Silver Bars

-

New

New Sale

Sale Flash Sale

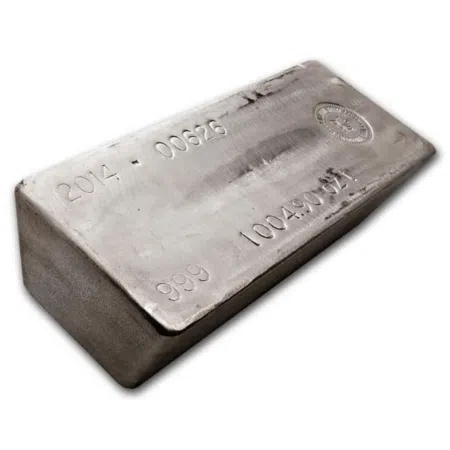

Flash SaleSilver 1,000 Ounce Cast Bar - Various .999% Purity LBMA

31.1 KGFrom ... US$ 33,499.78 Live PricesPer Toz: US$ 33.50 Sale

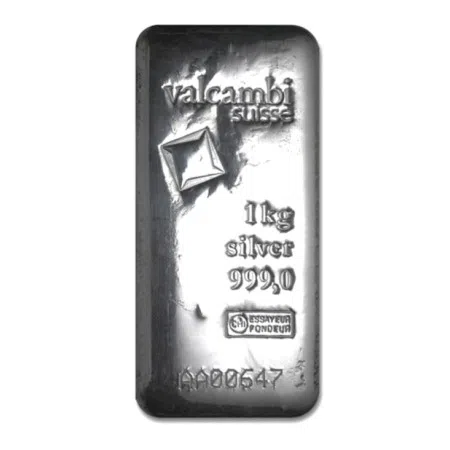

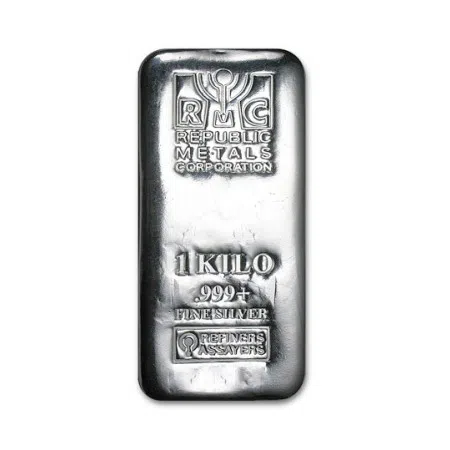

Sale1 Kilo JBR branded Cast Silver Bar, 999% Ag : LBMA Good Delivery

1 KGFrom ... US$ 1,118.96 Live Prices

Sale

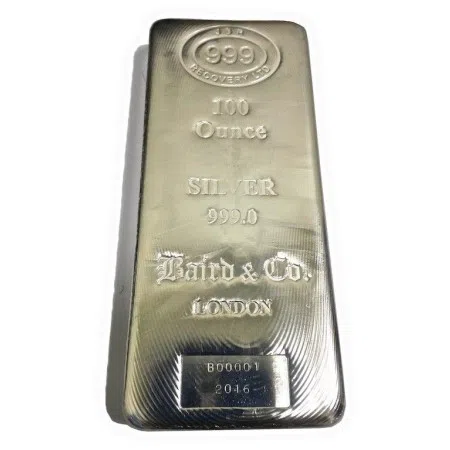

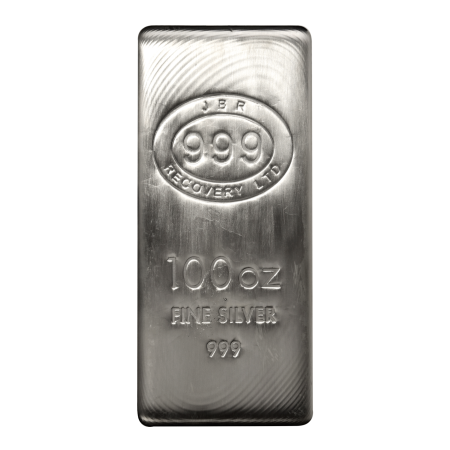

SaleLBMA 100 oz JBR / Baird Silver Cast Bar, 999% Ag

