Black Swans’ facing our macroeconomic landscape today.

The evidence of black swan risks that we face today are so numerous (considering the epic imbalances in our system that have been driven by unjustified policies of our central banks and governments) that they literally darken the skies. I am not going to attempt to try and describe all of them, but will provide a few likely examples below:

Ref Black Swan: A black swan refers to an unforeseen occurrence that deviates significantly from what is typically anticipated and carries the potential for severe consequences. These events are distinguished by their exceptional rarity, profound impact, and the tendency for people to claim their predictability in hindsight.

So to name just a few, please take note that these are not predictions but warnings of possible black swan events…..

- Global recession on the near horizon. Many analysts have flagged this as having an extremely high probability (baked in the cake some would say), while others disregard the warnings stating we are in the throes of a new period of economic expansion.

Whilst predicting major geographical or global recessions is thwart with danger (akin to predicting global weather storms) the data pointing to an economic “crisis” is certainly overwhelming. Europe is already in a technical recession with a myriad of severe issues facing them. China meanwhile is suffering a spluttering economy following their post Covid re-opening; which has been hampered by significant headwinds that have been brought about by the broken housing bubble, extreme debt loads and leverage and falling export sales due to the slowing global economy.

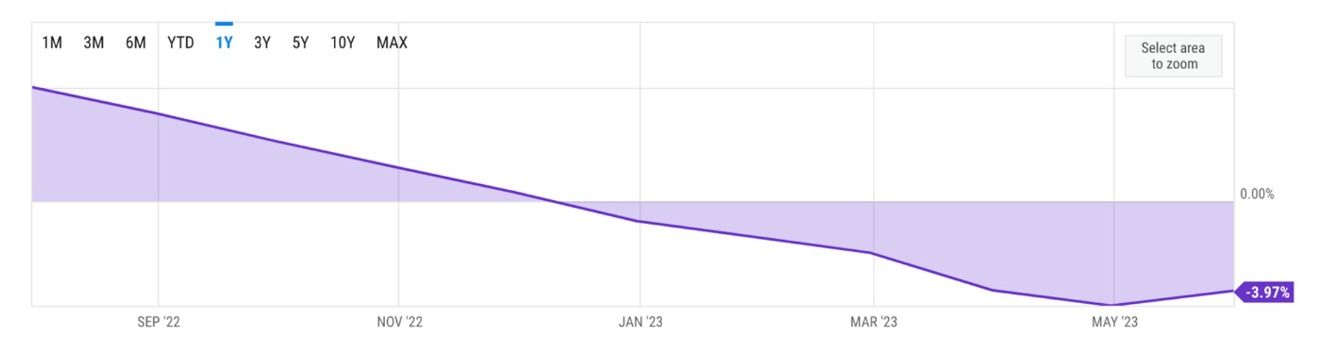

Since July 2022, the USA has been contracting their money supply with M2 growth now reported at -4% YoY or on a 3-month annualised rate of over -5%. The only time we have experienced contracting money supply (M2) was during the great depression of the 1930s or more specifically, in 1938.

US M2 Money Supply YoY

Source: Board of Governors of the Federal Reserve System (US)

While at the same time, they have raised interest rates at the fastest rate in history, while sitting on the largest accumulated debt mountain in history!

This debt mountain growth has been supported by extremely low interest rates and the necessity of high asset collateral valuations over the last 12 plus years, both of which have now moved in the opposite direction.

PMI and ISM surveys alongside inventory build-ups are also clearly pointing towards severe economic problems, dead ahead.

The Yield inversion, the 10-to-2year Treasury Yield Spread represents the disparity between the interest rates of the 10-year treasury bond and the 2-year treasury bond. When the 10-2 treasury spread approaches zero, it indicates a "flattening" yield curve. Historically, a negative 10-2 yield spread has successfully predicted every recession between 1955 and 2018, although typically occurring 6 to 24 months before the actual recession takes place. It is therefore considered a leading and very reliable indicator.

10 year versus 2 Year USA Treasury Yield Spread as of 23rd June 2023

This inversion first started to appear at the beginning of July 2022:

- Global Debt Crisis - If the globe moves into contraction (highly likely), the growing annual debt deficits will simply blow out, massive increases in debt growth over and above what we are already experiencing will place unprecedented pressure on the functioning of the debt markets. This will in turn escalate economic contraction.

