Perspectives of a Precious Metal Bullion Dealer

Massive Physical Liquidation By Retail Market, Latest Price Dynamics and Structure

By David Mitchell, dated 4th April 2024

CLICK HERE to download the full article in PDf version.

An important read when understanding the prices achieved when selling precious metals, dynamics effecting premiums and the clearing time to raise cash with bullion dealers.

Key Takeaways :

- Markets worldwide have been overwhelmed with substantial liquidations in precious metals for over five months now, even as prices have soared to new highs.

- How does a bullion dealer handle liquidations and how does it affect the price premiums?

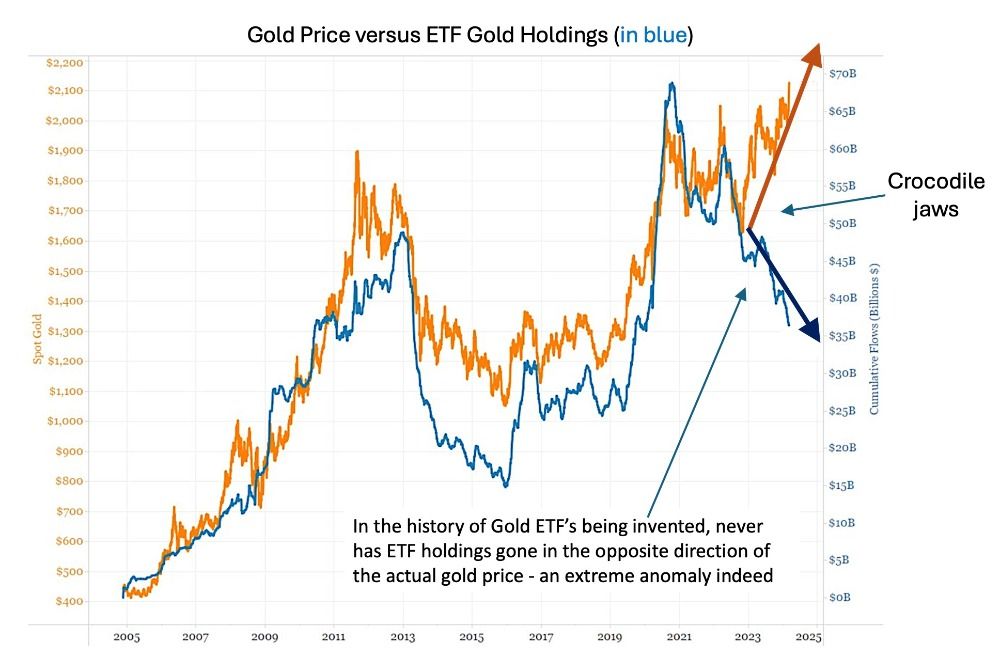

- Disconnection between Gold Prices & ETF Holdings

- Recent price appreciation is just the beginning of the bull market, market structure and who is buying?

Upon reviewing the analysis and insights on the global bullion and precious metal markets throughout the first quarter of this year, it's apparent that there has been very little discussion about the drivers behind the rising prices.

More crucially, the retail and investment sector has largely abstained from participating in the precious metals price rally completely; in reality, there has been a marked global trend of liquidations, as opposed to maintaining long positions or engaging in actual outright purchasing.

As an owner of several bullion enterprises with a relatively strong reach and exposure in both the retail and high-net-worth markets, and as a provider of regulated financial portfolio offerings within the precious metals market, my vantage point allows for a greater understanding of market structures and consumer investment trends, also a fairly strong viewpoint on a global scale.

Since the inception of our retail investment operations in Singapore in 2014, and with my personal history as an active professional investor and trader in precious metals dating back to 2003/4, I've amassed extensive experience in this sector.

Our observation of an increased trend of buy-back liquidations from clients began five months ago, from November 2023 to the present, in fact the present trend in liquidations have not ceased or abated.

While buy-backs are a standard part of our business operations and can persist for varying lengths of time, this particular period has been remarkably distinct and quite peculiar for several reasons.

- Notably, there has been a consistent rise in prices over the last five months; silver has increased by nearly +23% since November 2023, and gold by about +19%, while platinum has not done much, but is up +11% from its early November lows to today (as I write this piece 4th April 2024). Despite the upward trend in prices, we are witnessing a highly irregular situation where liquidations are happening on a very large scale.

- This physical liquidation has persisted for an unusually long five months, highlighting a significant and prolonged period of physical metal asset liquidation.

- This trend of selling physical assets from the retail and investment sector has been a worldwide phenomenon, affecting every major market from the United States, UK to Europe, and stretching to Singapore and Australia, among others. Each market is experiencing varying degrees of net purchasing, but from our specific perspective, net liquidations have significantly exceeded any buying activity.

How Does a Bullion Dealer Handle Liquidations

In my perspective, a bullion dealer has an intrinsic duty to their clientele, striving to ensure a smooth trading experience and to contribute to the success of their clients' investment portfolios through regular market updates, macroeconomic analysis, and by offering crucial liquidity when required.

Nevertheless, bullion dealers must navigate within certain limitations. Standard practice in the industry involves dealers taking on as many client liquidations as they can manage on to their own balance sheets, whilst considering the costs of hedging which involves maintaining cash margins, based on the physical stock they hold.

But this practice does have its ceiling restrictions; by accumulating assets onto their balance sheets, dealers can facilitate swift and immediate payments, however this becomes very challenging when the demand for liquidity by the clients, manifested in net liquidations, greatly exceeds the dealer's sales, leading to a strain on the bullion dealers' liquid cash reserves.

As bullion dealers experience a depletion in their cash reserves, they are compelled to offload their precious metal holdings into the wholesale market, consisting of several very large institutions.

