Gold Makes History ! - Capitulation ?

plus China's Insatiable Gold Appetite

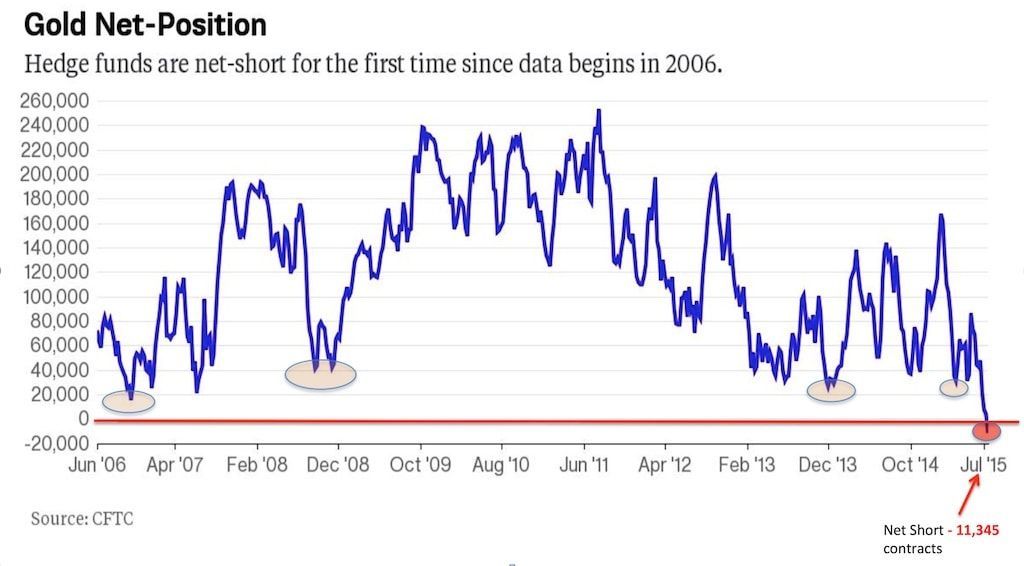

For the first time since records began, hedge funds are net short gold futures, according to CFTC data...

- Lowest net long position late 2006 led to a price appreciation in Gold from 3rd Oct 2006 ($585) to 17th March 2008 ($1,004) + 71%

- Lowest net long position late 2008 led to a price appreciation in Gold from 23rd Oct 2008 ($726) to 22nd August 2011 ($1,900) + 161%

- Lowest net long position late 2013 led to a price appreciation in Gold from 20th Dec 2013 ($1,203) to 14th March 2014 ($1,379) +15 %

- Lowest net long position late 2014 led to a price appreciation in Gold from 6th Nov 2014 ($1,142) to 22nd Jan 2015 ($1,300) + 14%

So everytime you have a net low reading its lead to a substantial rally, even in the bear market of the last 3 years !

Now they are net-short, so they have been net-long from 1900 down to 1100, gone short for the first time in history below 1100. This is certainly lending support for a substantial rally.

Which brings us to now......

As a further example...

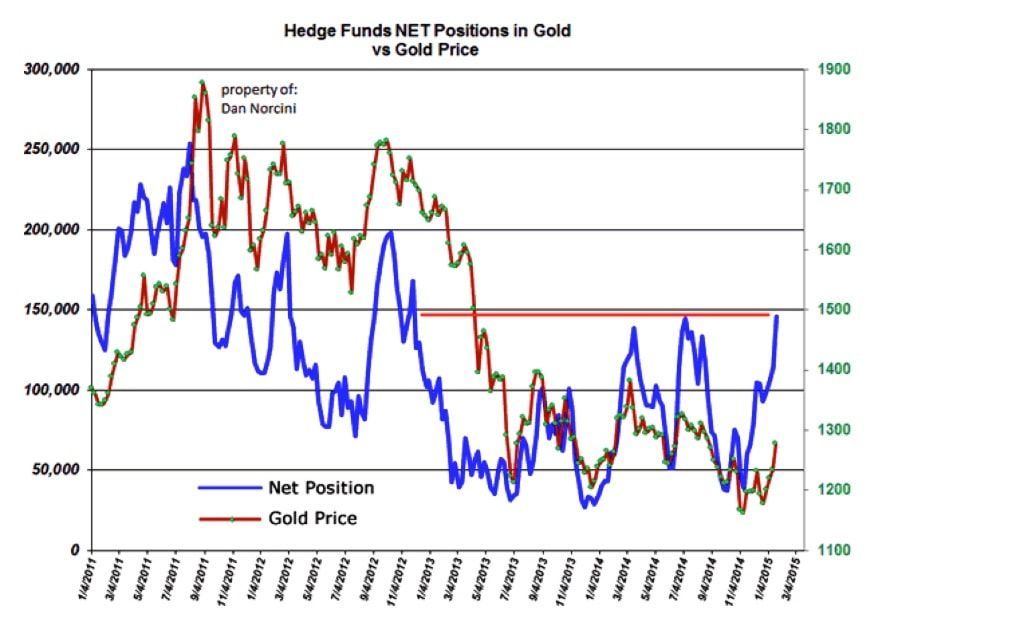

This next chart is the NET POSITION of the largest group of speculative forces in the markets today and that is the Hedge Funds. Overlaid upon that graph is the price of gold.