- Deglobalisation - which is in fact very inflationary in the medium to longer-term, while globalisation of the last 30 years was deflationary (good deflation). The momentum in the reversal of the last 30 years of global interaction and integration has entirely U-turned to geographical polarisation, and is massively aggravating an already severe shortfall in global commodity supply inventories.

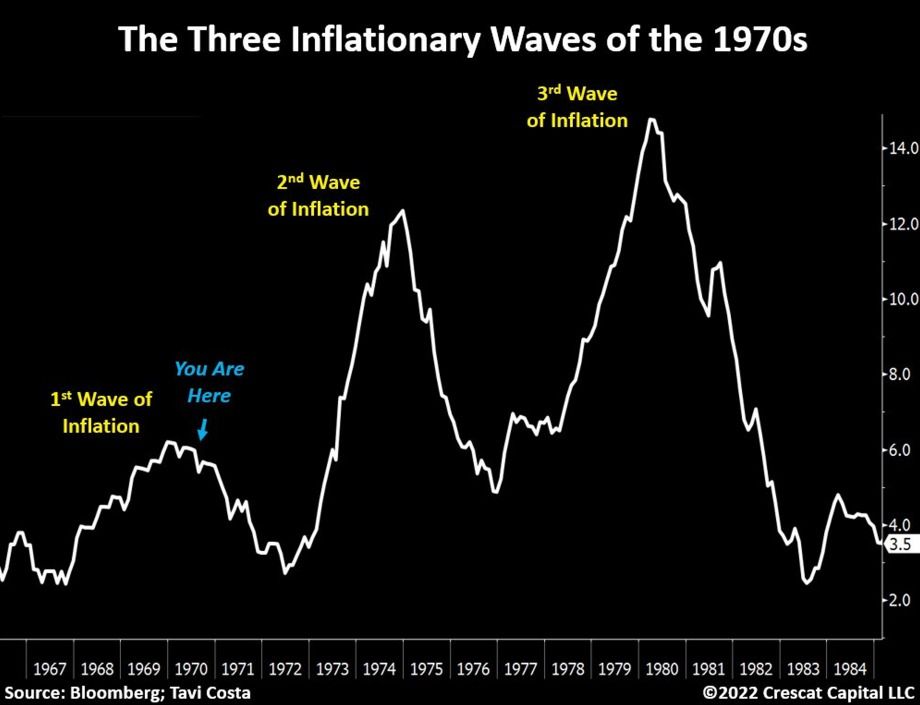

Inflation historically arrives in waves, with each wave progressively getting larger (we experienced 3-waves in the 1970). In this first wave, which has now peaked, we are now experiencing falling inflation due to drastic contraction of the money supply and very rapid interest rate rises. But, this has not solved the major supply issues that the world is presently facing, its merely dampening demand by instigating growth destruction. We have still yet to solve the supply issues (and hence the2nd wave of inflation is coming down the road).

- Geo-Political Tensions & Conflicts - the most significant tension build-up and policy clashes of the major global powers, particularly involving the United States and China, since the period of 1930-45. Global cycle-analysis has been warning about war-cycles for at least the last 10-years indicating the period of concern (from a cyclical perspective) would be from 2024-2027.

Throughout history, whenever the general populace rejects the established order due to disillusionment, staggering wealth disparities between a minuscule fraction of the privileged few and the overwhelming majority of the disadvantaged, as well as pervasive political ineptitude and egregious levels of corruption and embezzlement, governments have instinctively turned to the option of engaging in war. This pattern of behaviour holds true for various historical periods: the late Roman Empire, the disintegration of the Song Dynasty in China, Dutch colonial empire followed by the British empire and the continent-wide push for war in 1914 in Europe.

The ruling elites resort to this strategy because wars possess the unparalleled ability to unite and divert attention like no other method. Moreover, war conveniently offers the attractive attribute of employing "national security" as a means to suppress dissent, even to the extent of imprisoning opposition figures. In essence, war represents a ready-to-use tool for implementing a form of totalitarianism at the push of a button.