These institutions, typically endowed with ample cash liquidity or indeed access to banking cash liquidity, alongside considerable balance sheet size. They prudently consider several factors when setting their purchase prices for bullion directly from dealers, namely....

- They account for the cost of capital itself, as it does come with a cost these days,

- Expenses associated with hedging, and the necessity and costs to preserve their cash margins, particularly in relation to their financial futures hedging strategies.

- Overall global market dynamics in bullion, factoring in estimated holding times of stock and turnover rate.

Such expenses are integrated into their pricing models, often resulting in reduced buy-back pricing to bullion dealers for their metal liquidations.

Triggered by these market mechanics, bullion dealers are sometimes forced to adjust their own buying prices from their retail clients to safeguard their business against real potential financial losses.

Taking this one-step further, consider the scenario where the wholesale market is swamped with bullion buy-backs from dealers worldwide, (this very situation is being actively communicated to us is consistent with this recent and ongoing liquidation period built up over the last five months.). In such instances, these institutions begin to offload excess holdings to the banks. The banks, in response, manage their increased physical holdings by employing hedging strategies, as evidenced by their short position increases on exchanges like COMEX in Chicago, USA, and LBMA in London.

Subsequently, the banks are compelled to accumulate a reasonable amount of physical bullion and then delivering to the exchanges, aligning with their strategy to offset their short futures positions with their long physical holdings, thereby cancelling one another out.

In this particular dynamic, this quite often involves circulating a volume of metal through refineries to ensure that the delivered bars meet the stringent size and quality standards mandated by the exchanges. Such a process incurs additional logistical and refining expenses.

Which Physical Products to Own and Physical Premiums

In an environment as we have such as today the largest institutional bars suddenly become the most liquid and viable products (to the detriment of smaller investment bars and coins), as they are easily transferred through the chain back to exchanges (as described in my article above). Nevertheless, I foresee a shift moving forwards, with an impending scarcity of small investment-grade products on the horizon.

Presently 1,000 Troy Ounce Silver bars, 1 kilo gold bars and weight sizes above, large platinum ingots effectively achieve the best liquidation prices as the wholesale market are not required to process back through refineries and can simply lodge back at the exchanges very quickly.

Premiums on physical commodities in the precious metals sector are governed by market dynamics, just like any other tradable goods. Hence you need to take into account supply-demand considerations; alongside your own individual situation, needs, and expectations. In the context of smaller investment-grade products, there's currently an oversupply confronting dealers, leading to a drop in buy-back prices. This is compounded by the fact that these smaller products do not readily enter the professional institutional market unless they are melted down and reconstituted into larger bars, a process that incurs significant costs.

Refineries and mints that specialize in creating smaller, investment-grade products (bars and coins), distinct from the large bars preferred by the institutional and exchange markets, have been particularly impacted by the current market situation. Their usual business involves selling to global bullion dealers, who then cater to the demands of their retail clients. However, during atypical periods like the one we are still presently witnessing; over the past five months, these producers face a rapidly contracting market.

This contraction is because bullion dealers have amassed significant inventories on buy-back client liquidations, leaving less room for new purchases from the producers, they in turn reduce production to protect themselves and move to larger bars for liquidity purposes.

When the investment market turns back up again the market finds itself lacking smaller investment grade products to cater to the returning client investment demand, this rapidly drives up premiums, and bullion dealers in turn raise their buy-back prices quickly so they can have stock to offer, as quite typically wait times can suddenly become quite considerable from the refineries and mints who altered their supply chain in the last down-turn.

Based On the Enormous Liquidations

Present Structure of Market Is Incredibly Bullish Medium to Long-Term

Amidst the significant retail liquidations in physical investment precious metals globally over the past five months, and concurrent liquidations in the investment, institutional sphere observable through the prism of Gold ETF and Silver ETF sales, the pivotal query arises as to who is actually purchasing and propelling prices upward.

The primary buyers, driving demand for gold, have been Central Banks, Sovereign Wealth Funds, and even governments themselves, all engaging in an unprecedented spree of physical gold acquisitions as a direct diversification of their own balance sheets.

China and India demand has been very strong domestically, which have sucked in gold and silver imports.

Meanwhile Gold ETF’s have been heavily sold or more accurately liquidated in a rising price frame work, they have made a big mistake on this and will utilise any price correction to start loading the boat again, meanwhile SLV ETF’s have been heavily shorted, again any correction in price will be utilised to buy into.

Bull markets do not materialize from a lack of engagement or involvement by retail, investor, and institutional participants, especially not from widespread liquidations as we've seen recently. True rising bull markets are characterized by substantial price surges over time that draw in widespread buying activity from every market segment.

The retail and wealth management sector has barely touched or involved themselves in the precious metal asset markets and faced with a global perfect storm of geo-political tensions rising, multiple wars predominately being driven by the West, de-globalisation trends, a global debt crisis expounding exponentially that is aggravating the irreversible trend to substantial long-term currency value destruction so as to devalue the debt loads, which are driven at official policy level, to name just a few growing global problems.

This spectacular structural dis-investment in physical investment grade precious metals alongside the extreme liquidation in Gold ETF’s and shorting outright the Silver ETF is helping to build the platform for very significant price rises over the next few years.

I expect price pullbacks and a great deal of volatility, but with structural supply-demand deficits and currency value destruction, the bullish case for this sector is without question.

Get ready for the ride of a lifetime!!

Protect your wealth; invest in physical gold, silver or other precious metals at best prices from Indigo Precious Metals. Physical delivery across the world.

Consider the safest option of segregated, allocated vault storage at Le Freeport Singapore with IPM Group.

Disclaimer : The information contained in this website should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.