Notice how precise the movement of the speculative Hedge Fund category is in relation to the gold price. As their net long position increases, the price of gold rises. As that same position falls, so too does the price of gold. The relationship is absolutely perfect.

So taking this historic moment in history with hedge funds being net long all the way from $1900 to $1100 and have now gone net short , what does the actual real world physical buying of Gold look like ?

Please read the link Smaulgld

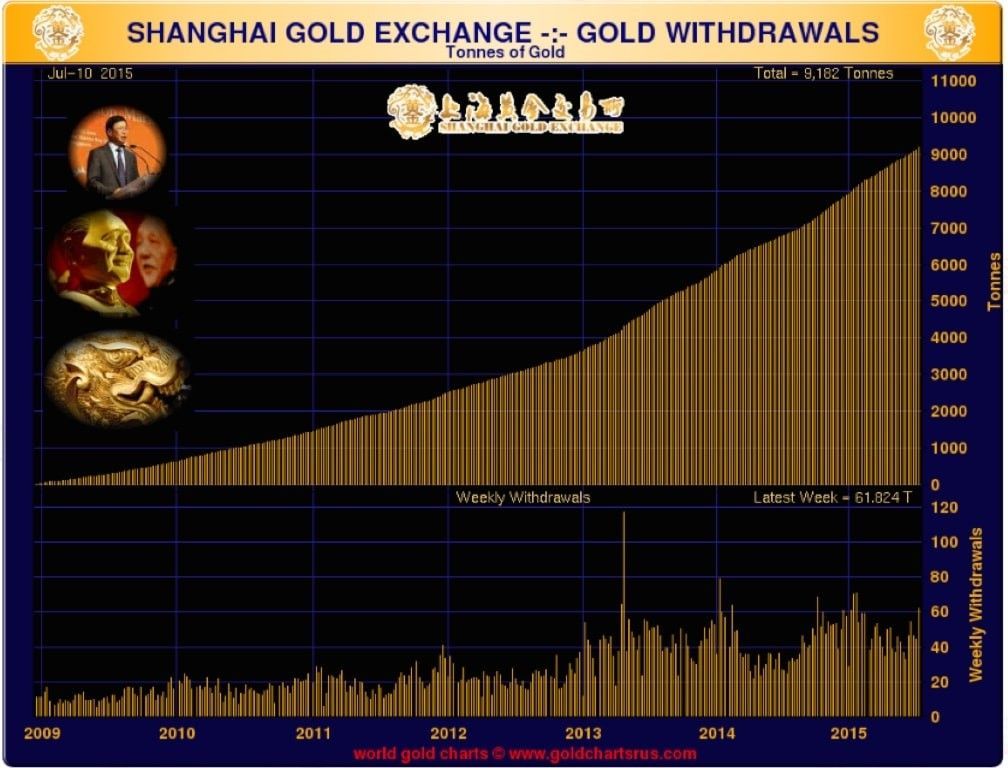

Gold withdrawals on the Shanghai Gold Exchange the past two weeks were larger than the amount of gold delivered on COMEX during 2014 and greater than the amount of gold Germany has repatriated from the New York Fed since 2013.

The Shanghai Gold Exchange (SGE) delivered 61.824 tons of gold during the week ended July 10, 2015. The prior week the SGE delivered 44.335 tons of gold. The two week total is over 106 tons of gold delivered and the year to date total is over 1,269 tons, for an annualized run rate of approximately 2,400 tons.