3.11 KGFrom ... US$ 3,346.63 Live PricesPer Toz: US$ 33.47 Sale

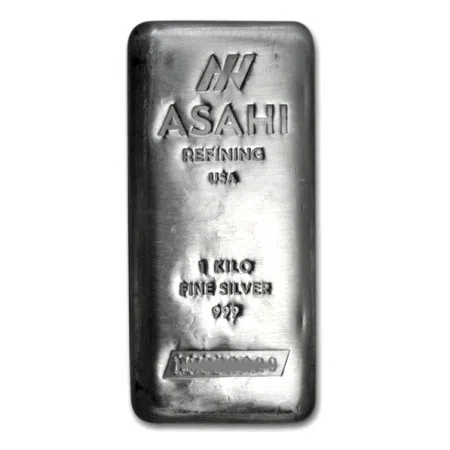

Sale100 oz Silver Bar - Asahi Refining Bar .999 Fine

3.11 KGFrom ... US$ 3,386.56 Live PricesPer Toz: US$ 33.87 Best Price

Best Price Sale

Sale

Low Stock

Low StockJBR UK Silver 100 Toz bar LBMA Good Delivery

3.11 KGFrom ... US$ 3,406.58 Live PricesPer Toz: US$ 34.07 Best Price

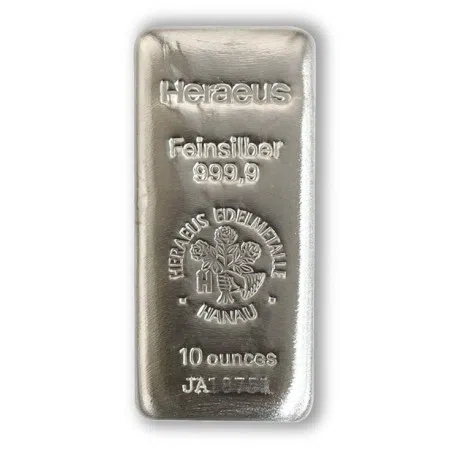

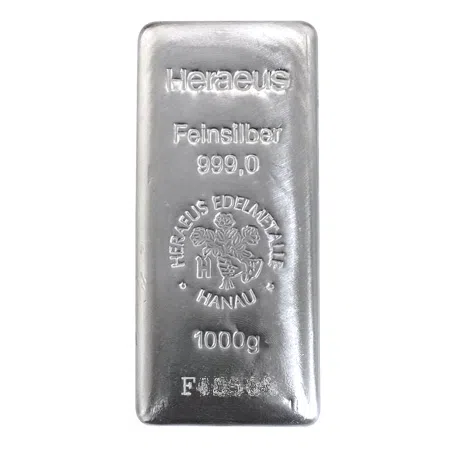

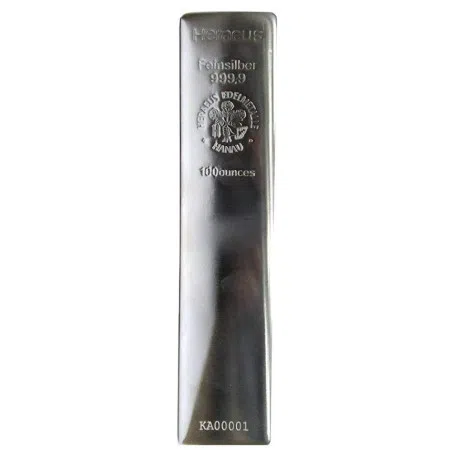

Best Price100 Toz Heraeus Silver Cast Bar 999.9% Purity (w/COA)