- New Trading BRICS Currency System - in late August 2023, South Africa will play host to the leaders of Brazil, Russia, India, China and South Africa, collectively known as BRICS. One of the key topics to be discussed during the meeting is the establishment of a long-discussed and carefully developed New Trading BRICS Currency System. The primary objective of this system seems to be the creation of a streamlined and effective payment mechanism for international transactions, eliminating the dependence on the US dollar as an intermediary.

It has been reported that 30 countries having formally and informally applied to join the new alliance.

Latest reports indicates that some of the countries ready to join the BRICS alliance are Algeria, Argentina, Bahrain, Bangladesh, Belarus, Egypt, Indonesia, Iran, Kazakhstan, Mexico, Nicaragua, Nigeria, Pakistan, Saudi Arabia, Senegal, Sudan, Syria, the United Arab Emirates, Thailand, Tunisia, Turkey, Uruguay, Venezuela and Zimbabwe.

Once the initial step of establishing a seamless payment system is achieved, the intention is to eventually introduce a new currency system that is flexible and widely accepted.

There have been many reports and analysis that the new trading payment system and currency bloc is going to be pegged or linked to free price floating commodities.

The Chinese government has expressed its serious concerns regarding the prevailing dominance of the US dollar, characterizing it as "the primary cause of instability and uncertainty in the global economy." Beijing specifically attributed disruptions in the international financial market and significant devaluation of other currencies to the recent interest rate increases by the Federal Reserve, further aggravating the global debt crisis. China, along with other BRICS nations, have joined in criticism for using sanctions as a geopolitical tool.