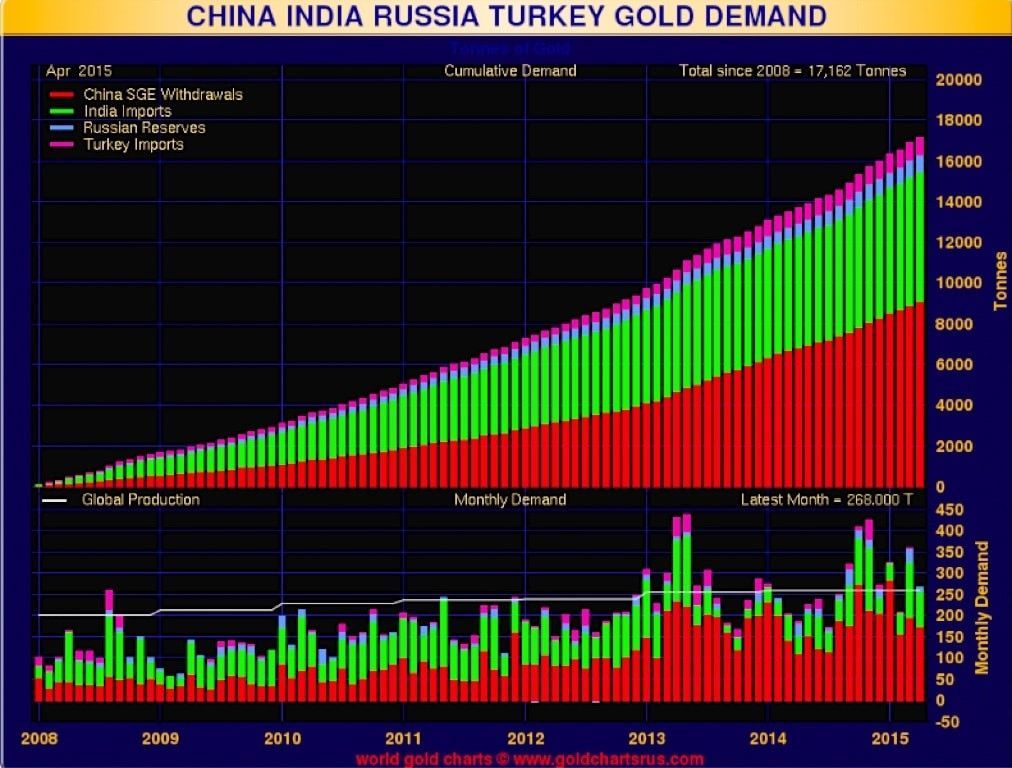

Along with India, China consumes much of the world’s gold. Depending on any given month, either China or India is the number one gold consumer in the world. Together they account for approximately 3,000 tons a year in gold demand.

That is just India and China alone consuming near 100% of present global production !

However..........

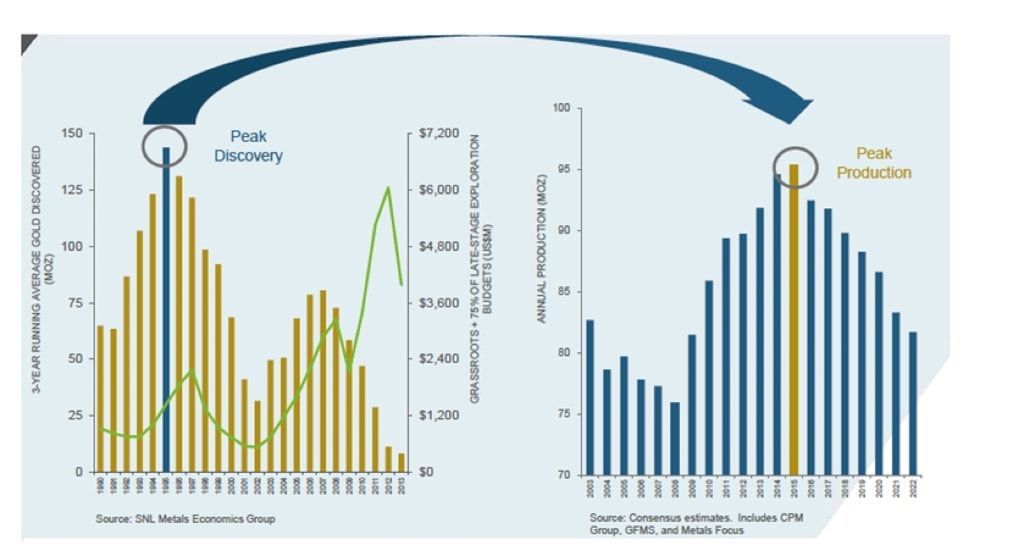

Many industry experts contend that 2015 will be the peak year for gold production. According to a report by World Gold Council (or WGC), gold mining output increased and set another record in 2014 to reach 3,114 tons. Going forward, however, WGC maintains that “growth in supply from such projects continues to diminish and is likely to cap out in 2015 as the supply pipeline thins.”

This global production decline could actually fall by over a third, as we have written about here.

So we have the hedge fund community net short of Gold futures for the first time in recorded history, while the world demand for physical gold is hitting new highs of over 100% of global production and then you have the production of Gold forcast to be falling off dramaticaly over the next few years.

What do you think ?

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery in Singapore, Malaysia or safe storage at Free port Singapore.