3.11 KGFrom ... US$ 3,403.25 Live PricesPer Toz: US$ 34.03 Sale

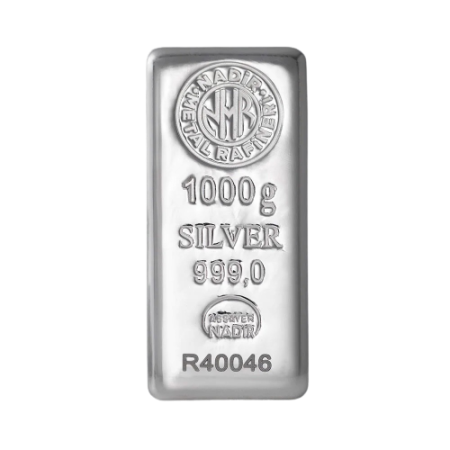

Sale100 oz Nadir Refinery Silver Bar .999 Fine

3.11 KGFrom ... US$ 3,371.55 Live PricesPer Toz: US$ 33.72

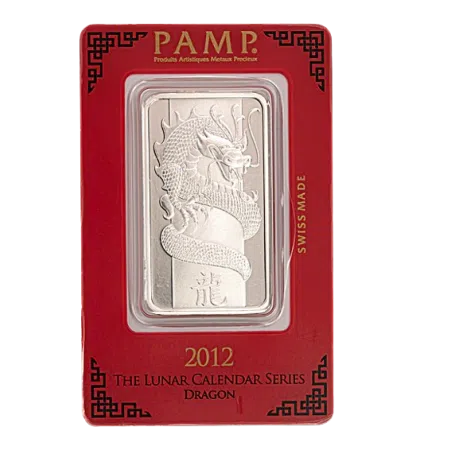

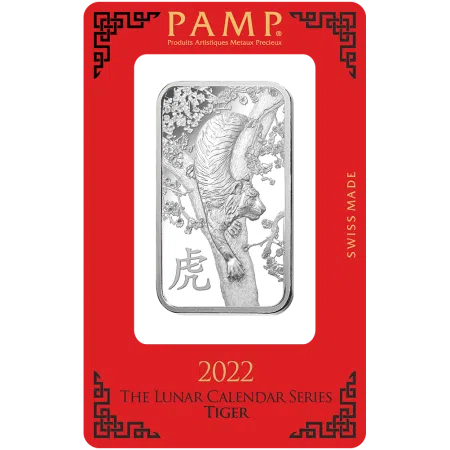

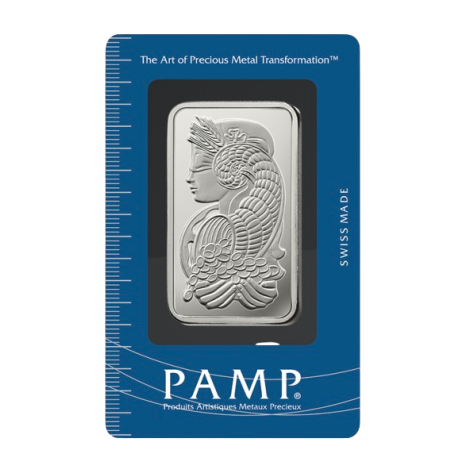

1 Oz PAMP Suisse Lunar Tiger .999% Fine Silver Bar (With Assay Card)

31.1 gramsUS$ 62.09 Live Prices

Sale

Sale Low Stock

Low Stock NewOut of Stock

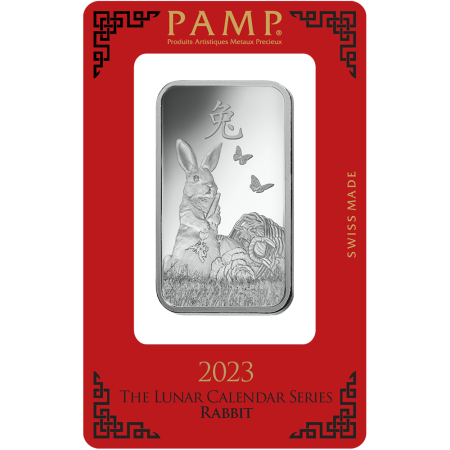

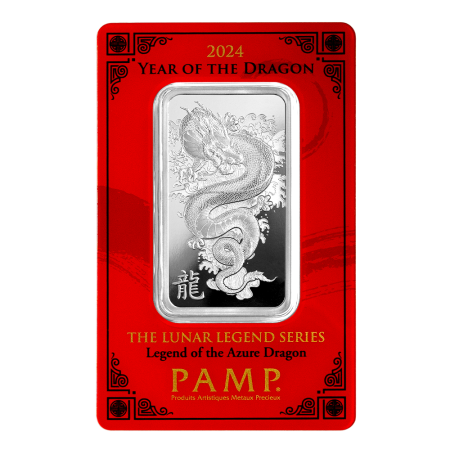

NewOut of Stock1 Oz Silver Year 2024 PAMP Suisse Legend of the Azure Dragon Bar (In Assay CertiCard)

