Understanding these components is essential to making smart, profitable bullion decisions. As one of Singapore’s most trusted precious metals dealers, Indigo Precious Metals offers transparent pricing and some of the most competitive premiums and buyback rates in the market, helping investors maximise long-term value.

What are Premiums?

A premium is the amount added to the spot price when purchasing physical bullion. It represents the cost of refining, minting, transporting, and delivering investment-grade gold or silver to the end buyer.

Premiums cover:

Fabrication and minting – converting raw metal into specific weights and purities.

Brand recognition – top refiners like Heraeus, Valcambi, or PAMP generally command slightly higher premiums.

Logistics and insurance – secure handling and international shipment costs.

Dealer operations – authentication, testing, and market risk coverage.

Example

If spot gold trades at US$2,400/oz and a 1 oz coin costs US$2,460, the premium is US$60 (2.5%).

At Indigo Precious Metals, premiums are kept as tight as possible—ensuring clients access physical bullion close to global market spot levels.

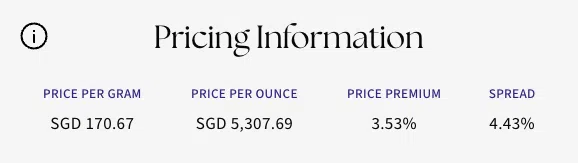

See the example below:

Why Premiums Matter

Premiums are not arbitrary mark-ups — they reflect real market conditions.

Low premiums may indicate a well-supplied, stable market.

High premiums couldsignal physical tightness and strong investor demand.

During periods of financial stress or global uncertainty, premiums can rise sharply as investors rush into physical gold and silver. Monitoring premiums helps investors identify trends and entry opportunities.

Indigo Precious Metals consistently maintains some of the most competitive premiums in Singapore, even during periods of high demand, giving clients an edge in cost efficiency and portfolio performance.

What is the Spread?

The spread is the difference between a dealer’s buy price (bid) and sell price (offer) for the same product. It represents trading and handling costs, and often varies depending on product liquidity.

Example

If we sell a 1 Oz gold coin at US$2,460 and buys it back at US$2,420, the spread is US$40 (1.63%).

Tighter spreads indicate a more liquid market and fairer pricing. Recognised bullion products from leading refiners tend to have smaller spreads than lesser-known or collectible items.

Understanding Buyback Prices

The buyback price is what a dealer will pay when an investor decides to sell their bullion. It’s typically based on the spot bid price, adjusted for handling and market factors.

Buyback values depend on:

The type and brand of bullion (coins vs. bars, refiner reputation).

Real-time market volatility and currency movements.

Supply tightness and dealer inventory demand.

At Indigo Precious Metals, buybacks are quoted transparently and updated live—ensuring clients always receive fair, market-reflective value. Our buyback rates are widely regarded as among the most competitive in Singapore, providing investors superior liquidity and trust when it’s time to exit.

How These Elements Work Together

When buying or selling physical bullion, three numbers define the transaction:

|

Term |

Definition |

Example |

|

Spot Price |

The live global market value |

Gold spot = US$2,400/oz |

|

Premium |

Added cost when buying bullion |

+ US$60 → Buy at US$2,460 |

|

Buyback Price |

Dealer’s offer when selling back |

~ US$2,420/oz |

The difference between the buy and sell prices is the spread. Understanding these relationships helps investors identify value, plan entry and exit points, and manage costs efficiently.

Why This Matters for Investors

True Cost Awareness: The premium determines your real purchase cost—not the spot price alone.

Liquidity Assurance: Knowing the buyback price upfront provides confidence when selling.

Market Insight: Premiums and spreads offer valuable clues about demand, supply, and market sentiment.

For long-term investors, tight premiums and strong buyback policies translate into greater overall returns.

The Indigo Precious Metals Advantage

Based in Singapore, Indigo Precious Metals is known for transparent, real-time pricing, deep liquidity, and industry-leading competitiveness in both premiums and buyback rates.

Our clients benefit from:

Live pricing directly linked to the international spot market.

Narrow spreads on popular bullion products.

Reliable, fast buyback execution at excellent market terms.

Secure vaulting and storage options.

Whether you’re buying your first ounce or expanding a long-term portfolio, IPM ensures that every trade reflects fair value and transparency.

Discover transparent pricing and the most competitive premiums in Singapore. Visit Indigo Precious Metals to explore gold, silver, and platinum bullion investment opportunities today.

Related Articles: