Monetary Bazookas Or Not, “Global Crisis Is Inevitable” by Saxobank

Gold Best Investment Strategy Going Forward ?

Submitted by Saxobank’s Dembik Christopher via TradingFloor.com,

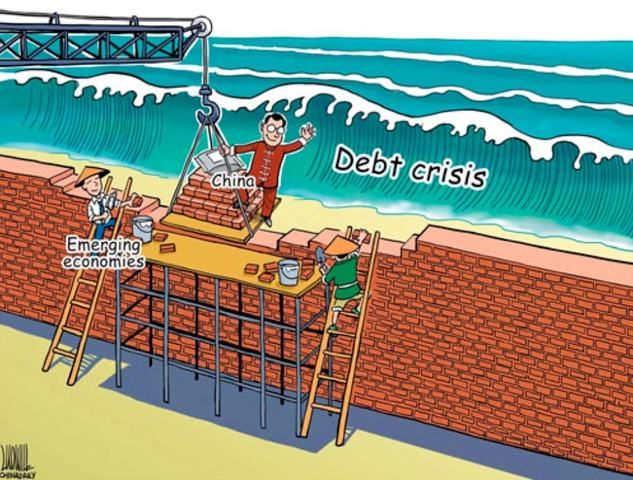

- There is an “inevitable” global financial crisis on the way

- We are near the end of the global recovery cycle even if it may not feel like it

- China could delay the crisis through a QE ‘monetary bazooka’

- A new paradigm is emerging but we could jump from deflation to hyperinflation

Reuters Plaza in Canary Wharf is a symbol of the global economy, but, accommodative policies notwithstanding, a “global crisis is inevitable”. Photo: iStock

Until recently, the consensus assumed a strengthening of the global economy in 2016. It won’t happen. If the global economic growth manages to reach 3.1% next year, as forecast by the IMF, it will be a miracle.

We haven’t realised that the global economic recovery is already here for over six years. This recovery phase is weaker than previous ones and much more disparate.

Since the onset of the global financial crisis in 2007, the potential growth rate has been much lower everywhere: from 3% to 2% for the US, from 9.4% to 7.20% for China and from over 5% to below 4% for Poland.

Many regions, such as the euro area, have remained on the sidelines and experienced stalling economic growth. Over the last two decades, economic cycles have been shortened due to the financialization of the economy, trade globalization, deregulation and the acceleration of innovation cycles.

Since the 1990s, the US went through three recessions: in 1991, 2001 and 2009. It is erroneous to believe that the recovery has just begun. We are close to the end of the current economic cycle. The outbreak of a new global crisis in the coming years is inevitable.

The lack of economic momentum next year and short periods of deflation related to falling oil prices will certainly push central banks to pursue their disastrous “extend-and-pretend” strategy which will increase the price of financial assets and global debt.

Low oil prices will see central banks revert to ‘pretend-and-extend’ policies. Photo: iStock

The European Central Bank could push further interest rates into negative territory and could increase or lengthen the purchase program. Several options are on the table: the central bank could drop the 25% purchase limit on sovereign bonds with AAA rating or could add a program to help the corporate bond market.

Following the same path, China could take out the monetary bazooka in the first half of 2016 by launching its own version of QE-style bond buys. Along with a dovish monetary policy, China could implement a massive Keynesian stimulus programme, relying on the already-expected bond issue plan which could raise 1 billion yuan.

This move could temporarily reassure world markets.

The only central bank that has a leeway to hike rates is the US Federal Reserve. 52% of investors expect a tightening of US monetary policy in December. However, the speed and magnitude of tightening will remain low. It is unlikely the rates will be back anytime soon to where they were before the global financial crisis. Too high interest rates could cause a myriad of bankruptcies in heavily indebted industries, such as the shale oil sector in the US.

The Fed and other central banks are in a dead-end having fallen in the same trap as the Bank of Japan. If they increase rates too much, they will precipitate another financial crisis. It is impossible to stop the accommodative monetary policy.

China could open the QE floodgate to help alleviate the global economy, temporarily. Photo: iStock

Because of the persistent low-rate environment and the risk of a new global crisis, finding the right investment has never been harder. No one is able to know the outcome of the central bank printing press.

The world could go from deflation to hyperinflation without a stop in between for inflation as predicted by Nassim Taleb. In this uncertain context, gold remains certainly the best investment that can be used as a hedge against the coming crisis.

Since the sudden drop of the EURCHF floor last January, the Swiss franc is no more a reliable safe haven. This decision has hurt irremediably the Swiss National Bank’s credibility. Investors understood they cannot blindly believe the words of central bankers.

Although the yuan is not a safe haven, it may be the right time to invest in the Chinese currency. It is well-placed to grow in popularity and become stronger.

By the end of 2016, the yuan could be the third most traded currency in the world, behind the US dollar and the euro. The new Silk Road has been probably the most ambitious global economic strategy in the past 50 years. It is likely to succeed and to push investors to hold more yuan products.

The paradox of the current state of the economy is that innovation clusters, linked to cloud computing or digital fabrication for instance, have never been so numerous and the growth so weak. The economy is switching to a new paradigm.

The three biggest trends for investors are related to changing global demographics, low economic growth and climate change. An aging population will boost the development of elderly care services. Greater inequalities between the haves and have-nots will stimulate shared creation, production, trade and consumption of goods and services by different people and companies.

The energy transition towards renewable energy will encourage the development of financial products still little used, like the green bonds. It is a very challenging time for investors because financial markets have never been so much influenced by central banks but plenty of investment opportunities exist in the new economy.

As Martin Armstrong and his cycles are predicting… Deflation followed by extreme Inflation

Taxes are too high and the standard of living has declined. Those in power will ONLY raise taxes because they are incapable of reform. The year 2017 will cross the Rubicon. The inflation they are desperately trying to create will arrive, but not in the form they desire.