31.1 gramsUS$ 65.45 Live Prices

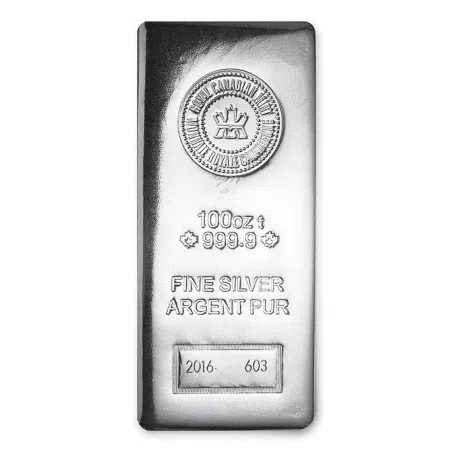

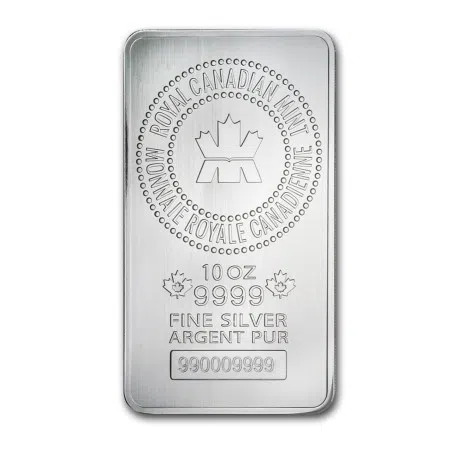

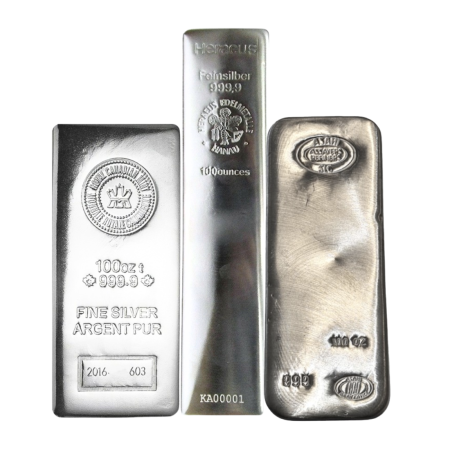

100 Oz LBMA Brand Silver Bar (Assorted)

3.11 KGFrom ... US$ 3,403.25 Live PricesPer Toz: US$ 34.03

Sale

Sale New

New Best Price

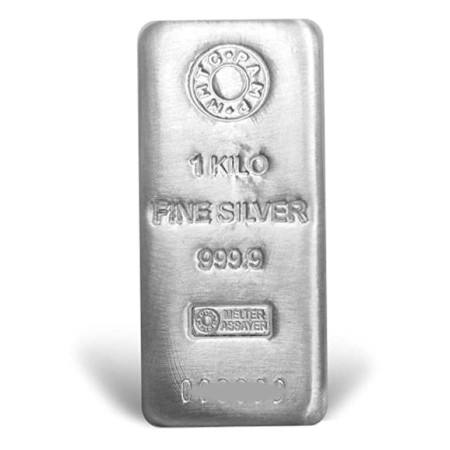

Best PriceIndigo offers a wide range of silver investment bars from around the world. Buying silver bars is often the most cost effective solution which ultimately comes with the greatest liquidity to invest in silver. Bars are available in a wide range, covering weights and types from minted to cast bars.

All our bars are at least 999% purity, LBMA investment grade bullion available for secure segregated A-class bonded vaulting in Le Freeport Singapore, or indeed fully insured delivery worldwide using world class logistics, our clients can of course self-collect from our showroom.

Indigo is generally considered one of the markets most price competitive precious metal bullion solution companies and the ranges of silver bars across different weights from 1 Troy Ounce all the way up to 32 kilos, these include a diverse selection from the world’s refineries including Valcambi, Heraeus, Royal Canadian Mint, Perth Mint, Asahi, Nadir, JBR Recovery, Baird London and large 32 kilo bars covering a wide spectrum of LBMA registered refineries.

The Silver Price Is Determined by Both Industrial & Investment Demand

Industrial demand fluctuates with new innovations and the rise of a vast middle class in the emerging market economies created an explosive demand for electrical appliances, medical products, and other industrial items that require Silver. From bearings to electrical connections, mobile phones, computers, anti-bacterial filters, solar panels and EV’s , Silver’s unique properties have made it a highly desired commodity.

Silver’s price is affected by its huge and growing industrial demand and is the second most diverse consumed hard commodity after oil, there is simply no substitute for Silver on the periodic table given it’s highly unique properties.

This enormous industrial demand will not diminish as the Silver price rises because this metal is generally used in very small quantities within products. Even a substantial increase in the price of Silver will not cause industrial demand to fall.

Silver is presently an extremely under-valued asset and is one of the very few commodities on the planet presently trading at less than it did in 1980. Silver is considered a monetary metal alongside gold, hence its global investment demand from retail consumers to major wealth investment houses as a store of wealth and speculative asset diversification looking for price revaluations.

Longer term when examining industrial demand trends, supply issues, cost of production and monetary debasement policies, IPM Group expects silver prices to rise to new record levels into years 2023 to 2025.