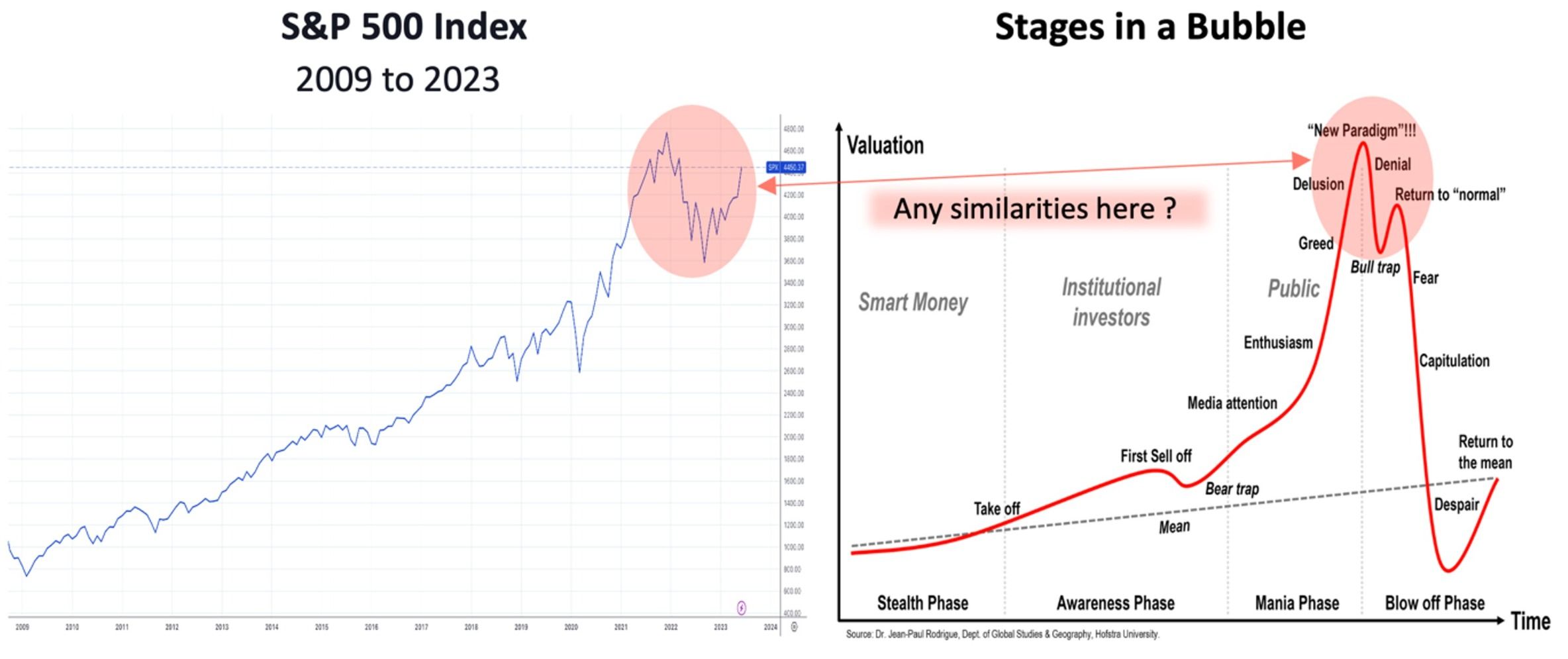

- Asset price collapses - asset market valuations are extremely vulnerable considering the enormous global mis-allocation of capital. They are clearly recognized using multiple forward valuation metrics. The historically high housing market bubbles (commercial real estate is already in free fall) alongside equity markets and AI present values are unsustainable, especially when you consider the contraction of money supply and rapid increases in the cost of capital, placing further stress and risk on leveraged positions. Earnings per Share (EPS) of the main indices have been falling steadily since the summer of 2022. The S&P 500 EPS is down -11% since March 2022 and in the last 4 weeks estimates for the S&P 500 have dipped lower again. They look like they will continue to decline further during Q3 and Q4, and an earnings recession hardly buoys higher stocks prices already at extreme valuations.

- Banking Crisis - whereas the predominant pain has been concentrated in the USA and Switzerland so far this year, the European and UK banking sectors are also looking extremely vulnerable.

In 2023, the banking industry has been hit by a crisis primarily caused by the dramatic rise in interest rates over the past year. This increase has resulted in a decline in bond prices, leading to unrealized mark-to-market losses exceeding US$2 trillion on the balance sheets of US regional banks, in particular.

These losses become actualized when depositors withdraw their savings in large quantities, seeking higher interest rates elsewhere. Consequently, the banks are compelled to sell their bond holdings at considerably lower prices than their original purchase values to raise cash to return to their departing clients. This challenging situation unfolded during the first and second quarters of this year, exposing significant issues within the regional banking sector in the USA. Notably, Silicon Valley Bank (SVB), Signature Bank and First Republic have all experienced collapses and no longer exist.

These regional banks play a pivotal role in providing credit to various sectors of the US economy and should not be underestimated as influential contributors to economic well-being and growth.

Moreover, the banks are currently confronted with substantial losses on debt obligations related to the commercial real estate sector, which is undergoing a rapid decline, the final outcome of which is still unknown.

In June, Credit Suisse, the once mighty Swiss powerhouse collapsed and was absorbed by the larger Swiss institution, UBS. This merger has resulted in the creation of an enormous institution within Switzerland, consolidating risk to a remarkable extent relative to the size of the country itself.

The list just goes on, including pension fund shortfalls, independent state shortfalls in budget outlays and debt crisis, car and student loan crisis, the often talked about demographic crisis, commodity spikes due to shortages and supply shocks.

Trying to predict what tips us over is not easy, but the risks are abundant.

Conclusion - Why dawn is breaking on a new bull market in metals.

Ray Dalio – The World’s Great Disorder

The prolonged period of substantial price consolidation patterns within the precious metals has been a source of great frustration for many. However, as evidenced by the gold chart example on page 4, the technical analysis paints an extremely positive long-term picture, not only gold but also the other precious metals. The markets have established a strong foundation in terms of price, that has been back-tested many times, setting the stage for significant upward movements. By examining the price patterns on charts alongside raw economic data, a clear indication emerges that we are at long last on the brink of major breakthroughs in prices. This leads me to assert the following...

We are currently entering a phase characterized by heightened economic volatility and the possibility of substantial market downturns in traditional asset classes. Over the past 12 years or even longer, a worrisome and unprecedented imbalance of capital allocation has emerged, leading to severe deficiencies in capital expenditures (CAPEX) within the commodity sectors across the globe.

This can be observed directly through the substantial supply-demand deficits that have materialized in commodities such as platinum, silver, and others, while backwardation curves have resurfaced in various individual commodities.

The global system has become excessively leveraged in relation to GDP and the overall growth of debt worldwide. Consequently, our policymakers are compelled to prevent the devaluation of the assets supporting the system as collateral, at all costs.

Therefore, the data-driven collapse of the system itself and the declining valuations of asset collateral undoubtedly confirm that policymakers will have no alternative but to engage in another round of global money printing and system re-liquidation. This will inevitably result in a substantial devaluation of the monetary system (specifically fiat currency values and debt) on a massive scale.

Here are a few intriguing points to consider:

In 2022, the fiscal deficit in the United States alone amounted to a staggering US$1.38 trillion (without even taking into account the expansion of global sovereign deficits). In contrast, the US$ value of newly extracted gold during the same period amounted to approximately only US$200 billion globally (3,612 Tons).

Between 2011 and 2021, the federal debt of the United States alone has doubled. However, during that same timeframe, the total amount of gold available (above ground) has only increased by 16%. I guess this very fact has been a strong motivator for global sovereign central banks to go on the largest net buying spree of physical gold over the last 11 years since at least the 1960s. Central banks have been net buying every single year as a clear asset diversification: follow what they do, not what they say.

Silver Crisis and Real Demand

The Silver Institute declared that global demand for silver rose by 18% last year to a record high of 1.242 billion ounces, creating a huge supply deficit, predicting annual shortages in the years to come. The silver market was undersupplied by 237.7 million ounces in 2022, the institute said in its latest World Silver Survey, calling this "possibly the most significant deficit on record".

The 2022 undersupply and a 51.1 million ounce shortfall in 2021 have wiped out cumulative surpluses from the previous decade and a further undersupply of 142.1 million ounces is predicted in 2023.

Now the real challenge of industrial demand will also impact countries that heavily rely on silver for manufacturing, such as the United States, Europe, China, Japan, South Korea, and others. By 2030, the global demand for silver is projected to reach 35,000 tons. However, the depletion of Mexico's silver minerals at a rapid pace and China's diminishing reserves will cause global supply to plummet to 16,000 tons, further intensifying the silver resource crisis.

Some individuals argue that alternative materials could potentially reduce the demand for silver in various industries. However, silver possesses unique physical and chemical properties, such as high ductility, conductivity, thermal conductivity and reflectivity, making it indispensable in high-tech electronics and green energy sectors. Although new metals might emerge as potential substitutes in the future, and scientific and technological advancements could lead to innovative materials and processes, these advancements cannot be realized within the next two decades. Consequently, silver will be on the brink of depletion by that time.

Platinum Crisis, Supply-Demand Deficits

Over the past two years, our team at IPM Group and Auctus Metal Portfolios have conducted extensive research and produced comprehensive reports on the imminent challenges facing the platinum market. We have closely monitored the developments independently of the World Platinum Investment Council (WPIC), but in full support of their forecasts.

The WPIC has recently updated their data to acknowledge the significant supply-demand deficits and China's absorption of more than 80% of the available worldwide above ground platinum stocks. You can find their updates on this matter by referring to their published information here.

According to the latest forecast from the World Platinum Investment Council (WPIC), they anticipate a record deficit in the platinum market, reaching nearly 1 million ounces (Moz) in 2023. Alongside many other research agencies forecasting the deficits to grow year-in and year-out for the next 5 years.

As of the end of 2022, the estimated above ground platinum stocks stood at approximately 5 Moz, equivalent to approximately 39 weeks of platinum demand. However, the majority of these stocks, over 80%, are located in China and are not accessible to the rest of the world.

This means that the rest of the world will be left with only six weeks' worth of platinum demand in stock by the end of 2023, not accounting for the rolling decrease in supply.

In final conclusion

All indications from economic hard data point towards an impending hard recession starting around the fourth quarter of this year. At that juncture, governments and policy leaders will face a straightforward decision: either allow the situation to deteriorate into a severe depression, exacerbated by the rapid growth of debt (which historically tends to double its expansion during recessions), thereby further intensifying the economic contraction, or opt for the alternative.

Remembering of course, the most precarious element in this scenario is the valuation metrics of assets, as they serve as collateral for the system, preventing its collapse.

As mentioned earlier in this article, we will be confronted with the second option, a new and massive global scale of money printing and system re-liquidation, accompanied by substantial investments in global infrastructure to counteract the escalating global polarization.

This is extremely bullish for precious metals moving forwards.

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery across the world.

Consider the safest option of segregated, allocated vault storage at Le Freeport Singapore with IPM Group.

Disclaimer : The information contained in this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.